10 papers you should know if you are interested in the stock market

Numerous researchers have contributed to the development of economics over the past few hundred years, including Jeremy Bentham, Karl Marx, von Neumann, and Thomas Piketty. Marty MK, who is familiar with economics and financial engineering, has selected and published 10 major papers useful for studying economics and financial markets.

Most Important Papers for Quantitative Traders – QMR

01: Optimal Execution of Portfolio Transactions (Almgren & Chriss, 2000)

In this paper, authors Robert Almgren and others point out that stock prices fluctuate for the following two reasons.

• Exogenous: the volatility of the market itself. This fluctuation occurs randomly, regardless of the order you want to place in the market.

• Endogenous: Market impact caused by an order. The magnitude of this effect is inversely related to liquidity, and this change can be temporary or permanent.

To minimize controllable endogenous price volatility, Almgren et al. propose the use of execution algorithms. We have formalized a rigorous and pragmatic approach to how to measure trading and execution performance by minimizing the combination of trading costs and volatility risk. Execution algorithms split large orders into smaller orders to reduce market impact , but this comes with a risk trade-off. This paper proposes a solution to this problem.

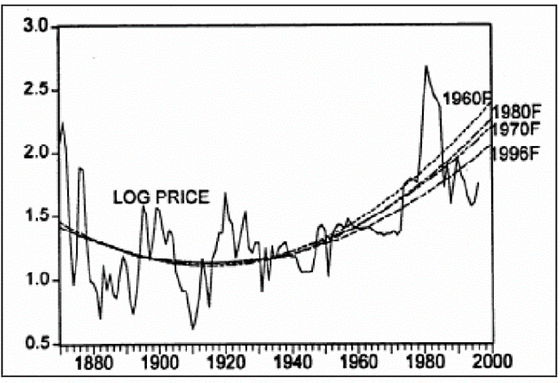

◆ 02: The Long-Run Evolution of Energy Prices (Pindyck, 1999)

This paper shows that the price of raw materials varies according to a convex function. Author Robert Pindick analyzes natural gas, coal, and oil over the period 1916-1996 and finds that trends in oil price fluctuations are related to the marginal cost of raw material extraction and the estimated available reserves of the resource. concluded to have associated changes. On the other hand, it wrote that no conclusion was reached on natural gas and coal.

This paper introduces a closed-form evaluation formula that models the dispersion of assets acquired in spots using GARCH .

Regarding GARCH, which appeared as a model for analyzing volatility, author Heston Stephen said, ``With the usual volatility calculation method, the value is fixed and it cannot be said to be optimal.As long as stock returns are time series, It is reasonable to assume that volatility changes over time, and traditional methods assume a fixed average value, which is also a limiting assumption when modeling stock returns. The GARCH model can relax this assumption.'

04: Portfolio Selection (Markovitz, 1952)

The paper shows that there is an optimal risk-minimizing portfolio for a given expected return and a portfolio that maximizes the expected return for a given level of risk. The author, Harry Markowitz, won the 1990 Nobel Prize in Economics for this paper.

◆ 05: A New Interpretation of Information Rate (Kelly, 1956)

This paper officially announced the 'Kelly Criterion' for calculating the optimal investment rate that maximizes the rate of return from compound interest. The Kelly Criterion later became widely used in gambling and investing.

This paper presents the Capital Asset Pricing Model (CAPM), which is used to calculate the expected return depending on the risk when investing in financial assets. CAPM demonstrates that, assuming all investors have the same information, receive it at the same time, and process it in the same way, there is only one efficient portfolio, called the Market Portfolio.

07: Incorporating Signals into Optimal Trading (Lehalle, 2017)

Similar to Almgren et al., this paper deals with the execution of optimal trades, and derives optimal trading strategies for the special case of assets that follow the Ornstein-Uhlenbeck process with drift. Using historical tick data, we show that order book imbalances lead to predictions of future price movements and exhibit mean-reverting properties.

◆ 08: Efficient Capital Markets: a Review of Theory and Empirical Work (Fama, 1970)

This is a well-known paper that first formulated the concept of the efficient market hypothesis, which assumes that stock prices reflect all available information. Given the efficient market hypothesis, it is impossible to use existing information to predict future prices, and it is impossible to get returns above expectations.

A paper presenting the ' Black–Scholes equation ' that can be applied to the pricing of options on derivatives, the paper used the heat equation of physics to estimate option prices.

◆ 10: Does the Stock Market Overreact? (Bondt & Thaler, 1985)

The paper presents statistically significant evidence that investors tend to overreact to unexpected news, contrary to the assumption of the efficient market hypothesis. “If you are interested in the fascinating field of behavioral finance, this paper is a good place to start,” MK wrote.

Related Posts:

in Posted by log1p_kr