IBM acquires multi-cloud infrastructure automation leader HashiCorp for $1 trillion

On April 24, 2024 local time, major technology company

IBM to Acquire HashiCorp, Inc. Creating a Comprehensive End-to-End Hybrid Cloud Platform

https://newsroom.ibm.com/2024-04-24-IBM-to-Acquire-HashiCorp-Inc-Creating-a-Comprehensive-End-to-End-Hybrid-Cloud-Platform

HashiCorp joins IBM to accelerate multi-cloud automation

https://www.hashicorp.com/blog/hashicorp-joins-ibm

IBM to buy HashiCorp in $6.4 billion deal to expand in cloud | Reuters

https://www.reuters.com/markets/deals/ibm-buy-hashicorp-64-billion-deal-expand-cloud-software-2024-04-24/

IBM to acquire HashiCorp in $6.4 billion deal, reports another revenue miss

https://www.cnbc.com/2024/04/24/ibm-q1-earnings-report-2024-ibm-to-acquire-hashicorp.html

On April 24, 2024, IBM announced that it had signed an agreement to acquire HashiCorp. The acquisition will be at $35 per share (approximately 5,400 yen), for a total acquisition value of $6.4 billion. HashiCorp's product line provides enterprises with a wide range of infrastructure lifecycle management and security lifecycle management capabilities, enabling organizations to automate hybrid and multi-cloud environments. Therefore, IBM describes the acquisition of HashiCorp as 'a commitment and investment in the hybrid cloud and AI fields.'

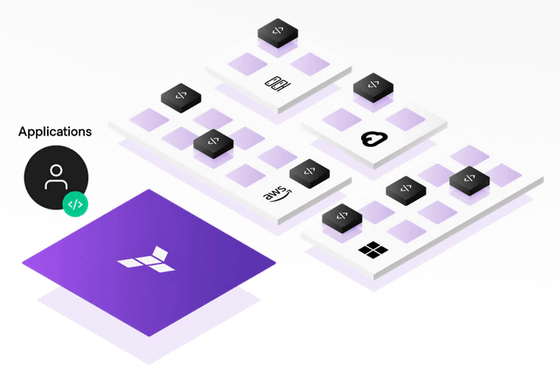

The rise of cloud-native workloads and associated applications has led to an exponential increase in the number of cloud workloads that enterprises manage. The advent of generative AI is driving this number even higher, resulting in developers having to grapple with increasingly heterogeneous, dynamic and complex infrastructure strategies.

HashiCorp's products enable companies to use automation to manage the lifecycle of infrastructure and security, providing a 'system of record for critical workflows' required for hybrid and multi-cloud environments. In particular, HashiCorp's open source IaC tool, Terraform , has become the industry standard for infrastructure provisioning. HashiCorp products are expected to help clients adopt a cloud-agnostic, interoperable approach to multi-cloud management and complement IBM's efforts in industry collaboration (including deep and expanding partnerships with hyperscale cloud service providers), developer community, and open source hybrid cloud.

Commenting on the acquisition, Armon Dadgar, co-founder and chief technology officer (CTO) of HashiCorp, said, 'At the core of our strategy is to enable enterprises to innovate in the cloud while providing a consistent approach to cloud management at scale. The rise of multi-cloud and hybrid cloud has made the need for effective management and automation critical, and this is being accelerated by today's AI revolution. We are excited to join IBM to accelerate HashiCorp's mission and provide access to our products to a wider range of developers and enterprises.'

IBM explained that the acquisition of HashiCorp 'creates a comprehensive, end-to-end hybrid cloud platform built for AI-driven complexity. The combined portfolios and talent of both companies will provide clients with extensive application, infrastructure and security lifecycle management capabilities.'

In addition, IBM noted that once the acquisition of HashiCorp is complete, it is expected to bring significant synergies to IBM, including in several strategic growth areas such as

The acquisition is also expected to expand IBM 's total addressable market (TAM). Combined with IBM and Red Hat, HashiCorp's products will provide clients with a platform to automate the deployment and orchestration of workloads across evolving infrastructures, including hyperscale cloud service providers, private clouds and on-premises environments. This strengthens IBM's ability to address the entire cloud opportunity, which research firm IDC said is expected to drive TAM compound annual growth rates in the high teens through 2027.

IBM plans to complete the acquisition of HashiCorp by the end of 2024, and according to a company spokesperson, HashiCorp CEO Dave McJannet will report directly to IBM's vice president of software, Rob Thomas. After IBM announced the acquisition of HashiCorp, IBM's stock price fell by as much as 9% in after-hours trading.

In addition, IBM also announced its financial results for the first quarter of 2024 (January to March) on April 24, 2024. IBM's sales for the same period increased 3% year-on-year to $14.46 billion (approximately 2.25 trillion yen), of which software sales increased 5.9% year-on-year to $5.9 billion (approximately 920 billion yen), consulting sales increased 1.7% year-on-year to $5.2 billion (approximately 810 billion yen), infrastructure sales increased 0.2% year-on-year to $3.1 billion (approximately 480 billion yen), and lending sales decreased 1.5% year-on-year to $200 million (approximately 31 billion yen).

Related Posts:

in Software, Posted by logu_ii