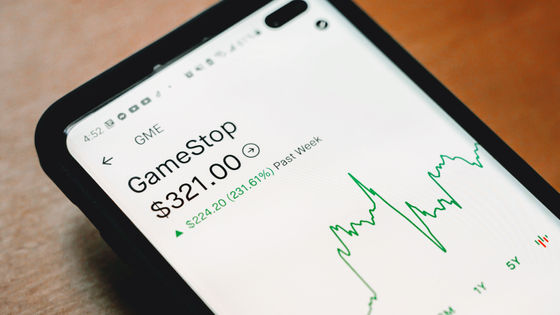

GameStop Stock Trading Restrictions Robinhood, a stock trading app, explains, 'I didn't want to prevent you from buying stock.'

In January 2021, individual investors gathered on the overseas bulletin board Reddit called for the purchase of GameStop, a game retail chain, and the company's stock price soared. In response to this, Robinhood, a stock trading app that announced that it will temporarily restrict the purchase of GameStop shares and resume trading in response to a fierce backlash from users, explains why it has decided to restrict trading.

What happened this week — Under the Hood

https://blog.robinhood.com/news/2021/1/29/what-happened-this-week

Robinhood: GameStop restrictions due to increase in clearinghouse deposit requirements

https://www.cnbc.com/2021/01/30/robinhood-says-restrictions-on-gamestop-due-to-tenfold-increase-in-deposit-requirements.html

Analysis: Robinhood and Reddit protected from lawsuits by user agreement, Congress | Reuters

https://www.reuters.com/article/us-retail-trading-robinhood-liability-an-idUSKBN29Z0HI

GameStop, a video game sales chain, is expected to experience a slump in stock prices due to sluggish performance due to the effects of the new coronavirus infection, and hedge funds and others have set up short sales. However, Reddit users who rebelled against this all bought the stock of GameStop and the stock price rose, causing a ' short squeeze ' that the repurchase of the loss cut causes a further rise in the stock price, and the stock price of GameStop was in 5 days It swelled three times.

Reddit people shoot short-selling hedge fund, stock price of the world's largest game retail chain triples in 5 days-GIGAZINE

In response to this situation, the stock trading app Robinhood enforced a trading restriction on GameStop stock on January 28, 2021, but the restriction was lifted on the following 29th after being criticized by users and politicians. .. Since then, we have taken steps to limit the number of GameStop shares that users can hold to one .

Stock trading app 'Robinhood' enforces trading restrictions in response to stock price surge, but decides to resume trading due to strong opposition --GIGAZINE

Robinhood updated its official blog on January 29th, explaining why it announced that GameStop would stop trading stocks. According to Robinhood, when an individual investor places an order for stock trading through a brokerage firm such as Robinhood, the brokerage firm sends the order to a financial institution called a ' market maker .' Market makers, also known as 'price traders,' play a role in facilitating stock trading by having people who buy and sell stock.

After the stock transaction is completed, the market maker shares the transaction information with the clearinghouse, which handles the processing necessary for settlement, and based on this, the clearinghouse sends the stock to the buyer and the funds to the seller. I will do it.

When a brokerage firm like Robinhood makes a payment through a clearinghouse, the brokerage firm must pay the deposit to the clearinghouse, but due to the surge in some stocks including GameStop, the amount of this deposit is It has swelled 10 times. That's why Robinhood tried to stop GameStop trading.

'We stopped trading some stocks not because we didn't want people to be able to buy those stocks, because the deposits to the clearinghouse would be very high,' Robinhood said. We had to limit the purchase of stocks with volatile prices to ensure clearinghouse payments. '

Robinhood is facing at least 12 class action proceedings after suspending trading in shares such as GameStop, according to Reuters. However, Robinhood has no legal obligation to fulfill all investor orders, and the terms and conditions stipulate that 'Robinhood may, at any time, in its sole discretion, prohibit or limit transactions without prior notice.' Reuters has pointed out that it has been.

In addition, the US Securities and Exchange Commission issued a statement on January 29, in which while avoiding names such as GameStop and Robinhood, 'extreme fluctuations in stock prices expose investors to sharp and serious losses, and the market There is a risk of damaging the credibility of the stock market, 'he said, expressing concern over recent stock market developments.

Related Posts:

in Web Service, Posted by log1l_ks