Investors seeing the promise of Uber think about what are the factors to decide investment / postponement to technology companies?

ByKen Teegardin

Publish new stock on the stock marketIPOIt is now commonplace for technology companies to get huge amounts of money by. From the standpoint of investing in technology companies that buy high growth potential and collect large amounts of money, it is pointed out that what kind of company to invest in is a different viewpoint from investment in general companies It is being done.

All Revenue is Not Created Equal: The Keys to the 10X Revenue Club | Above the Crowd | By Bill Gurley

http://abovethecrowd.com/2011/05/24/all-revenue-is-not-created-equal-the-keys-to-the-how-to-invest-on-tech/

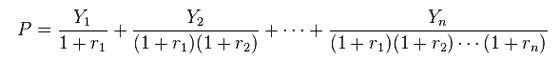

As one method of evaluating the value of profitable assets such as stocks and real estate, calculate by discounting the future cash flow as the current valueDCF methodIt is commonly used.

In the calculation of the value by this DCF method, it is necessary to forecast the long-term cash flow, and the technology companies that issue new shares by IPO are often companies that are not so often founded and weapons innovative services and business models It is extremely difficult to predict the future cash flow because it has the special nature to aim to acquire huge amounts of funds. Therefore, it can not be said that it is "inappropriate" to decide whether to invest in young technology companies only by the DCF method which is a general evaluation method.

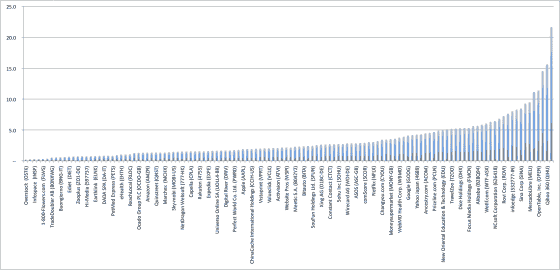

This is based on major IT companies listed in the US in 2012Stock price sales multiplierAs a graph. The value of Overstock with the lowest value is "0.2", the highest Youku.com's value is "21.7", which is 100 times or more difference, etc. As a criterion for evaluating the future potential of technology companies It seems to be said that it is also not appropriate to use stock price sales multiplier.

As to how to evaluate the future potential and value of technology companies in not only the framework of the DCF law but also it is effective to consider the following factors as venture capitalistsBill Gary"He says. In addition, Mr. Gurley gave the dispatch serviceUberIt is a well-known investor who is also known for having invested huge amounts in 2011 through the prospect of the future.

◆ 01: Stable competitive advantage

ByRob Hurson

Mr. Garley holds "competitive advantage" as a decisive factor that separates the differences between enterprises worth investing and those not worth investing. Not to mention absence of competitors, even if there are many competing companies, having overwhelming advantage over competitors is said to be the most important in the evaluation of market value. The future potential of companies with killer contents and non-substitutable services is extremely promising.

◆ 02: Network effect

BySimon Cockell

As the number of users who use the same products and services increases, the effect of increasing the utility and value of itself is "Network effectIt is called. For example, in OS such as Windows, as the number of users increases, the number of related software developers increases and the service becomes more enriched, so positive network effect can be expected. Also SNS like Facebook can be said to be a service where network effect is likely to occur because the number of users has the effect of enhancing the service item. Technology companies with services and products that have positive network effects are worth investing.

◆ 03: Companies that can predict future

For technology companies that can experience rapid growth compared with other industries, it is difficult to evaluate growth potential as mentioned above. Therefore, if it is foreseeable that high profitability could be raised in the future, in investment decisions Mr. Gurley thinks that given a very high reputation. For example, a service that allows users to use for a long period of time in a mechanism such as a monthly system rather than a one-off selling out style service is promising for expecting stable future revenues in the future.

◆ 04: Alternative difficulty

ByJeff_golden

In order to benefit users from the future, it is important that there are factors that makes it difficult to switch to competitor services. Once customers are successfully locked in, the pricing right will be held by the service provider, not by the user, so the possibility of getting big benefits in the future will increase.

◆ 05: gross margin

Mr. Gurley thinks that gross margin is an important factor not only for technology companies. It is money you can freely use by maintaining a high gross marginFree cash flowIt is because it is possible to pile up, and it is possible to hit the appropriate means at the appropriate time.

◆ 06: Identify marginal revenue

It is important to think about the marginal profit which is a concept showing how much the total revenue will increase when the production amount of a certain thing is increased. Beyond a certain line, it is not profitable to make as long as you make it that the increase in production does not catch up with the increase in profitabilityLaw of diminishing returnsThe profit margin increases as it makes, the company that can enjoy the profits of the scale is more valuable than the company tied to it. For example, after collecting development costs, Microsoft's OS sales style, which can keep raising profits with little cost, can be said to be an extremely ideal business model.

◆ 07: Customer bias

ByNick Royer

Mr. Gary believes that services that are supported only by highly biased users are more promising than having a wide range of users. This is because it is easier for users to change services or to change prices than when the audience has a commonality across a wider audience.

◆ 08: The presence of dependent partners

In service provision, if you rely on the services of a specific company, you need to lower the evaluation. If the dependency is high, management may be affected depending on the trend of the partner company, and it is necessary to discount the corporate value when there is such a risk factor.

◆ 09: Marketing activities

Mr. Gary believes that companies that increase users on a per-user basis based on advertising strategies are more valuable than companies that introduce more advertising and promotional expenses and incorporate new customers vigorously. The increase in the number of users by word of mouth has higher growth power than transient advertisement.

◆ 10: Growth power

ByChris Potter

Mr. Gary's last mentioned factor to judge whether it is worth investing is "growth potential". There seems to be a strong correlation between the growth potential and the value of a company, the more rapidly it grows, the more the value obtained in the future will increase, and the momentum of growth seems to be a very important judgment factor.

Related Posts:

in Note, Posted by darkhorse_log