Credit card company Visa releases new features including passkey support

Visa's new features, including

Visa Reinvents the Card, Unveils New Products for the Digital Age | Business Wire

https://www.businesswire.com/news/home/20240515563838/en/

◆ Flexible Credentials

This is a function that allows you to manage multiple payment methods with one card. This allows you to access various payment methods such as debit, credit, points payment, and ' Pay in 4 ' which allows you to pay in four interest-free installments with one card (credentials). Flexible credentials have already been launched in Asia, and Sumitomo Mitsui Card has released it in the form of a ' Flexible Pay Function ' that allows you to switch between credit, debit, and points payments via an app.

◆ Tap to Everything

Visa hopes to increase the number and capabilities of touch-enabled payment processing terminals and will provide an SDK to enhance touch-enabled payments, allowing buyers to make secure payments with debit and prepaid cards, simplifying identity verification for online purchases and providing added security when adding cards to wallets and apps.

◆

Visa will support 'Passkey,' which authenticates accounts using biometric authentication on smartphones without entering a password. The Visa Payment Passkey service will link account authentication information to a device and use biometric authentication to unlock the device to authenticate payments.

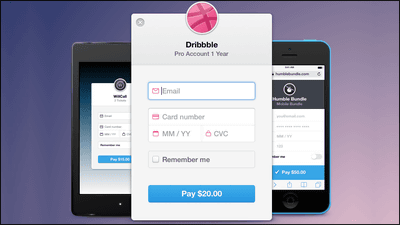

The first implementation of Passkey will be the integration of Passkey into Visa's Click to Pay service . Going forward, Visa will enable Click to Pay and the Visa Payment Passkey service on new Visa cards in many markets around the world, reducing the need to manually enter card information and passwords from the moment you receive your card.

◆ Streamlining inter-account settlement

Visa is digitizing and streamlining ' A2A payments, ' which are payments between accounts without going through a payment service provider, and is increasing the number of payment options. In the future, the company will expand its solutions that link customer and buyer financial accounts from Europe to the United States, helping customers enjoy a more seamless and protected experience.

◆ Protection solutions for A2A payments

Visa analyzes 500 different data elements contained in more than 200 billion transactions per year to identify and prevent fraud in real time. The solution already available in Europe works with real-time payment networks around the world and is overlaid with AI to help mitigate fraud, and these efforts will be strengthened.

◆Data Protection

Visa is increasing security by tokenizing payment and account information. Visa plans to offer new ways to improve the shopping experience using these tokens, but believes consumers should have more control over their data, so Visa will allow consumers to choose whether or not to share their data and to see where their data has been shared.

These services and new features are scheduled to be rolled out in the second half of 2024.

Related Posts:

in Posted by log1p_kr