In the takeover bid for Fujisoft, the board of directors plans to accept the proposal from PE fund giant KKR, but the founder opposes it and supports the higher-priced proposal from Bain Capital

It has been reported that there is a

Notice regarding the planned commencement of a tender offer by FK Corporation for Fujisoft Inc. (Stock Code: 9749)

(PDF file) https://www.fsi.co.jp/company/news/2024/20240808_1.pdf

Summary of opinion in support of the planned commencement of the tender offer for the Company's shares by FK Corporation and recommendation to tender

(PDF file) https://www.fsi.co.jp/ir/library/docs/presentation/kigyoukachi_report20240808.pdf

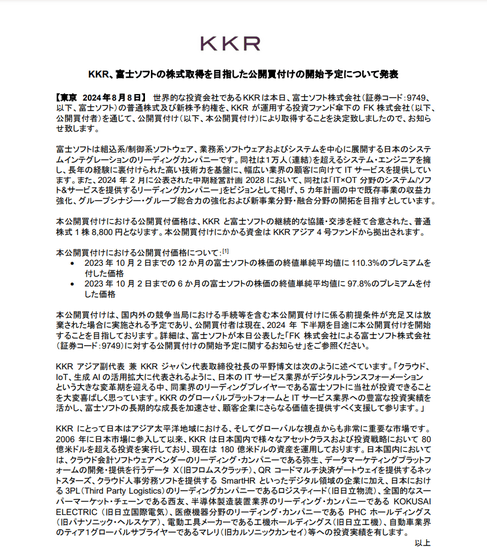

KKR Announces Plan to Commence Tender Offer to Acquire Shares of Fujisoft

(PDF file) https://www.kkr.com/content/dam/kkr/country-sites/jp/press-release/2024/20240808-kkr-announces-tender-offer-to-acquire-fuji-soft-jp.pdf

In June 2022, Fujisoft established a corporate value improvement committee composed of members of the board of directors to consider measures to maximize corporate value, and began discussions with several companies, including major private equity fund KKR, as one of the value-enhancing measures. At that time, going private was also included as a management option.

On August 8, 2024, Fujisoft and KKR agreed to a tender offer to acquire shares at 8,800 yen per share. The tender offer began on September 4, 2024.

KKR launches tender offer for Fujisoft

(PDF file)

KKR's tender offer was scheduled to end on October 21, 2024, but on October 11, 2024, private equity fund Bain Capital announced that it would begin a tender offer at 9,450 yen per share.

According to Bain Capital, there was a request for information process led by Fujisoft in the summer of 2023, and it proposed a tender offer of 8,006 yen per share. At that time, KKR had proposed 6,800 to 7,200 yen per share.

Notice regarding the planned commencement of a tender offer for FUJISOFT Inc. shares (securities code: 9749) (supplementary materials)

(PDF file) https://www.baincapital.co.jp/sites/default/files/2024-10/BC_PR11102024.pdf

Notice Concerning the Planned Commencement of the Tender Offer for FUJISOFT Inc. Shares (Stock Code: 9749) (Updated Supplementary Material)

(PDF file) https://www.baincapital.co.jp/sites/default/files/2024-10/BCP_PR_9749-20102024.pdf

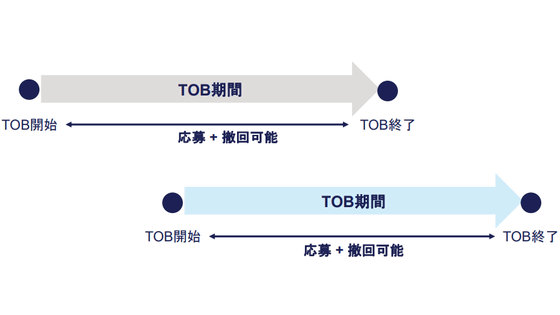

A TOB can be applied for at any time during the tender offer period, and an application can also be withdrawn at any time, but Fujisoft's board of directors supported KKR's privatization proposal rather than Bain Capital's TOB, which offered better terms, and recommended applying for KKR's TOB.

For this reason, Bain Capital claims that it is 'confident that its proposal is in the best interest of all shareholders.' Fujisoft founder and major shareholder Hiroshi Nozawa has also called on Fujisoft to endorse Bain Capital's proposal and recommend the tender offer.

Fujisoft founder requests support for Bain proposal, submits letter to company regarding acquisition | Reuters

https://jp.reuters.com/markets/japan/5ZNOVA6FQ5PAHMOLFVGAFHF5FQ-2024-10-17/

Continued

In a takeover bid for Fujisoft, PE fund giant Bain Capital announced that it would not raise the purchase price any further and would not conduct a takeover bid - GIGAZINE

Related Posts: