What are the advantages and disadvantages of 'decentralized finance (DeFi)', a crypto asset that rewrites the existing financial system?

Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets | St. Louis Fed

https://research.stlouisfed.org/publications/review/2021/02/05/decentralized-finance-on-blockchain-and-smart-contract-based-financial-markets

DeFi is a blockchain-based financial infrastructure, and generally refers to a collection of protocols built on a public smart contract platform such as Ethereum. DeFi is based on decentralized applications (DApps) and open protocols, instead of requiring brokers such as brokerage firms or centralized administrators such as banks. As a result, it is highly transparent and has equal access rights, and is expected to replace the traditional financial system.

by

The core of DeFi, smart contracts, was proposed by cryptography researcher Nick Susabo . Mr. Susabo likened smart contracts to vending machines, saying, 'When you put coins in a vending machine, products will come out according to their value. Similarly, anyone with a coin in a smart contract will come out. and you can join ' explanation has been.

Smart contracts have the advantages of being easy to join and highly secure. This is because each participant in the blockchain where smart contracts take place can verify transactions, which is inefficient but transparent and arbitrary intervention compared to traditional centralized computing. The risk is also minimal.

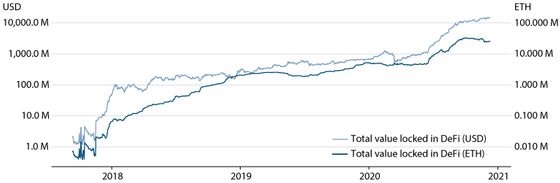

Because of these benefits, DeFi is rapidly gaining in popularity. Below is a graph of assets associated with DeFi-related smart contracts. Looking at the light blue line that represents the amount of assets on a dollar basis, we can see that the scale of DeFi exceeded 10 billion dollars (about 1.48.6 trillion yen) from the end of 2020 to 2021.

by DeFi Pulse

On the other hand, DeFi also has the following disadvantages.

◆ Existence of security key

The DeFi protocol uses an administrator key, which can be used by a small number of predefined groups to renew contracts or suspend contracts in an emergency. While this is a precautionary measure that plays a part in the security of DeFi, there is a risk that the key holder may be malicious or the key may fall into the hands of a malicious third party, Professor Share points out. I am.

◆ Dependencies

DeFi interacts with a wide variety of smart contracts and decentralized blockchain applications, which enable new services to be created from existing services. This property comes from one of the characteristics of DeFi, openness, but it causes the dependency problem that 'if there is a problem with a particular program, other programs related to that program are also affected'. It will also be. Also, many smart contracts rely on external data, which can lead to dependency issues.

◆ Abuse

One of the common concerns of the authorities that regulate crypto assets is misuse of criminal activity. In this regard, Professor Share points out, 'The situation is complicated, because transparency, which is the strength of DeFi, can curb criminal use, and anonymity can provide privacy to criminals.' I will.

In January 2021, US Treasury Secretary Janet Yellen said at a hearing that 'many cryptocurrencies are mainly used for illegal cash flow', regardless of whether it is DeFi or not. It has been pointed out that there are concerns that assets can be misused for illegal activities .

'Most of the cryptocurrencies are used by criminal organizations,' said US Treasury Secretary candidate, but also pointed out that 'the facts are different' --GIGAZINE

◆ Scalability

'Blockchain decentralization and security are in a trade-off relationship with scalability,' said Professor Share. Since Ethereum is relatively decentralized and security-oriented, it is facing the problem that it is difficult to scale up and keep up with demand. As mentioned earlier, adopting centralized computing will increase efficiency, but it can also undermine the strengths of DeFi and smart contracts, so how to keep up with ever-growing demand. It is expected to be an issue.

In light of these advantages and disadvantages, Professor Share said, 'While DeFi has great potential, it also carries certain risks. However, if such problems are resolved, DeFi will shift to the financial industry as a paradigm. Will contribute to the construction of a stronger, more open and transparent infrastructure. '

Related Posts:

in Software, Web Service, Security, Posted by log1l_ks