It turns out Silicon Valley founders aren't actually taking as many risks as you might think

There's a common perception that startup founders give up stable jobs to take on high-risk ventures in exchange for big rewards if they succeed, but as veteran startup employee Stephane Siard points out, 'startup founders are often lower risk than employees.'

Silicon Valley's Best Kept Secret: Founder Liquidity

After graduating from university, Mr. Siad joined a startup, and when the company grew, he would quit and join another startup, repeating the cycle and working as an early engineer at five startups over the course of nine years. He has also experienced three liquidity events , such as acquisitions. In February 2024, he became the founder and launched his own startup.

Over the years, Mr. Sheard has found that startup founders are not taking as many risks as people think. According to Mr. Sheard, when a startup raises funds, the founders simultaneously sell some of their shares to ensure their personal financial stability.

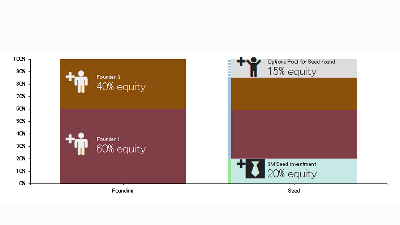

The changes in cash compensation for typical founders and employees based on Mr. Sheard's experience are shown in the figure below. As the company grows through repeated fundraising from 'SEED' to 'Series A' and 'Series B,' employee cash compensation, shown in green, only grows slightly, but founders can earn large cash compensation through the sale of personal shares, shown in light purple, in addition to salary compensation, shown in dark purple.

So while the story of founders going all-in on startups is highly persuasive, in reality it's actually their employees who are all-in, and founders are largely avoiding financial risk. 'If this situation becomes more widely known, it could change the perception and evaluation of startups,' says Sheard.

Sheard cited WeWork founder Adam Neumann as a particularly famous example. Neumann was able to cash out a total of $2 billion through personal stock sales during multiple fundraising rounds, but not a single WeWork employee was able to sell any stock. Employee stock compensation was hyped during WeWork's valuation rise, but the COVID-19 pandemic caused WeWork to collapse, rendering employee stock almost meaningless.

And in the case of Hopin, an online meeting hosting platform, the founders were able to cash out their shares during the fundraising, but the subsequent decline in valuation meant they had to sell the company for less than the liquidation preference amount they received at the time of the fundraising, rendering employee shares worthless.

In these instances, Sheard says, 'the problem isn't that founders are selling shares to reduce risk, it's that employees can't cash out.'

Sheard recommends asking employees at startups whether the founders liquidated their shares when funding was announced. If the answer is 'no,' the risk the founders bear remains unchanged, but if the answer is 'liquidated,' the risk to employees and founders has changed.

Sheard said he avoided risk differentials between him and his early employees by only selling shares at the same time as his employees in his startups, and that venture capital firms should be transparent in their fundraising to ensure employees don't have a fundamentally wrong understanding of the risk environment.

Related Posts:

in Note, Posted by log1d_ts