In the past 40 years, 45 million people have student loans in the United States, where the tuition inflation rate is 710%

Alman Madani, a senior data scientist in California, points out that tuition fees in the United States have risen 710% in the last 40 years, and debt per student has also increased due to taking out loans.

The Student Debt Crisis, Explained.

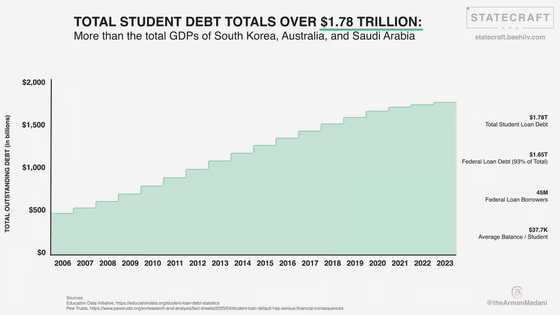

According to Mr. Madani, the total student loan balance of Americans is increasing year by year, and in 2006 it was less than 500 billion dollars (about 70.3 trillion yen), but in 2023 it will be 1.78 trillion dollars (about 250 trillion yen). This figure exceeds the GDP of developed countries such as South Korea, Australia, and oil giant Saudi Arabia.

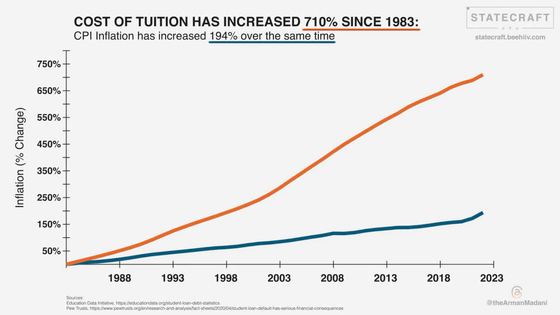

One of the reasons is the skyrocketing tuition fees. When 1983 was used as the base year, the inflation rate of the consumer price index was 194%. However, the tuition fee is 710%, which is a big difference.

Of the 1.78 trillion dollar debt, 93%, or 1.65 trillion dollars (about 232 trillion yen), is a federal student loan. Indeed, 45 million Americans are in a state of federal student loan debt.

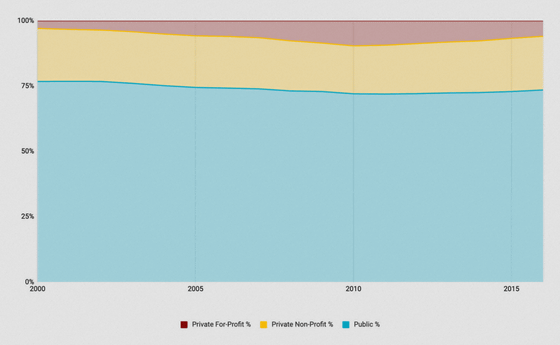

According to Madani, the number of students enrolled in higher education institutions has increased consistently since 2000, and tuition fees have risen sharply in response to the demand for degrees. Especially during the recession of 2008-2009, enrollment in private universities increased as unemployed people rushed to attend college for re-education purposes. The following shows the enrollment ratio of for-profit private universities, non-profit private universities, and public universities from the top.

Of these, the rate of default (default) was high for students enrolled in commercial private universities, and it seems that 16% of borrowers were in default within 3 years.

Mr. Madani presents a solution to the student loan problem while taking it as a private opinion.

First, as a short-term solution, students need to be 'recourse,' or redeemed, Madani said. Failure to repay student loans can cause borrowers to miss college attendance certificates, lower credit scores, and have their wages garnished, all of which can lead to a cascading loss of income. Madani argues that these loans should be forgiven or allowed to be canceled, especially since some loans are likely to default after the COVID-19 grace period. In Madani's view, if a default occurs, the aftermath of the impact on low- and middle-income degree holders will be a greater economic cost than canceling the loan.

In addition, managing and regulating some of the information reported to credit bureaus can reduce the negative income impact of defaults, Madani said.

Madani also points out that in the long term it will be necessary to control the fundamental costs of higher education itself. For example, the state of California has a program that provides free tuition fees to citizens attending community colleges, and the federal government's support for a similar mechanism can reduce the burden on some new graduates. Also, by reviewing tax revenue allocation and creating new tax revenue sources, it may be possible to lower tuition fees at underfunded private and public universities.

Related Posts:

in Note, Posted by logc_nt