Four advice on financing by Y combinator that keeps producing a lot of famous startups

By401 (K) 2012

Just as business enthusiasts like "how to create excellent ideas" is important, "fund procurement" is also an important point. Mr. Sam Altman of venture capital · Y combinator who has sent out many startups is giving advice on fund raising to entrepreneurs.

Fundraising Advice for YC Companies - Y Combinator Posthaven

https://blog.ycombinator.com/fundraising-advice-for-yc-companies

No matter how good the startup is, it is not always possible to procure funds smoothly, and "bad startup" is better or worse than raising funds rather than "start-ups that are not fashion". This is expressed as Mr. Altman as "Market bug" and concretely gives four advices for startup aiming for raising funds.

The first point is "to find a" good investor ". This is more important than getting a good reputation and for this we should talk to the venture capital and the founder of the company that is investing, making use of the Y combinator's investor database It is said that.

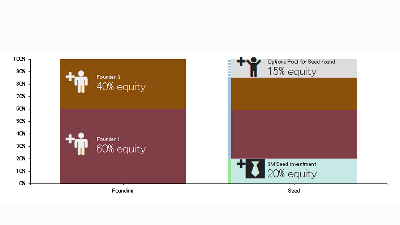

The second point is "to sell the company in the seed round to about 20%". Although it is the seed round that procures funds at the initial stage, such as during service planning, if investors have a high proportion of stocks at this stage, after all, even though they are founders, they can not exercise management rights freely Please be careful as it may be the case. By the way, it seems that it is OK up to 25% if the amount is "large project" of more than 2.5 million dollars (about 280 million yen).

The third point is "to earn enough money to reach the next serious milestone." This is a literal meaning.

And at the end, "to end the process as reasonably quickly as possible, return to the original work". Financing is certainly an important part of the business, but Altman says, "Founder who is keen on fund procurement hardly succeeds," Altman says.

Also, Altman writes the following five words as a good thing to remember for raising funds apart from advice.

· The best investor knows that the most important thing at this point is "how much users love you". Good engagement and growth of 'word of mouth' is "magic" of financing.

· "Growth" surely, and indeed is helpful.

· It is important to clearly express why the company can become a strategically valuable position.

It is also important to express your mission clearly.

· Do not be arrogant. There are people who tactics to "act proudly" in raising funds, but it does not apply to many people.

Related Posts:

in Note, Posted by logc_nt