Pointed out that the operation of crypto assets such as Bitcoin and Ethereum depends on 'legitimacy'

There are many news reports about crypto assets, such as

The Most Important Scarce Resource is Legitimacy

https://vitalik.ca/general/2021/03/23/legitimacy.html

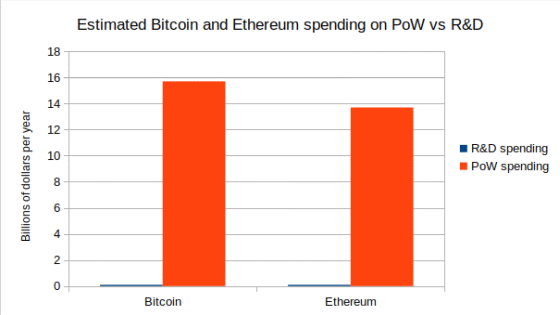

According to Buterin, at the time of writing the article, 19.5 million dollars (about 2.1 billion yen) of Ethereum is mined per day. However, the Ethereum Foundation's R & D budget is $ 30 million a year, which is very small compared to the amount mined. This situation is the same for Bitcoin, where 38 million dollars (about 4.1 billion yen) of Bitcoin is mined per day, but the R & D cost of Bitcoin is estimated to be 20 million dollars (about 2.1 billion yen) annually. I am.

Below is a graph of R & D costs (blue) and Proof of Work (PoW) costs used to mine crypto assets. It can be seen that R & D costs are overwhelmingly lower than the costs used for mining in both Bitcoin (left) and Ethereum (right).

Buterin points out that the reason why there is such a big difference between the amount of mining and R & D expenses is that 'the great value generated by Bitcoin and Ethereum is created by powerful social forces.' Buterin argues that this 'mighty social force' is the 'legitimacy.'

'Justice occurs when each person takes the same action towards a result that is widely accepted by people,' Buterin said. For example, when you can drive in either the left or right lane of a road, if everyone heading in the same direction chooses the same lane, smooth traffic will be achieved. In this case, it is justified that 'everyone heading in the same direction chooses the same lane'. Buterin also cites a

In March 2020, Steemit, a company that owns about 20% of the tokens supplied by Steem, was acquired by businessman Justin Sun. Generally, for crypto assets such as Bitcoin, the more tokens you have, the greater your decision-making power in the community. As a result, Mr. Sun, who acquired Steemit, has a great deal of decision-making power within the Steem community.

But Buterin said members of the Steem community didn't trust Sun. Community members who were worried about the abuse of authority by Mr. Sun developed a new crypto asset 'Hive' that hard forked Steem. Most members of the Steem community have moved to Hive.

Buterin points out that Steemit, which Sun acquired, did not actually make any major changes to Steem. However, the Steem community ruled that 'Mr. Sun's acquisition of Steemit' was 'unjustified,' resulting in a hard fork.

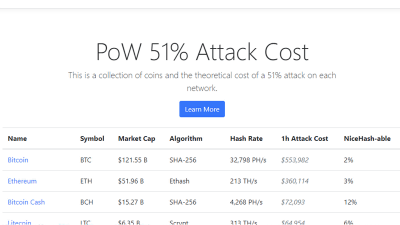

On the other hand, crypto assets such as Bitcoin and Ethereum rely on legitimacy to respond to the '51% attack' that invalidates the payment of crypto assets, Buterin points out. If many people collude and bring their tokens, a 51% attack is theoretically possible, but it is detrimental to many and is never actually done.

The crypto asset community emphasizes decentralization of authority. However, Britain points out that many crypto assets have concentrated authority in several places. 'The concentration of authority is not caused by the organization itself that supports the ecosystem of crypto assets.' The rules aren't perfect and there are blind spots, so to reduce the pressure on organizations that support the ecosystem, we need to create a variety of approaches to funding. '

In addition, Ethereum is raising hundreds of thousands of dollars (tens of millions of yen) through 'Gitcoin' which is a platform for open source projects to raise funds. 'Gitcoin is a platform that has achieved a high level of legitimacy,' Britain claims.

Related Posts:

in Web Service, Posted by log1o_hf