In a takeover bid for Fujisoft, Bain Capital, a major private equity fund, announced that it would not raise the purchase price any further and would not proceed with the takeover bid.

Notice regarding non-implementation of tender offer for FUJISOFT Co., Ltd. shares (securities code: 9749)

(PDF file) https://www.fsi.co.jp/company/news/2025/20250217_1.pdf

Notice regarding non-implementation of tender offer for our shares by BCJ-88 Co., Ltd.

(PDF file)

Notice Regarding Non-implementation of Tender Offer for the Shares of FUJI SOFT INCORPORATED (Securities Code: 9749)

(PDF file) https://www.baincapital.co.jp/sites/default/files/2025-02/BCP_%209749_17022025-En.pdf

Bain Capital ends acquisition battle with KKR for Fuji Soft | Reuters

https://www.reuters.com/markets/deals/bain-capital-ends-acquisition-battle-with-kkr-fuji-soft-2025-02-17/

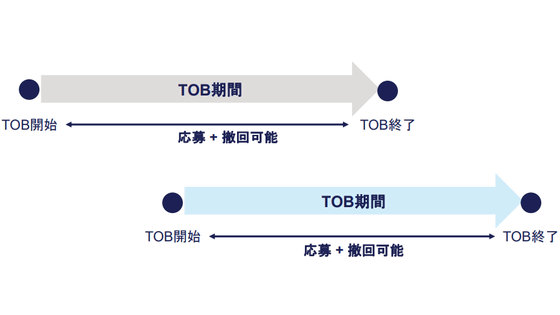

In June 2022, Fujisoft established a corporate value improvement committee composed of board attendees. As part of its efforts to maximize its corporate value, the company began discussions with several companies, including major private equity fund KKR, as one of its value-enhancing measures. At this time, privatization was also included as a management option. In August 2024, Fujisoft and KKR agreed to a tender offer to acquire shares at 8,800 yen per share. The tender offer began on September 4, 2024.

KKR's TOB was scheduled to end on October 21, 2024, but on October 11, 2024, Bain Capital, another private equity fund, announced the launch of a TOB at 9,450 yen per share. On the other hand, Fujisoft's board of directors supported KKR's privatization proposal rather than Bain Capital's TOB, which had better financial terms, and recommended applying for KKR's TOB.

In the TOB for Fujisoft, the board of directors plans to accept the proposal from PE fund giant KKR, but the founder opposes it and supports the high-priced Bain Capital proposal - GIGAZINE

Thus began the takeover race for Fujisoft between KKR and Bain Capital. In November 2024, KKR raised its TOB price from 8,800 yen per share to 9,451 yen, exceeding Bain Capital's offer (PDF file) , and Fujisoft reiterated its support for the KKR proposal and encouraged shareholders to tender. In contrast, it expressed opposition to Bain Capital's proposal.

In response, Bain Capital proposed a TOB of 9,600 yen per share on December 11, 2024. On the other hand, Fujisoft's board of directors has again expressed opposition to the Bain Capital proposal (PDF file), stating that 'the Bain Capital proposal has doubts about the improvement of corporate value compared to privatization by KKR.'

The Bain Capital proposal presented in December 2024 was a so-called 'acquisition without consent,' which did not require Fujisoft's approval as a prerequisite. Therefore, Bain Capital was making preparations to secure funds and select a tender offer agent in preparation for the start of the TOB on February 5, 2025.

Meanwhile, on February 4, 2025, KKR raised the purchase price (PDF file) to 9,850 yen per share . In response, Bain Capital issued a statement saying, 'We will carefully consider our future policy, including the option of withdrawing the TOB.' Fujisoft had requested Bain Capital to clarify the timing of the policy decision.

(Addition) Notice regarding the status of the tender offer for our shares by BCJ-88 Co., Ltd.

(PDF file) https://www.fsi.co.jp/company/news/2025/20250210.pdf

Then, on February 17, 2025, Bain Capital announced that it would not be conducting a tender offer for Fujisoft. In the release, Bain Capital stated, 'After consulting with Fujisoft's founder, Hiroshi Nozawa, and taking into consideration the interests of Fujisoft and its shareholders, we considered our response policy, but we have concluded that we will not raise the share purchase price any further in the tender offer and will not conduct the tender offer.'

Bain Capital also pointed out that 'we have doubts about the fairness of Fujisoft's process for considering taking the company private and about Fujisoft's response, including its system for considering the tender offer,' but commented that 'we hope to see Fujisoft continue to grow under the new governance that will be led by new shareholders.'

At the time of writing, neither Fujisoft nor KKR had made any comments.

Related Posts:

in Note, Posted by log1r_ut