SNS management service 'Buffer' publishes the flow of fund procurement and stock purchase over the past 8 years on a blog

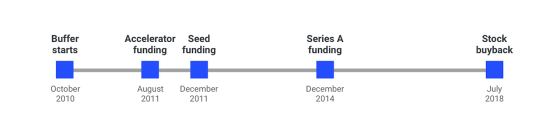

The service " Buffer " which can manage accounts of social network services collectively revealed that venture capital investors purchased 3.3 million dollars (about 370 million yen) of preferred stock in July 2018 I will. This buyout of shares is one of the very important things in Buffer's decision making and states that "Buffer is truly sustainable and the key to drawing long-term growth."

We Spent $ 3.3 M Buying Out Investors: Why and How We Did It

https://open.buffer.com/buying-out-investors/

Buffer revealed that it purchased a portion of Series A preferred stock issued when it raised funds in Series A round for $ 3.3 million.

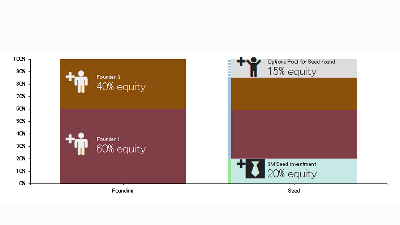

Buffer was born in October 2010, which initially operated the service with its own income. After that, we will raise funds for the first time from AngelPad of seed accelerator in August 2011 for about 120,000 dollars (about 13 million yen). In the following December 2011, Buffer successfully raised $ 330,000 (about 37 million yen) in seed funding, which makes Buffer's total fund raised to 450,000 dollars (about 50 million yen) It was. After that, in December 2014 Buffer raises 3.5 million dollars (about 390 million yen) in series A round.

In July 2018, Buffer succeeded in buying preferential shares from seven of the 16 investors holding the preferred stock when raising funds in Series A round. This is said to be purchase of 2.3 million dollars (about 260 million yen) out of $ 3.5 million raised in Series A round.

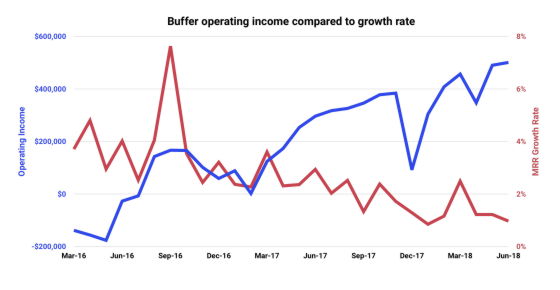

Of the past three fundraising, until the middle of 2015 after the Series A round, it was successful to keep high growth rate as a company. It seems that the entire team has grown rapidly and it is trying to accelerate the pace of product development, but as a result of just expensing it without taking out the result, it will face financial difficulty. Buffer noticed that the funds were decreasing and finally recognized that they were not able to properly manage the financial situation.

So Buffer first went to dismiss 10 employees. It seems that this was a necessary decision to solve the problem without procuring new financing.

Buffer laid ten people, what failed, how to recover from here showing concrete values - GIGAZINE

By changing layoffs and some internal tasks, Buffer will succeed in improving earnings right away. On the contrary, it is to raise the growth rate of the company that suffered. Buffer was originally an illusion to create two unique cultures, "excellent team working remotely" and "high transparency as a company" at the beginning of entrepreneurial activity, "Bringing it all", but funds of Series A round From the procurement it seems to have come to realize that "you must select the most important one" from various things.

In other words, in order to create an environment that boosts the growth rate of a company, it is necessary to remove factors such as 'transparency as a company' and 'workplace environment working remotely' that I felt that 'Buffer is worth' It seems to have become clear when there is. Usually it is likely to give up two for further growth, but Buffer will take the choice of "give up asking for a high growth rate". According to this decision, Leo Widrich co-founder of Buffer and Sunil Sadasivan who served as CTO officer were to leave the company, but Buffer still chose to protect the corporate culture that he cultivated up to then That is why.

According to retirement of leaders supporting layoffs and buffers, ' core value as a company has collapsed', CEO of Buffer Joel Gascoyne says. Since the core value is a guideline for judging how each employee acts, we dig down this again and added some changes, "We aimed to regain confidence as an organization," Gascoyne CEO said.

Buffer emphasized that it is important for organizations to succeed even if the leadership of "cooperating founder" is lost, "to improve the profitability of the company" and "to make the company sustainable over the long term" "Adoption of methods for effectively managing leadership" was. Buffer seems to have succeeded in setting core values that covers all of them, Gascoyne CEO says, "Buffer has the time to increase productivity by gathering multiple team members. , I have made the choice that the whole company grows slowly. "

As a result of long-term sustainability, Buffer's net margin increased by 7% in a few months. The profit will also increase from 300,000 dollars (about 33 million yen) to 500 thousand dollars (about 56 million yen), and the bank's deposit balance will increase and it will increase. However, on the contrary, the growth rate of companies will decline. This was a change that Gascoyne originally assumed, "We knew that investors would not be able to see layoffs and co-founders' withdrawal often."

Speaking of start-ups, we will continue to raise funds and accelerate team growth, but for the newly reborn Buffer, it seems that such a method is not the best, as opposed to the traditional startup It was said that it changed to a company. In the latter half of 2017 it was clear that Buffer was a company unsuitable for financing venture capital. Because Buffer explains that it was trying to build a ground as a financially long-term sustainable company with a monthly profit margin and at the same time striving to create employees' long-standing work and burnout-free cultures and environments I will.

by Christian Dubovan

After that, Buffer plans to buy Series A preferred stock. When we raised funds in the Series A round, Buffer had the rule that "We can not sell shares unless approval is obtained from majority of series A round investors", but as a company it has a financial aspect For Buffer which had improved to a certain degree of cash, it seems that this provision became an obstacle to raise the liquidity of the stock.

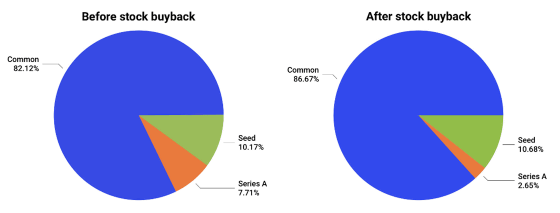

Buffer purchases 67.29% of Series A preferred stock for $ 3.3 million. This is not a large proportion for Buffer's outstanding shares as follows, but it is said to be of great significance for future Buffer.

Related Posts:

in Note, Posted by logu_ii