How are credit card rewards programs structured?

Patrick MacKenzie, an advisor to internet financial infrastructure company Stripe, posted an article explaining the structure of credit card rewards programs.

Anatomy of a credit card rewards program

As a premise, the revenue of credit cards is mainly made up of four elements: 'interest,' 'merchant fees (interchange fees),' 'user fees,' and 'marketing.' The detailed structure of these revenues is explained in the following article.

How do credit cards make money? - GIGAZINE

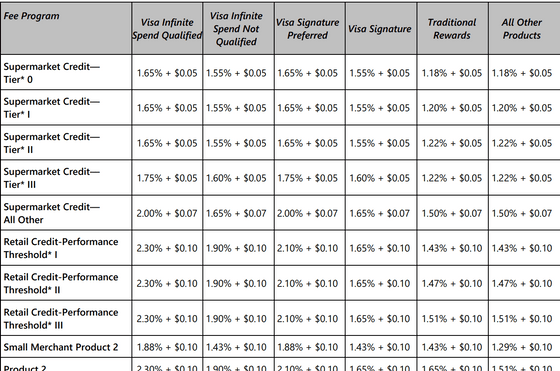

Of these, the main reason card issuers set up reward programs is to earn 'merchant fees.' When a payment is made with a credit card, a portion of the payment amount is paid to the card issuer. This is the merchant fee, which is a percentage fee based on the final total payment amount plus a fee per transaction. However, this fee is not fixed and is set based on quite a few factors.

According to MacKenzie, the overall trend is that the higher the card's tier, the higher the merchant fees, meaning that credit card issuers are marketing higher-tier cards to the wealthy and taking a cut from the rest of the economy.

To encourage these loyal customers to pay for products with higher fees, card issuers offer a variety of incentives.

However, not all credit cards come with perks. The reason for this is that 'each user has a different job that the credit card needs to do,' says MacKenzie.

Credit cards are a means of payment, but they also provide a way to borrow money. It is well known that credit card borrowing, such as revolving payments, has very high interest rates, but it is a fairly accessible way to borrow money, and for users with low economic status, it is a big 'value' of using a card. Since these users pay a low amount each month, card companies earn income mainly from interest rates, not merchant fees.

Credit cards for users with low economic status generally do not come with rewards programs, because merchant fees are used to subsidize credit costs rather than reward rewards, says MacKenzie. Payments made with credit cards are 'deferred' (even if they are one-time payments) until the following month, and the free credit costs during this period are also a benefit.

On the other hand, users with economic status use credit cards as a means of payment. For these users, merchant fees are much higher than interest income, so card issuers have an incentive to encourage them to use their cards by offering various rewards.

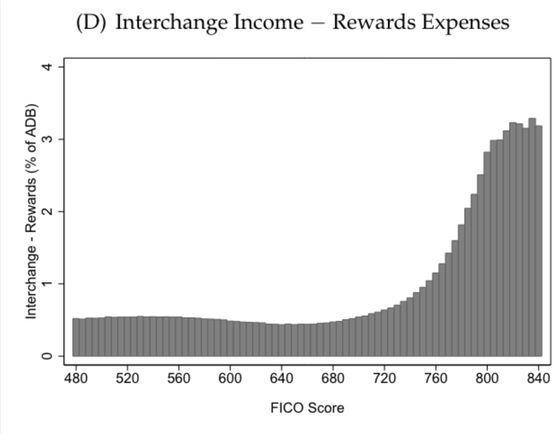

The chart below shows the percentage of revenue from average daily card transaction balances after subtracting the cost of rewards programs from merchant fees, sorted by

Credit card issuers offer a variety of reward programs, but the simplest reward is 'cash back.' If an issuer earns a 1.4% merchant fee, offering 1% cash back means that the issuer pays 1% of revenue as a de facto user acquisition cost and secures a 0.4% profit.

When reward programs were first invented, they had a simple structure, but over time, more complex programs such as '1% cash back as a rule, but 1.5% cash back at gas stations' were developed to attract users from competitors. These reward programs are designed to attract users with the number '1.5%' and encourage them to use it as their main payment method for other payments, thereby bringing the overall cash back cost closer to the '1%' line.

In addition, Chase Bank , one of the credit card issuers, has attracted many users by offering a diverse reward system, such as allowing users to pay directly with points when purchasing on Amazon. Chase Bank also offers other great benefits such as '3% cash back on travel and meals,' but these benefits can be sustained because many users do not use multiple cards to scrape together cash back, but instead keep overall costs low by paying for a variety of products with a few cards.

'If you use your spreadsheet skills in the financial industry, rather than in a credit card rewards program, you can clearly earn three or more figures more,' MacKenzie said, referring to the existence of users who make the most of their card rewards by making detailed use of them.

◆ Forum is currently open

A forum related to this article has been set up on the official GIGAZINE Discord server . Anyone can post freely, so please feel free to comment! If you do not have a Discord account, please refer to the account creation procedure explanation article to create an account!

• Discord | 'How many credit cards do you have? How do you choose them?' | GIGAZINE

https://discord.com/channels/1037961069903216680/1225737900600070217

Related Posts:

in Note, Posted by log1d_ts