How do credit cards make a profit?

Some 'credit cards ' that allow postpay with customer credits claim to be free of annual membership fees, while others claim to return a few percent to any payment. You may wonder if you are making a profit. Blogger Patrick McKenzie, who works for payment service company Stripe , explains these credit card revenues.

How credit cards make money

https://bam.kalzumeus.com/archive/how-credit-cards-make-money/

According to Mackenzie, there are four ways to earn money from good users who don't cheat on credit cards, which are very common: 'interest,' 'merchant fees (interchange fees),' 'user fees,' and 'marketing.' There seems to be. Below is a commentary by Mr. Mackenzie about these four ways.

◆ 1: Interest

Some credit card payment methods, such as revolving payments and installment payments, charge interest on borrowing. Interest is not appreciated by consumers, but according to Mackenzie, sellers are the best in marketing to 'choose their own company over competitors,' 'use more money,' and 'visit more often.' It is the ultimate service that realizes three important issues.

Prior to the advent of credit cards, retailers had to keep books for each trading partner and collect payments themselves, in addition to cumbersome administrative tasks and accounting. Credit cards not only wiped out these headaches, but also introduced a mechanism that 'the counterparty pays the loan repeatedly' so that even retailers with very little capital can secure sufficient profits. Mr. Mackenzie said that it became.

◆ 2: Merchant fee (interchange fee)

As the word 'cashless society ' also exists, many people prefer payment methods such as credit cards and e-commerce to banknotes and coins, and when deciding which store to go to, 'whether a credit card can be used' There are a certain number of people who use '' as one of the judgment factors.

In other words, since it is expected that the sign 'credit card compatible store' can acquire more customers, the credit card company collects a usage fee called 'merchant fee (interchange fee)' from the member store. This merchant fee is also paid to payment processors, credit card banks, credit card network installers, etc., but most are paid to credit card companies.

What is the payment system usage fee? Introducing the market price and points to note when introducing | Pay Support-Cashless payment started by the store-

https://www.smbc-card.com/kamei/magazine/knowledge/payment_system_fee.jsp

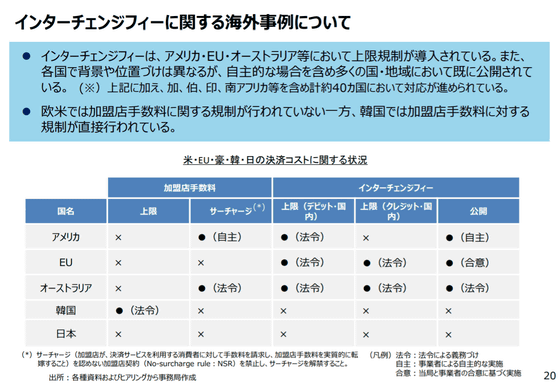

In Europe and the United States, the upper limit of merchant fees is set by law, but in Japan there is no upper limit set by law. 'There is no legal limit in Japan, but financial institutions mysteriously limit merchant fees to 1%, so card issuance is very high in Japan,' McKenzie noted in the case of Japan. It has become a profitable business and is subsidizing consumer finance in Japan's sustainable low interest rate environment. '

Review of the 4th discussion, analysis of interchange fees, efforts toward paperless, etc. Ministry of Economy, Trade and Industry, Commerce and Service Group, Cashless Promotion Office

(PDF file) https://www.meti.go.jp/press/2020/01/20210126003/20210126003-3.pdf

◆ 3: User fee

There are roughly two types of fees on the credit card user side: 'annual membership fee' and 'installment payment / revolving payment fee'. Of these, there are two types of installment payment and revolving payment fees: excess limit fees and late damages, but in recent years, with the spread of mobile apps and automatic voice response systems, consumers can easily grasp their own payment status. In addition to this, regulators are putting pressure on them to 'reduce installment payment and revolving payment fees,' so the percentage of total revenue is decreasing.

◆ 4: Marketing

Credit card companies are running a variety of campaigns, and it has been proven that successful use of these campaigns can lead to customer acquisition. A good example of how credit card companies are making money from marketing is Mackenzie's mobile, which is run by Twitter CEO Jack Dorsey and makes it easy to make credit payments using iPhone, iPad, and Android. An example of the payment service 'Square'. Square is developing an interpersonal money transfer app called 'Cash App' in the United Kingdom and the United States, and in the Cash App, '10% off when you use it at a grocery store' and '5% off when you use it at an adidas online shop' Campaigns are running regularly.

Cash App --The easiest way to send, spend, bank, and invest

https://cash.app/

'I don't have any internal knowledge,' McKenzie said. 'The grocery store case is meant to help customers get into the habit of using Square, and the Adidas case is Adidas. Is believed to have paid Square the campaign costs, 'he said, explaining that these campaign costs are equivalent to marketing costs such as advertising costs. “Credit card issuers, like Google and Facebook, can have a decisive impact on actual buying behavior. It's a business that is more valuable to many companies than buying and selling customer purchase data. '.

Related Posts:

in Note, Posted by darkhorse_log