Google and Meta's $300 billion ad business oligopoly may be threatened

In the past decade, digital advertising has been said

The $300bn Google-Meta advertising duopoly is under attack |

https://www.economist.com/business/2022/09/18/the-300bn-google-meta-advertising-duopoly-is-under-attack

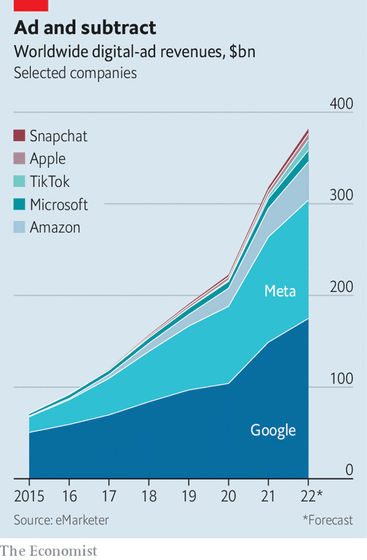

The combined revenue of Google and Meta is expected to reach $ 300 billion in the first half of 2022 alone, and even with ad business rivals such as Amazon, TikTok, Apple, and image posting app Snapchat combined, it will quadruple. There is more difference. However, as you can see from the chart below, these rivals were not involved in the advertising business at all five years ago, and now that many companies have emerged in the advertising business, they are in a duopoly. The Economist points out that even for powerful companies that can be said to feel 'the era of digital advertising transformation'.

According to The Economist, TikTok is the most disturbing digital advertising scene in recent years. In the five years since its launch, TikTok has improved its position on social media by taking advertising dollars away from Meta's main content, Facebook and Instagram. Analyst firm eMarketer expects TikTok's advertising revenue to exceed $11 billion (about 1.6 trillion yen) in 2022 and double that by 2024.

Also, Amazon, which is expanding its advertising business after Google and Meta, was less than 1% of the digital advertising market six years ago, but has grown to nearly 7% in 2022. The revenue of the advertising business, which Amazon reported in detail in 2021, was almost the same as the advertising sales of the global newspaper industry as a whole. Amazon's management positions its advertising business as a 'primary engine' alongside retail and cloud computing. Ad revenue is not reported for Apple's advertising business, as it sells many of its own ads. On the other hand, Bloomberg estimates that Apple's advertising business is already generating $4 billion annually, making it almost as big an advertising platform as Twitter.

While rival companies show growth, Meta predicts that `` advertising business sales in 2022 will decrease by $ 10 billion (about 1.1 trillion yen) ''. The reason for this is that with the introduction of ``App Tracking Transparency (ATT)'' to deal with privacy violations caused by behavioral targeting ads , the inability to deliver advertisements based on consumer interests weakens the effectiveness of advertisements. has a strong impact. A smaller platform than Meta, which has abundant funds, has suffered a similar blow, and Snapchat's market value is believed to have plummeted to $ 97 billion (about 14 trillion yen), which is 83% of 2021. I'm here.

``Advertising Facebook away'' accelerates, ``loser of advertising war'' and big letter-GIGAZINE

In contrast, Amazon, Apple, and Microsoft rely on their own 'first party' data, making them less susceptible to ATT, which prohibits user tracking. In addition, Amazon's 'Prime Video' and Apple's 'Apple TV+' such as 'Internet-connected TV' can deliver targeted advertisements even though they are TV commercials, which is making a big change in the advertising business. The Economist points out.

``I think a 'new order will come into being' as digital advertising permeates every corner of the economy,'' said eMarketer analyst Andrew Lipsman. Lipsman added that while he believes that Google will be better positioned to adapt to future changes in the advertising business, such as search ads and YouTube video ads, 'within five years, Amazon will overtake Meta in terms of total ad revenue.' I also expect.

At Hacker News , the discussion about the transformation of the advertising business is heated with the opinion that ``I think online advertising is a mess'' as a whole. The advertising business, including Google and Meta, is overly dependent on algorithms to improve the efficiency of ad distribution destinations in pursuit of profits, and the reason for the 'change' is that the convenience of the side of advertising is being reduced. As pointed out by a user who actually uses the advertising business. While there are many dissatisfaction with Google's advertising system, ``Google's semi-monopoly is not because Google is aiming for an anti-competitive state, but because Google is the best compared to other advertising products. It is because it has ', a contrasting opinion is also shown.

Related Posts:

in Web Service, Posted by log1e_dh