Why rising interest rates lead to fewer IT jobs

Engineer Matt Stancliffe analyses why IT jobs are so sensitive to interest rates.

Panic! at the Tech Job Market

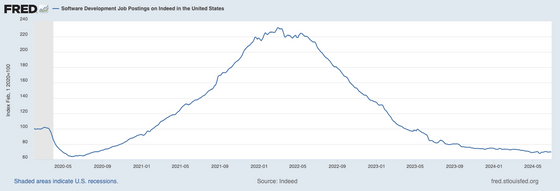

First, Stancliffe presented data on the number of software engineer job openings in the United States. Based on the number of job openings on February 1, 2020, there were 2.2 times as many job openings around 2022, but by 2024 the index had fallen to around 70, with the number of job openings being one-third of what it was in 2022.

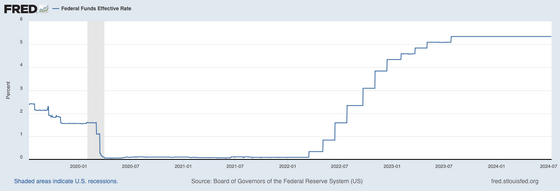

Meanwhile, the trend of the Federal Funds Rate, which is used as the policy interest rate in the United States, is as shown in the graph below. It has been gradually raised since mid-2022.

When interest rates rise, organizations with large amounts of cash can increase their cash risk-free by depositing funds in safe government-guaranteed accounts, reducing the incentive to make risky investments in search of profits. In fact, a 5% increase in the policy interest rate caused credit card interest rates to increase significantly from 9% to 30%.

Providing funds to companies with an uncertain future is one of the risks to avoid in an era of high interest rates. High interest rates make it difficult for companies to raise funds, so weak companies go bankrupt, and strong companies use interest rates as an excuse to 'clean up' employees. In either case, workers who had been highly paid up until then lose their jobs. As a result, a total of hundreds of thousands of IT workers have lost their jobs in the United States since mid-2022.

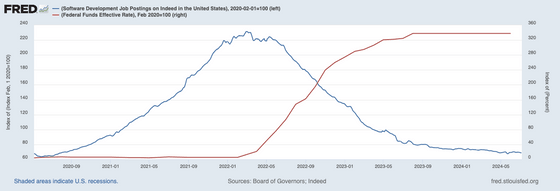

The figure below shows the number of job openings and interest rate data overlaid on each other. As interest rates rise, the number of job openings falls.

Stancliffe pointed out that during the same interest rate rise, employment in other occupations such as minimum wage part-time jobs and construction increased, and analyzed why software engineers are so affected by interest rates. According to Stancliffe's analysis, IT companies can be divided into four categories:

・nepo (connection) companies

Stancliffe coined the term 'nepo companies' to describe companies whose founders say, ' I want to be the king of the earth ,' or companies that create juice blenders that cost over 100,000 yen, and other companies that live in a fantasy world that realizes unrealistic dreams with no market value. Nepo companies obtain funding through personal connections with investors, so they are heavily dependent on the assets of their investors.

・Speculative companies

Stancliffe calls a company that has no product or customers yet, and no idea if there is a market for the product, but has an idea, so it gets funding and builds an organization to see if the idea works a speculative company. There is no doubt that it is a high-risk investment from the investor's perspective. Stancliffe says that it is a real loss to become an employee of a speculative company, saying, 'You will be asked to do 200% to 500% more work for 50% to 80% of the market salary.'

Early growth companies

Once the venture's idea proves to be a good fit, the company will try to grow it by selling some ownership stakes and generate as much revenue as possible. The product starts to get real customers and VC money starts to flow in. Companies at this stage are often unprofitable and are burning VC money to stay on the path to success.

Stancliffe says that early-stage companies 'exist only to make their founders rich,' and that, except for the very few that actually grow into large companies, 'working at one of these companies is a waste of your life.'

・Stable company

Stable companies are essentially what most people think of as 'businesses' - they have self-sustaining revenue and growth cycles, they aren't going to be destroyed by quarterly market trends or shifts in government economic policy, they are organizations with longevity, and they pay their employees well.

Of these four types of companies, NEPs, speculative companies, and early growth companies cannot even maintain their current status without investment from investors, so if interest rates rise and capital inflows decrease, the size of the company will suddenly begin to shrink. In addition, customers who purchase the products of these 'startups' often refrain from risky purchasing behavior when interest rates rise and capital margins decrease, so both capital and sales are strongly affected by interest rates.

In a blog post, Stancliffe said, 'Even if you're doing the same job, your salary can vary greatly depending on which company you work for,' stressing the importance of working for a large company.

Related Posts:

in Note, Posted by log1d_ts