When you understand the financing of IT startup and the collection of funds in time series charts

Among IT companies, it is not uncommon for companies to show rapid growth that is not limited by conventional common sense by providing original and innovative products and services based on their own technologies and advanced knowledge. A site that explains funding procurement and funds collection over IT startup using graphsVenture Dealr"You can better understand the investment and return in the IT startup investment round to not only the founder who aims to get rich quick money but also the venture capital that aims for a huge return by casting funds from an early stage .

Venture Dealr

http://dlopuch.github.io/venture-dealr/

◆ foundation

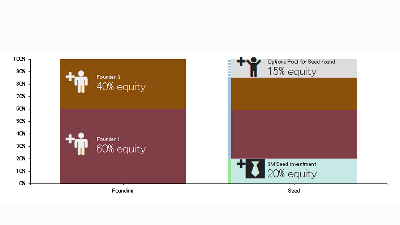

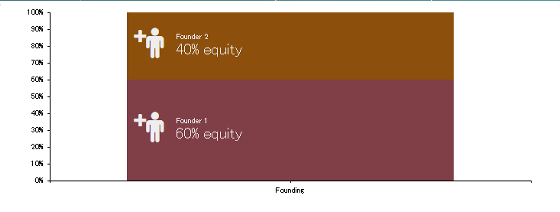

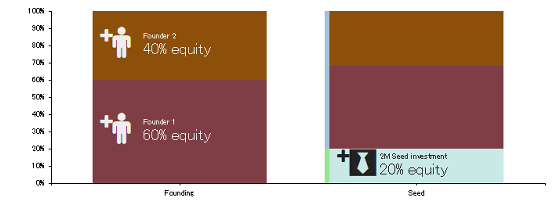

Suppose you have a startup with two people. All expenses such as product development and sale are supposed to be covered by cash on hand by two founding companies, and the share of the shares is presumed to be 60% and 40%, respectively. We will see how this value will be worth with the growth of the company.

◆ Seed

It is assumed that a start-up that has not been founded sells products and hits them. Most founder will raise funds from investors to further expand their business activities. We call this initial investment round "seed". Investors who invest in startups that have not yet been founded are generally "Angel investorsIt is called.

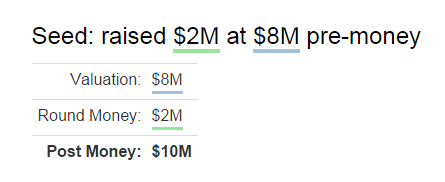

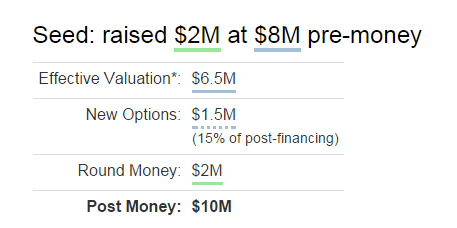

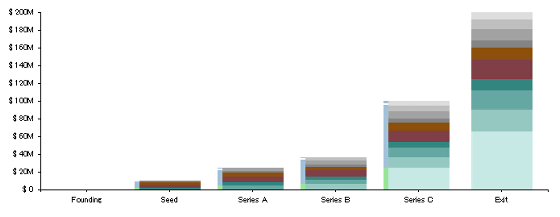

I finally got $ 2 million (about 240 million yen) of funds in the seed round. If you estimate the enterprise value at the time of financing in the seed round as $ 8 million (about 900 million yen), the company will have a potential asset value of $ 10 million (about 1.2 billion yen).

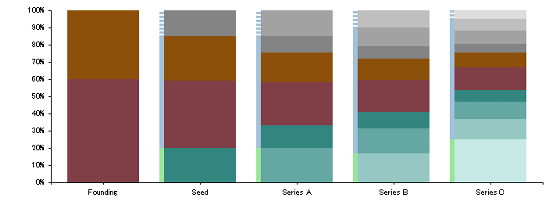

For funding, new shares will be issued to the angels. By issuing new shares, the whole pie will expand and "dilution" will occur that the ownership ratio of the founders will decline. It is like this when drawing the degree of dilution. The light blue part is the share of the angel, you can see that the founder's share (brown and purple) was compressed

In addition, while founder owns common stock, we can obtain favorable conditions for dividend and distribution of residual assets for angel who raised funds in seed roundPreferred stockIs issued in general, it is necessary to pay attention that the profit obtained from the founder's share is actually smaller than shown in the above figure.

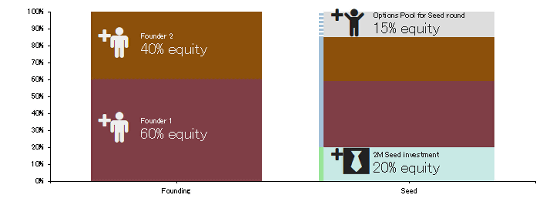

◆ After seed

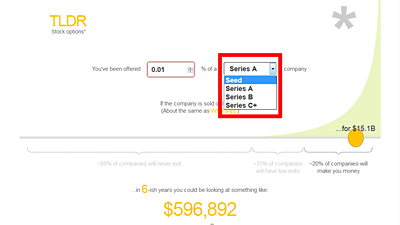

After succeeding in fundraising in the seed round, the first thing to do is to expand employees. Acquiring excellent talent around the founding of startup is important that greatly affects the development of the company. Therefore, in order to secure excellent talent, distribute sharesstock optionIt is common to publish. In addition, the founder will cut off the shares to be allocated from its share.

If 15% of the total shares are allocated to employees, dilution of the founder's share will proceed further.

At this point, the share of the two founders is $ 6.5 million (about 780 million yen), the share of the employee is $ 1.5 million (about 180 million yen), the share of the angel is 2 million dollars (Approximately 240 million yen) will be equivalent to shares.

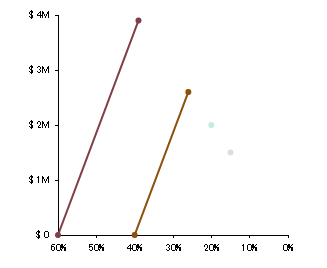

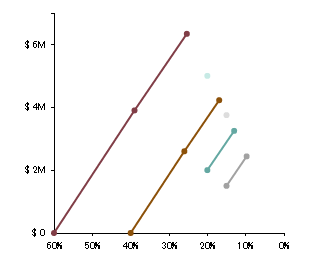

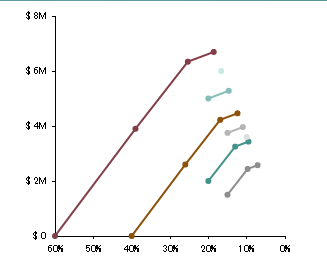

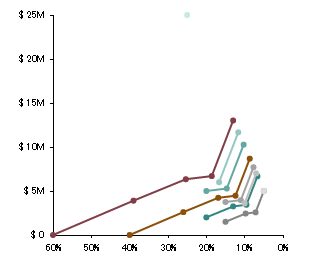

Plotting founder (purple, brown), angel (light blue), employee (gray) on a graph with latent asset value on the vertical axis and share on the horizontal axis is like this.

As the dilution progresses, the founder's share will decrease steadily, but as the business grows it gains more money than the reduction of ownership. As long as fund procurement has progressed, and the business is steadily expanding, the dilution is rather healthy.

◆ Series A

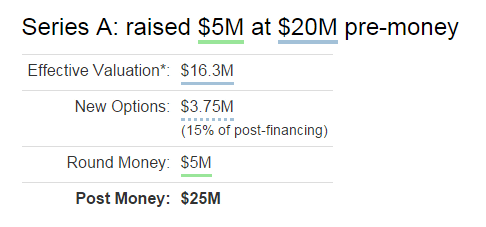

When we got a new employee, the business performance has steadily expanded, and the asset value has expanded to 20 million dollars (about 2.4 billion yen), it will be time to receive investment from venture capital. The first stage of financing from venture capital is called "Series A (early stage)". Series A successfully raised $ 5 million (about 600 million yen) of funds.

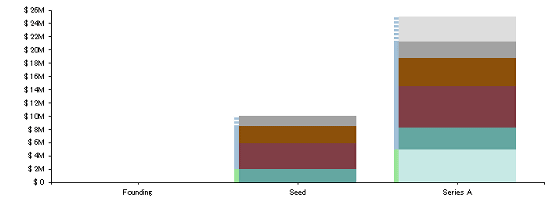

From seed to series A, startup asset value has expanded. In accordance with that, it is understood that founder, angel, and employee are all increasing the value of shares held.

Even though founder, angel, and employee reduce the share of ownership, the value of shares held is rising. That is exactly sound dilution is progressing.

◆ Series B

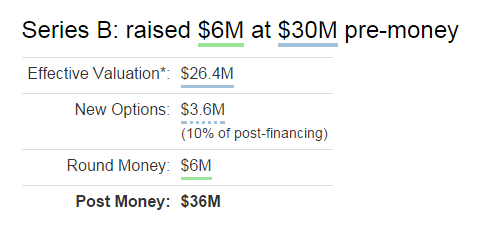

Investment rounds are generally followed by Series A, Series B, Series C ...... After finishing the earthing by raising funds in Series A, we will procure funds in series B for further growth.

Assuming that the corporate value at the time of Series B was 30 million dollars (about 3.6 billion yen), we assumed that we raised 6 million dollars (about 720 million yen).

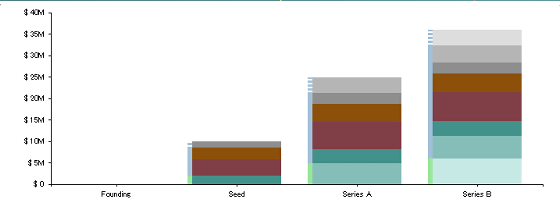

Potential corporate value is 36 million dollars (about 4,302 million yen), it shows as follows, showing the share of founder, angel, employee, investor in series A, investor in series B.

Compared to the expansion of the value of stocks held in Seed, Series A, we see that the pace of the rise in the asset value against the decrease in ownership ratio in Series B slows down. This represents the obvious fact that investing at a high risk of uncertainty whether it grows or not might benefit from a higher return.

◆ Series C

The series of investment rounds following the series B is "Series C". However, depending on the growth strategy of the company, we may not procure funds after Series B. Ali is a way to hire dilution and raise funds by issuing bonds etc.

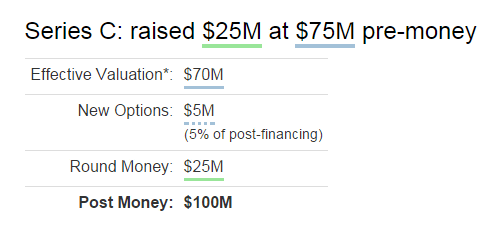

If the company value is 75 million dollars (about 9 billion yen) at the time of series C, and raising a huge amount of funds of 25 million dollars (about 3 billion yen) ...

The value of the shares held by stakeholders such as founder and angel is like this.

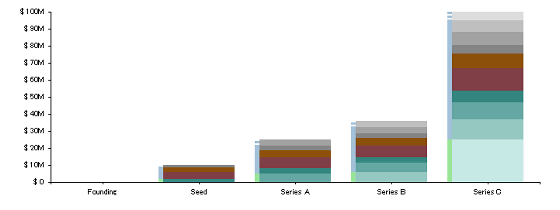

As the dilution progresses, the value of shares held is steadily growing. As long as these graphs of rising up are drawn, wealth of stakeholders such as founders, employees, investors and others will continue to expand, so the original purpose of companies seeking profit is more than enough It is likely to be demonstrated.

If you illustrate the share of stakeholder's company shares against the expansion of the asset value that it holds, it is like this. Every time the investment round goes through, the shareholding ratio decreases and it is diluted, but the asset value held will rise.

◆ EXIT (investment collection)

· Ideal type

Finally, after the Series C investment round, the enterprise value reached 200 million dollars (about 24 billion yen) at last. It is a somewhat sluggish growth, but it seems not to be such a rare case if it is an IT venture company.

Investors are to settle profits by selling shares at some point as companies grow and asset value rises. The goal of this investment collection is called "EXIT". Selling shares in EXIT can be not only for investors, but also for employees who own shares or founder who launched startups.

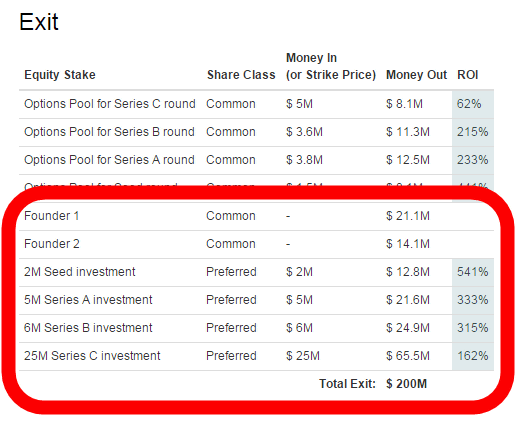

A list of grades when the founder, angel, stockholding employee, investor by series exited by the startup that grew steadily well as the company's market capitalization of 200 million dollars (about 24 billion yen) Then it looks like this. As Series C investors got 65.5 million dollars (about 7.86 billion yen) for an investment totaling 25 million dollars (about 3 billion yen)ROIWill be 162%. ROI of series B investors is 315%, series A investor ROI is 333% Angel who invested in seeds has an ROI of 541%. In addition, the founders are able to get a large sum of $ 21 million (about 2.5 billion yen) and $ 14.1 million (about 1.6 billion yen) respectively.

However, corporate activities are not so easy as to be sailing. In the event that you can not make good results on investment, the existence of preferred stock may have a significant impact on the money that interested parties will have.

· Last-In-First-Out

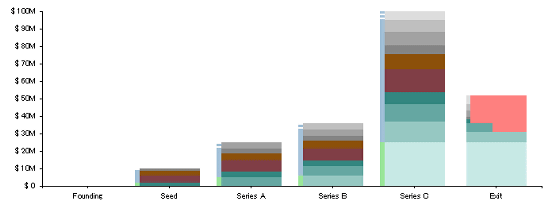

Consider the case where the performance deteriorates after the series C investment round and the asset value drastically decreases.

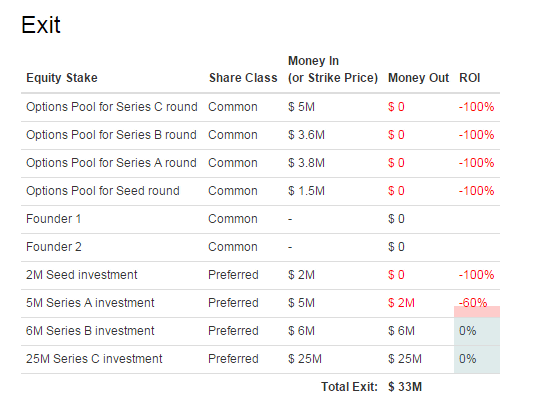

Here, if the rule "Last-In-First-Out" is adopted that protects priority from investors who participated in the investment round later, investors of Series C and Series B contribute from residual assets On the other hand, series A investors can collect only 2 million dollars (about 240 million yen) against an investment totaling 5 million dollars (about 600 million yen) while being protected by the special agreement that amount is protected preferentially It is also ant to suffer loss. Of course, since the founder of the founder is an ordinary shareholder, it becomes a penniless sentence.

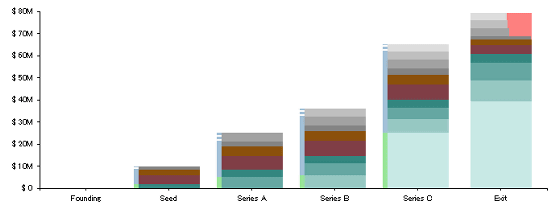

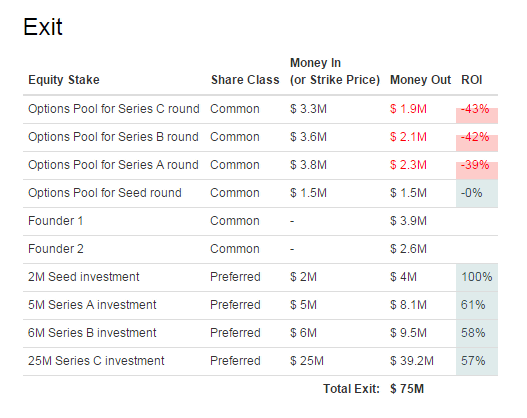

On the other hand, the existence of preferred stock may impair the interests of ordinary shareholders even if performance is not deteriorating. In case there was no growth corresponding to that after the series C's huge investment round.

Angels holding preferred shares, Series A, B, C investors profit from the sale of shares, while common stock holders, such as employees who have been allocated stocks or are assigned stock options, reduce their profits There are also cases. In this way, it seems that there is a case where the difference in cloudiness arises depending on whether it is a preferred stock or a common stock in return for investment and labor.

Related Posts:

in Note, Posted by darkhorse_log