What are Wall Street's 'private rooms' that are even darker than dark pools?

Institutional investors and large investors such as investment companies and insurance companies may trade stocks in a system known as an 'alternative trading system (ATS),' commonly known as

Wall Street's Dark Pools Grow Murkier with 'Private Rooms' - Bloomberg

https://www.bloomberg.com/news/features/2025-03-16/wall-street-s-dark-pools-grow-murkier-with-private-rooms

According to Bloomberg, the main purpose of dark pools is to prevent large-scale transactions from affecting stock prices. In many cases,

In addition to these benefits, private rooms are limited-access private rooms that provide the added exclusivity of being able to specify in detail who can participate in which transactions. The head of electronic trading at one asset management firm described the experience of using private rooms as 'not going to Walmart for a Black Friday sale, but going shopping after deciding in detail what you want and who you want to buy it from. In other words, you control the terms of the contract yourself.'

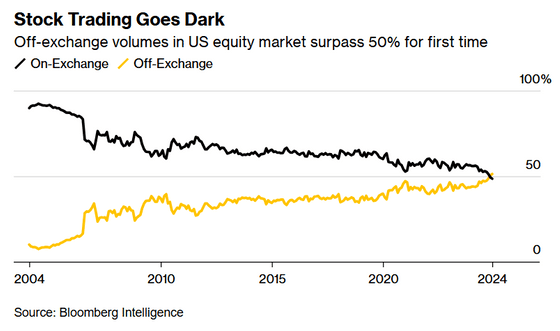

It is unclear how much private rooms are being used, and since they are relatively new, it is said that the trading volume is not large. However, private rooms are rapidly gaining popularity among companies, and the trading volume of one major ATS company's private room exceeds the trading volume of nine competitors' dark pools. The use of dark pools is also increasing, and in the United States, it is becoming common for off-exchange trading volume to account for more than half of the total trading volume.

The graph below shows this. The black line shows the 'on-exchange' trading volume in the US stock market, and the yellow line shows the 'off-exchange' trading volume, and you can see that the two trading volumes are reversed around 2024.

The term 'dark pool' comes from the fact that transactions are conducted in a private system separate from the public market 'lit pool.' By using a dark pool, the details of your order are not visible to the public market, so you can prevent unfavorable price fluctuations from occurring before your order is executed.

However, since dark pools are anonymous, anyone can enter the dark pool, and companies in the pool have the inconvenience of not knowing who their counterparties are. On the other hand, private rooms allow you to specify your counterparties, eliminating the drawbacks of dark pools.

Companies use Private Rooms for a variety of reasons: For example, CastleOak Securities, an investment bank chartered by communities of color, uses its Private Rooms, which are exclusive to minority-owned brokerages, to work with companies that share its values.

On the other hand, more and more investors are using private rooms to move more quickly or outmaneuver those with better information, and some criticize the growing use of private rooms as creating 'phantom

Liquidity refers to the ease of trading, and generally the more people who trade actively in a market, the higher the liquidity. Trading in private rooms is also added to the overall trading volume of the dark pool and included in statistical data on the market. However, since it is not actually a widespread transaction in the market, the level of trading activity is overestimated, increasing the risk of average investors making incorrect judgments.

In 2018, the Securities and Exchange Commission strengthened regulations by requiring ATS companies that operate dark pools to disclose whether they have private rooms. However, the specific extent of disclosure that must be made has not been decided, so in reality it is not known how many private rooms have been opened or who is using them.

'A lot of companies are setting up private rooms these days,' said one investment firm employee who previously worked at the New York Stock Exchange. 'Private rooms are an innovation and they're here to stay. There's a lot more going on in them than most people realize.'

Related Posts:

in Note, Posted by log1l_ks