How do fledgling startups make a presentation to appeal to investors?

The key to a successful business for a startup is how to appeal to investors and venture capital to attract money.

How to Build a Great Series A Pitch and Deck: Series A | Y Combinator

https://www.ycombinator.com/library/8d-how-to-build-a-great-series-a-pitch-and-deck

YC is working on a program called 'Series A' that aims to help start-ups

◆ First, clarify 'why you get an investment'

When creating presentation materials, it is necessary to clarify 'why do you want to receive investment in the first place?' Therefore, Mr. Tam pointed out the following six points as the necessary precautions to solidify the direction of the presentation.

01. The other party is an investor, not a customer

Series A presentations are for investors only and should not be confused with customer presentations, Tam said. Investors may not have encountered the problem that the startup is trying to bring to the solution, and may not be able to intuitively understand how the business solves the problem. That's why the presentation needs to include two perspectives: 'the challenges faced by the target customer' and 'how your service solves them,' Tam said.

02. Make your presentation clear and concise

To help investors understand their business in the shortest amount of time, the material should be as straightforward as possible. 'The best presentations are to use simple words and avoid jargon. If you really need jargon, first briefly define its meaning,' said Tam.

03. Speak with a pinch

In a presentation, it is important to attract investors, not to make them understand everything about the business. The best time allocation for that is 'presentation 15 to 20 minutes, question and answer 40 to 45 minutes'.

04. First cut out from the achievements

'Unlike the pre-founded seed rounds, where we only had to make a verbal promise, the series A rounds are tough,' said Tam. Tam points out that startups that have already started their businesses need to have a track record, so they should start with 'what they did.'

05. Talk about where to go next

After showing performance, investors need to show investors a blueprint for where their business is heading in the future. Venture capital investors, in particular, expect huge returns, so you have to make them think that your startup can do that.

06. Make funding seem to be the last barrier

In the presentation, it is necessary to clarify that the lack of funds is hindering the growth of startups, not the lack of power of the company or the poor quality of products. Tam advises that the presentation material should be designed to ooze that out so that it can show how the money can be used to reach the next level.

◆ Slide composition (10 to 15 pages in total)

According to Tam, the slides used for Series A presentations usually have a volume of 10 to 15 pages without attachments. Then, using 'If YC was a startup giving a Series A presentation' as an example, I showed a sample slide for successful financing as follows.

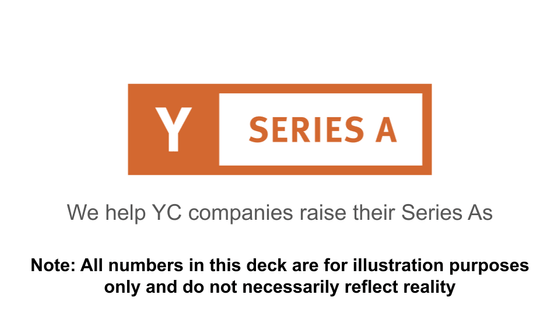

01. Title (1 page)

The first slide of YC is below. A large YC logo is placed in the center, and below that, the business content is briefly written as 'We will support the financing of Series A'.

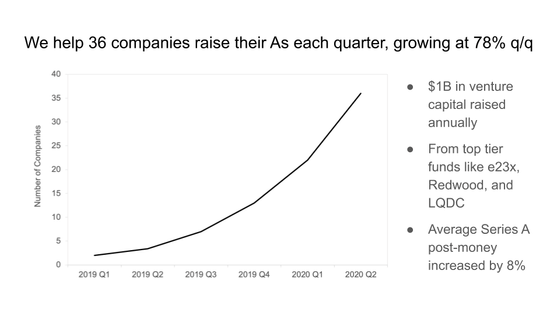

02. Traction (1 page as a teaser)

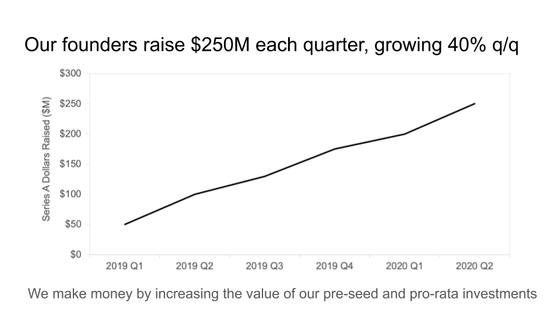

The second page contains a graph that briefly summarizes the data used in the presentation as a traction to attract the attention of investors. 'We are 36 companies every quarter. We supported Series A and achieved 78% quarter-on-quarter growth. '

03. Raising a problem (page 1)

The third piece presents the issues that the business is aiming to solve. In the case of YC, 'Entrepreneurs lack good guidance on how to raise money in Series A. Specifically, (1) when to raise, (2) how to build relationships with investors, ( 3) There is not enough way to present and create materials, and (4) to effectively execute the funding process. '

04. Solution (1 page)

The fourth piece describes how to solve the above-mentioned problems. In the case of YC, 'We provide clear guidance at each stage of entrepreneurial funding. Specifically, (1) create a Series A best practices guide, (2) when and what to finish. We will advise you if you need it, (3) hold workshops for presentations and slides, (4) give advice to maximize leverage and minimize process time. '

05. Traction (several pages)

Then, in a few pages, we'll dig into the details of the traction that we first showed as a teaser.

06. Market Survey (1 page)

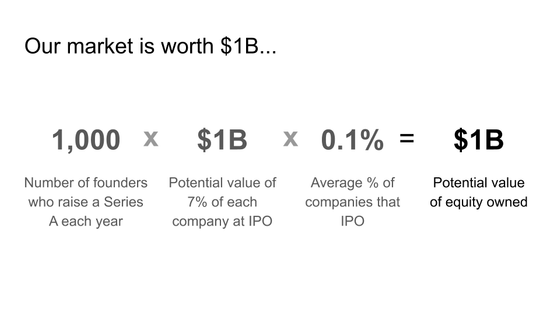

Next, we will briefly show the impact of startups on the industry and their value in the market.

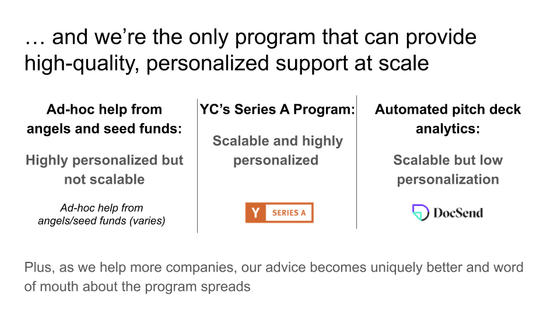

07. Competitors (1 page)

List your competitors and leading services, and show your advantage over them.

08. Vision (1 page)

Here's what the startup has in mind. In the case of YC, 'We will ensure that all entrepreneurs who start a valuable company succeed in raising funds in Series A.'

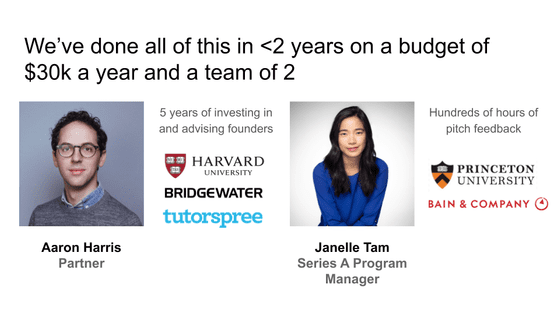

09. Team (1 page)

Next, I would like to introduce the core members of the startup. The slide below shows the biography of YC's partners, individual investors Aaron Harris (left) and Tam (right).

Ten. Use of funds (1 page)

Finally, if you have successfully raised the funds, specify how to use them.

11. 11. Appendix for Q & A (as needed)

There is no sample in particular, but it is good to prepare materials that will be a source of talk in the question and answer time after this. For example, a list of frequently asked questions, or a slide when you need visual information to answer that question. In addition, materials that predict future financial conditions and materials that describe the above-mentioned 'use of funds' in more detail are also effective.

'Questions and answers are the climax of the presentation, and all the slides are like I made for this time, but it's also true that there are startups that often give presentations without questions and answers. If you are reading this, please be sure to include time for questions and answers. '

◆ Notes on the design of materials

The material should focus on clarity rather than beauty. 'In my experience, in many cases, trying to keep the material as simple and simple as possible will make the slides easier to understand. Especially, you should avoid things that distract you from the point. Flashy and complex figures and colorful images that look good but don't explain anything are often used, but that's also NG. '

◆ Notes on making a video presentation

In recent years, instead of inviting investors to the venue to present their presentations, online presentations are also common. Therefore, Mr. Tam summarized the points to be careful when making a presentation with the online video conference tool Zoom etc. as follows.

-Look at the camera, not the screen of your PC.

・ Be careful about lighting. For example, use good TikTok user ring light it might be useful.

-The audio settings should be appropriate. This includes providing a quiet environment for calm questions and answers.

・ As a general rule, speak alone. Switching microphones can cause trouble, so it is safe to have only one speaker.

・ Record it. It will help you to look back at your presentation later. In particular, it seems that he often speaks less enthusiastically than he thinks.

・ Prepare a script. At a minimum, you should have a bulleted script. Also, when you have to speak a long phrase in one breath, it is effective to write the line in advance so that you do not get stuck or bitten in the middle.

After the presentation materials are completed, it is advisable to have angel investors and other entrepreneurs who have already succeeded in raising funds become spectators and practice the presentation. In addition, Mr. Tam advised to look back on the presentation even after the presentation was over, identify the scene where the investor was eating and the part that was confused, and brush up the presentation.

Related Posts:

in Note, Posted by log1l_ks