It turns out that it is very difficult to earn more than $ 1000 per month from smartphone subscriptions & Japan's subscription renewal rate is the highest in the world with amazing numbers

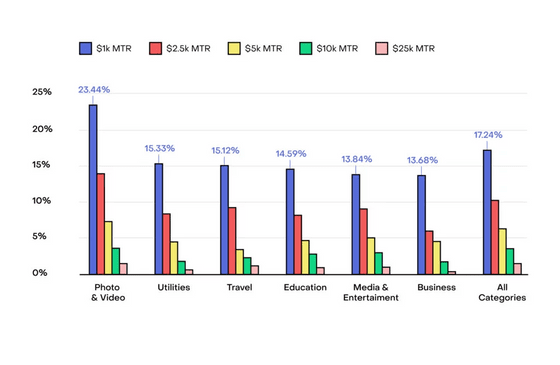

RevenueCat, which provides tools for introducing subscriptions into apps, has released the 2024 version of the results of an analysis of more than 30,000 apps that use their tools. According to RevenueCat, only 17.2% of apps had monthly revenue exceeding $1,000 (approximately 147,000 yen) in 2024. In addition, the survey includes app categories that are likely to generate revenue through subscriptions and countries where it is easy to sign up for subscriptions.

State of Subscription Apps 2024 – RevenueCat

◆Subscription price range

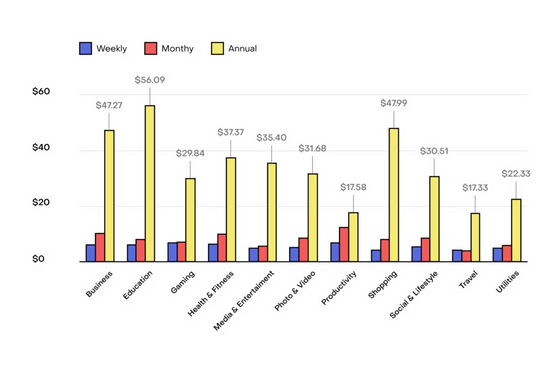

The most common price ranges for subscription plans in 2024 are $4.99 (about 740 yen) per week, $9.99 (about 1,470 yen) per month, and $29.99 (about 4,420 yen) or more for 3 months and 1 year. , and there has been no change since 2023. The average price of the monthly plan will increase by 14% from $7.05 (about 1040 yen) to $8.01 (about 1180 yen) in 2023, the weekly plan will increase by less than 2% to $5.55 (about 820 yen), and the annual plan will increase by less than 2%. has fallen by over 1% from $32.94 (about 4850 yen) to $32.53 (4790 yen).

Looking at each category, ``Education'' is offered at the highest price range, and the annual price range of $ 59.99 (about 8,840 yen) is said to be the most preferred. The average price of an annual plan in the 'Education' category was $56.09 (approximately 8,260 yen)

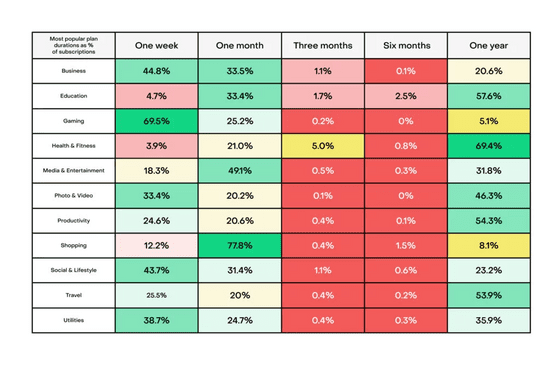

In addition, users tend to strongly desire annual plans in 'Health & Fitness' and 'Education', making it easier to maintain long-term contracts. On the other hand, in the case of 'games', nearly 70% of users subscribe to weekly plans, highlighting the trend of shorter contract periods.

◆Significance of providing a trial version

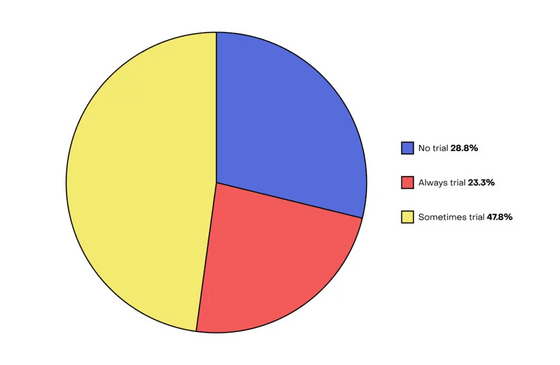

Some apps offer a trial version for users who want to try it out before paying for a subscription, but 23.3% of apps ``always'' offer such a trial version, depending on the plan. It was found that 47.8% of the apps provided the service 'subject to certain conditions' and 28.8% did not provide the service at all.

This is a sharp contrast from the 2023 report, where almost 40% of apps did not offer a trial version, and the same percentage of apps that always offered one was just over 23%, up from over 30% in 2023. It seems that it has decreased significantly. As a result, there has been an increase in the number of apps that are offered on a conditional basis, and RevenueCat says, ``There is a growing desire on the part of providers to accurately classify app users and divide subscriptions into several groups. 'Maybe it was,' he thought.

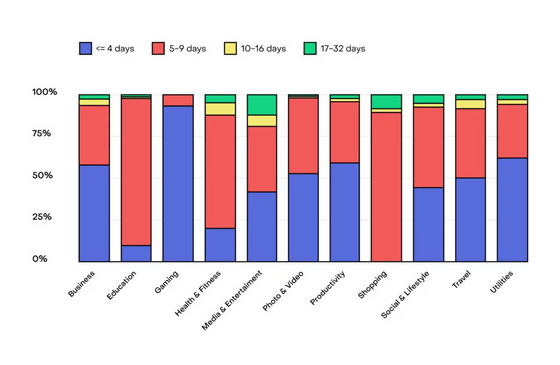

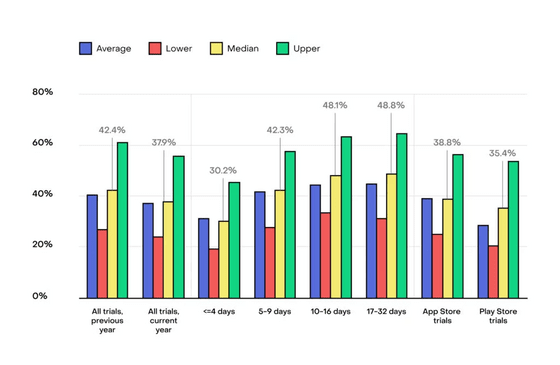

By the way, the average trial period was 5-9 days. Despite a lot of data suggesting that ``the longer the trial period, the better the `` conversion rate ,'' which indicates the percentage of trial users who convert to a full contract, many apps have short trial periods. , it can be inferred that developers seem to prioritize obtaining a quick conversion rate over a high conversion rate.

By category, trial periods for media and entertainment, primarily streaming apps, are relatively long, while trial periods for games tend to be very short, with over 90% of apps lasting less than 4 days.

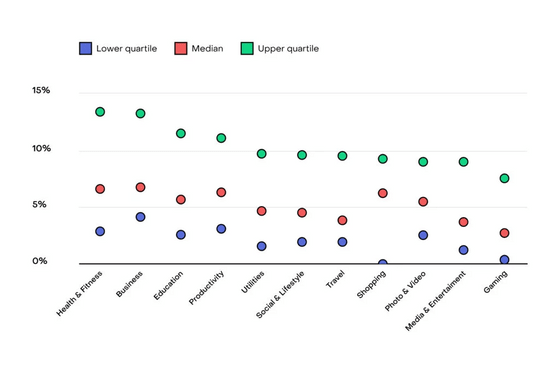

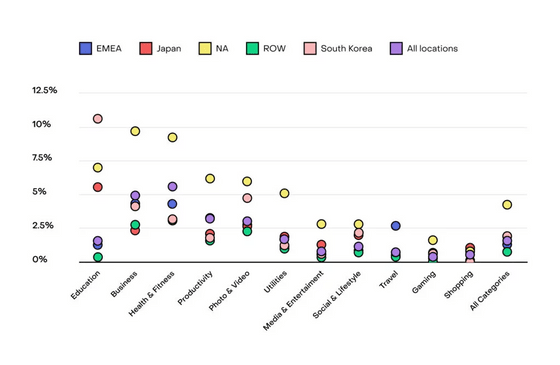

Trial usage rates vary widely by category, with Health & Fitness and Business leading the way with medians of 6.7% and 6.9%, respectively. In comparison, 'Games' (2.9%) and 'Media & Entertainment' (3.9%) have lower values.

These differences may be due to differences in monetization models and users' familiarity with subscriptions, with high-value apps like business and health & fitness having more money for subscriptions. It seems that there is a tendency for there to be users who are highly motivated to pay.

Below is a graph showing how many days it took from downloading the app to starting the trial version by category. Most users started the trial version on day 0 (within 24 hours), and 'Utility' (86.0%) and 'Business' (85.1%) use the trial version relatively quickly. On the other hand, in 'Shopping', only 38.5% started the trial on the first day, followed by 29.0% after the 30th. This is believed to be because shopping apps rely on e-commerce as their main monetization method and do not focus on subscriber subscriptions. Other categories with relatively slow trial launches are those that are generally feature-rich even in the free version, such as 'Social & Lifestyle.'

The median conversion rate in 2024 was 3.2% lower than 40.5% in 2023. The median conversion rate for apps with a trial period of less than 4 days was 30.2%, and 48.8% for apps with a trial period of 17 to 32 days, suggesting that apps with longer trial periods are more likely to convert users to this agreement. . Additionally, the median conversion rate for the App Store was 38.8% and for Google Play it was 35.4%.

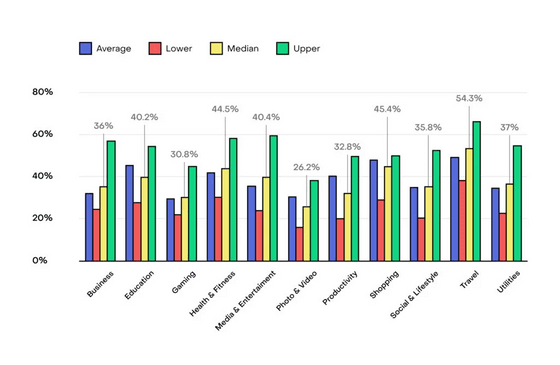

By category, 'Travel' had the highest rate at 54.3%, followed by 'Shopping' and 'Health & Fitness.' Compared to these, 'Photos & Videos' at 26.2% and 'Games' at 30.8% are clearly inferior.

RevenueCat says, ``High conversion rates for shopping and travel suggest strong user intent, while low conversion rates for games and photos & videos reflect more casual tastes.'' There is a possibility that there is.''

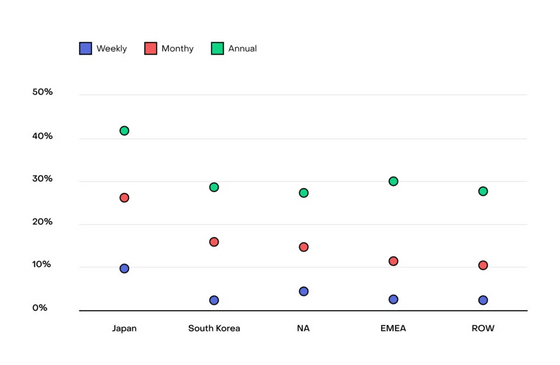

◆Subscription contract rate by market

By market/category, the percentage of subscriptions in the 'Education' category is much higher in South Korea than in other countries, while in North America it is higher in 'Business' and 'Health & Fitness.' Japan has a high percentage in 'Education' and 'Media & Entertainment,' while EMEA (Europe, Middle East and Africa) has a high percentage in 'Travel' etc.

◆Refund rate (App Store only)

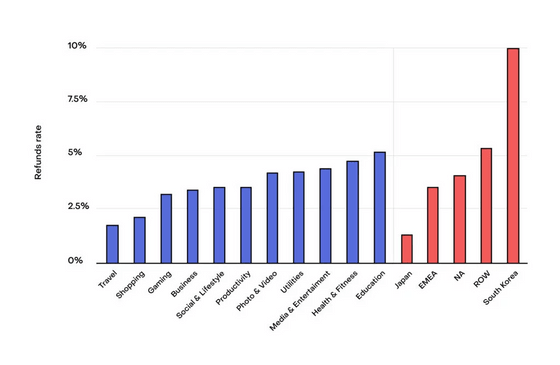

Refund rates are almost flat in most categories. By market, South Korea has the highest refund rate, while Japan has the lowest rate of any region.

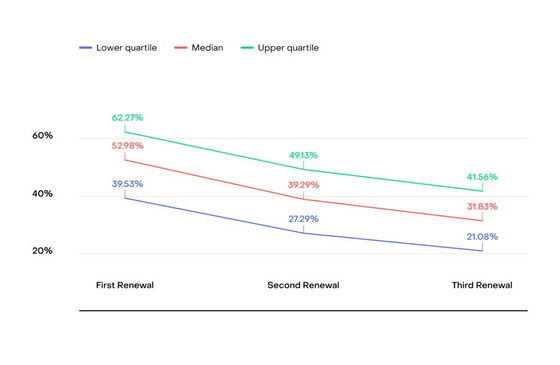

◆Retention rate

Looking at each plan, the contract retention rate for the weekly plan is lower than that for the monthly and annual plans, with just over 40% remaining as of the third contract renewal date. On the other hand, up to 52% of monthly plans will maintain their contract even on the third renewal date.

RevenueCat says, ``Weekly plans are not very suitable for apps that can be expected to be maintained over a long period of time, but are suitable for apps that want to quickly generate revenue from advertising expenses.Other than that, weekly plan subscribers It would be wiser to increase the number of subscribers to monthly and annual plans rather than trying to increase the number of customers.'

By region, Japan has the highest contract retention rate, and the highest proportion of users in the world continued to sign up for the second year in terms of weekly, monthly, and annual fees.

◆Profitability rate

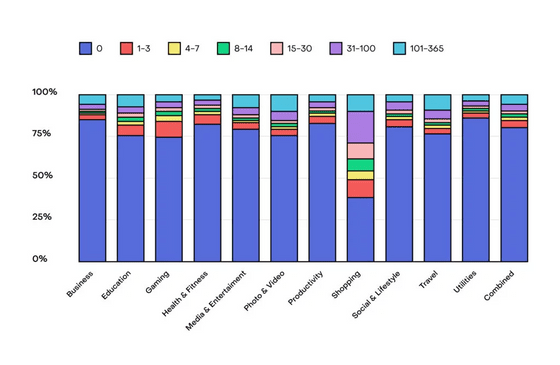

On average, only 17.2% of apps reach $1,000 in monthly revenue, which is very low. However, apps that reach $1,000 have a high probability of growing from there: 59% of apps that reach $1,000 have a monthly income of $2,500 (approximately 368,000 yen), and 60% of apps that reach $2,500 have a monthly income of 5,000. It is said to reach US dollars (about 737,000 yen).

Looking at each category, ``Photo & Video'' has a high probability of achieving over $1000, while ``Utility'' and ``Business'' have a low probability.

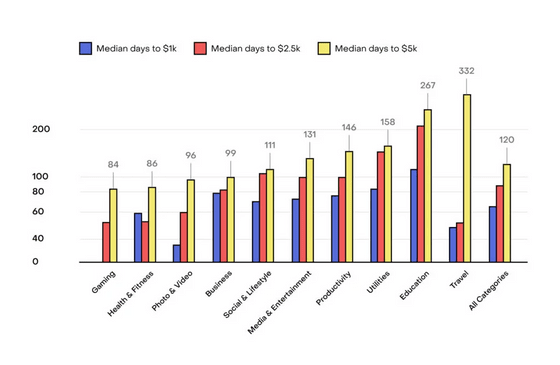

The median number of days it takes to reach $1000 in app revenue is 65 days, and it takes a total of 120 days to reach $5000. A notable exception is Travel, where apps reach $1,000 and $2,500 faster than average, but take much longer to reach $5,000. The reason why it takes so few days for 'Photo & Video' to reach $1,000 may be due to the recent explosive growth of AI image apps.

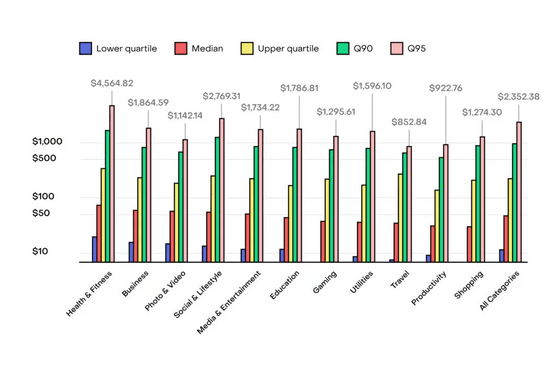

The specific revenue by category is as follows, and the median monthly revenue for the app is just under $50 (about 7,400 yen). Focusing on the top 5% (Q95), some had monthly incomes of $2,352 (approximately 346,000 yen).

◆Forum now open

A forum related to this article has been set up on the GIGAZINE official Discord server . Anyone can write freely, so please feel free to comment! If you do not have a Discord account, please create one by referring to the article explaining how to create an account!

• Discord | 'How much yen do you spend on subscriptions? What is the subscription you have been contracted for the longest?' | GIGAZINE

https://discord.com/channels/1037961069903216680/1217405290748706917

Related Posts:

in Software, Smartphone, Posted by log1p_kr