Why do the wealthy use American Express cards?

There are many different brands of credit cards, including Visa, MasterCard, and JCB, but many wealthy Americans prefer

Why Wealthy Americans Love AmEx - YouTube

AMEX was founded in the mid-19th century as a shipping company, and later expanded into the traveler's check and charge card businesses, building a long history and tradition. In particular, AMEX's premium cards, such as the Gold Preferred Card and Platinum Card , are widely recognized as status symbols for the wealthy.

AMEX credit cards have relatively high annual fees, such as the Platinum Card's annual fee of 165,000 yen. However, AMEX offers a wide range of benefits and rewards programs to customers who pay the high annual fees. For example, AMEX offers customers hotel accommodation vouchers, travel credits, and airport lounge access, meeting the travel and business needs of the wealthy. In fact, it has been reported that AMEX spends approximately $17 billion (approximately 2.6 trillion yen) a year on providing services and rewards to its members.

According to CNBC, by offering customers a variety of benefits that are useful in everyday life, AMEX has succeeded in increasing the frequency of customer use. AMEX's business model targeting high-income earners has led to AMEX earning $52.9 billion in revenue in 2022, and it has been revealed that AMEX members spend an average of three times as much annually as non-members.

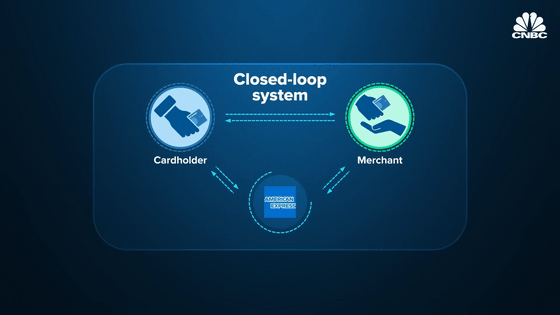

AMEX's rivals include brands such as Visa and MasterCard, but Visa and MasterCard operate on an 'open loop system' that acts as an intermediary to process transactions without actually issuing credit cards, while AMEX operates on a 'closed loop system' that performs all three roles of credit card issuer,

Unlike Visa and MasterCard, which collect fees from card issuers and merchants, AMEX collects interest income in addition to transaction processing fees. As an issuer of its own credit cards, AMEX is able to collect interest on the debt customers incur when they use their cards. AMEX also often charges higher fees to merchants than Visa and MasterCard, which translates into higher revenues for AMEX. Still, some merchants pay higher transaction processing fees to attract high-value shoppers who have AMEX cards.

Through this differentiation, AMEX has established a business model different from Visa and MasterCard, and has been successful. However, in recent years, Visa and MasterCard have also been using data analysis and AI to reduce the advantage of AMEX's closed-loop system. For this reason, AMEX has been focusing on expanding its customer base in recent years, targeting millennials and Americans who do not have bank accounts. In fact, about 60% of customers who issued new credit cards in 2022 were from Generation Z and millennials, which shows that approaching younger generations is important, and it has been pointed out that capturing these customer groups is essential for AMEX's long-term growth.

In response to the growing demand for digital payments and online services in recent years, AMEX is also focusing on improving its apps and website and strengthening data analysis. AMEX is also accelerating its expansion into overseas markets with great room for growth, and has obtained a business license in China as the first American credit card company to do so, and is working to attract wealthy customers through partnerships with local brands. In the European market, the penetration rate of credit cards in France and Germany is lower than in the United States, the United Kingdom, and Australia, so AMEX expects there to be significant growth opportunities.

Related Posts: