AMD Acquires American Semiconductor Company Xilinx for 3.6 trillion Yen to Compete with Intel by Strengthening Business for Data Centers

AMD, a major chip maker, has announced that it has reached a final agreement to buy

AMD to Acquire Xilinx, Creating the Industry's High Performance Computing Leader | AMD

https://www.amd.com/en/press-releases/2020-10-27-amd-to-acquire-xilinx-creating-the-industry-s-high-performance-computing

AMD to Acquire Xilinx | AMD

https://www.amd.com/en/corporate/xilinx-acquisition

Rumors that AMD is trying to buy Xilinx have been whispered since early October 2020. Also, in an interview with technology media AnandTech at the same time, AMD's CTO Mark Papermaster was asked about the possibility of new market development, 'We want to provide valuable high performance to the industry. We are thinking and will focus on gaining market share in what we can offer as truly valuable. '

AMD Chief Technology Officer talks about 'Zen 3 architecture' adopted by 4th generation Ryzen CPU --GIGAZINE

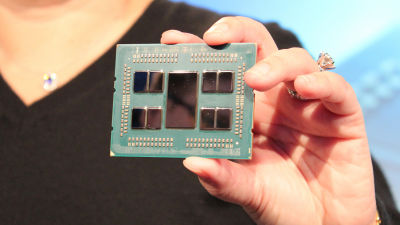

FPGAs created by Xilinx are rewritable integrated circuits that enable high-speed processing in data centers and communication base stations. AMD is developing the CPU brand ' EPYC ' that adopts Zen microarchitecture targeting the server / embedded system market, but by absorbing the FPGA technology and brand of Xilinx, it will be better than high-performance computing. You will be able to provide a powerful system package.

AMD's rival Intel acquired Altera , a Xilinx competitor in the FPGA market, in 2015 and is developing the brand Intel FPGA . AMD's acquisition of Xilinx will compete with Intel not only in the CPU market but also in the FPGA market.

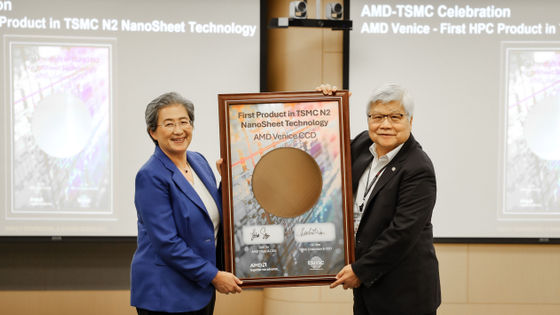

AMD CEO Lisa Su said, 'The acquisition of Xilinx is the next step in establishing AMD as a leader in high-performance computing in the industry and as a partner of choice for the world's largest and most important technology companies. This is a truly compelling combination that creates great value for all stakeholders, including AMD and Xilinx shareholders. The Xilinx team is one of the most powerful teams in the industry and they belong to the AMD family. We are delighted to welcome you. Combining Xilinx's world-class engineering team with deep expertise creates industry leaders with the vision, talent and scale to define the future of high performance computing. I will. '

Big day @AMD with our strong financial results and strategic acquisition of @XilinxInc . So proud of our upcoming @AMDRyzen , @Radeon and @AMDServer products and very much looking forward to welcoming Victor and the Xilinx team on the next leg of our journey pic .twitter.com/FkXXBrNQ97

— Lisa Su (@LisaSu) October 27, 2020

'We are excited to be part of the AMD family,' said Victor Penn, CEO of Xilinx. AMD, with a common culture of innovation, excellence and collaboration, is the ideal pair. Together, we will lead a new era of high performance and adaptive computing. Xilinx's state-of-the-art FPGAs, adaptive SoCs, accelerators and SmartNIC solutions enable innovation from the cloud to the edge and end devices. We help our customers bring their differentiated platforms to market faster, with optimal efficiency and performance. Partnership with AMD accelerates the growth of our data center business. It enables us to pursue a broader customer base in more markets. '

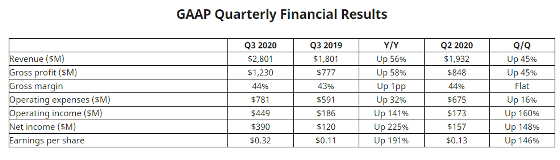

At the same time as the acquisition of Xilinx, AMD announced its financial results for the third quarter of 2020 (July-September).

Total sales for the third quarter of 2020 increased 56% year-on-year to $ 2.8 billion (about 290 billion yen), and operating income increased 141% year-on-year to $ 449 million (about 47 billion yen). Net income increased 225% year-on-year to $ 390 million (approximately ¥ 40.7 billion), and earnings per share was $ 0.32 (approximately ¥ 33), showing significant growth.

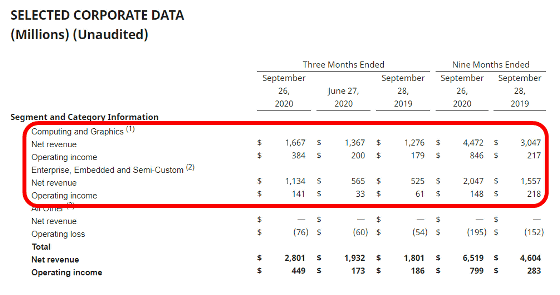

In the computing and graphics division, which handles CPUs and GPUs, sales increased 30% year-on-year to $ 1,667 million (about 172 billion yen), and operating income increased 114% year-on-year to $ 384 million (about 174 million yen). It was about 40 billion yen). In the enterprise products, embedded systems, and semi-custom products division, sales increased 116% year-on-year to $ 1.134 billion (approximately 118 billion yen), and operating income increased 131% year-on-year to 141 million. It was a dollar (about 14.7 billion yen).

Related Posts:

in Note, Posted by log1i_yk