Bankruptcy Silicon Valley Bank is acquired by First Citizens BankShares, a major American regional bank

Silicon Valley Bank, based in Santa Clara, California, USA, which announced

First Citizens Bank Enters into Whole Bank Purchase of Silicon Valley Bridge Bank, NA - Mar 27, 2023

https://newsroom.firstcitizens.com/2023-03-27-First-Citizens-Bank-Enters-into-Whole-Bank-Purchase-of-Silicon-Valley-Bridge-Bank,-NA

First–Citizens Bank & Trust Company, Raleigh, NC, to Assume All Deposits and Loans of Silicon Valley Bridge Bank, NA, From the FDIC

https://www.fdic.gov/news/press-releases/2023/pr23023.html

First Citizens is acquiring $72B in deposits and loans from Silicon Valley Bridge Bank | TechCrunch

https://techcrunch.com/2023/03/26/first-citizens-to-acquire-silicon-valley-bank/

First Citizens (FCNCA) Buys Silicon Valley Bank After Run on Lender - Bloomberg

https://www.bloomberg.com/news/articles/2023-03-27/first-citizens-to-buy-silicon-valley-bank-after-run-on-lender

Silicon Valley Bank, based in Santa Clara, California, USA, was a bank that had many technology companies as customers and actively invested in startups. However, with the announcement of financial results in March 2023, the stock price of Silicon Valley Bank plummeted and a bank run occurred. The bank announced bankruptcy on March 10, 2023, and it was revealed that it would be under the control of the Federal Deposit Insurance Corporation (FDIC).

What kind of bank is 'Silicon Valley Bank' and why did it fail? -GIGAZINE

With the bankruptcy of Silicon Valley Bank, startups around the world with which we had been doing business faced serious crises such as non-payment of salaries, which threatened the extinction of startups.

More than 100,000 people face a crisis of non-payment of salaries due to the collapse of Silicon Valley Bank, and the extinction of startups is also feared - GIGAZINE

Meanwhile, on March 27, 2023, the FDIC announced that First Citizens BankShares had entered into an agreement to acquire the former Silicon Valley Bank and take over all deposits and loans.

Today, we entered into an agreement with First-Citizens Bank & Trust Company to purchase and assume all deposits and loans of Silicon Valley Bridge Bank, NA https://t.co/vjDsnQxhrr pic.twitter.com/MI5lXN5y6r

—FDIC (@FDICgov) March 27, 2023

According to the FDIC, First Citizens BankShares has purchased approximately $72 billion in assets from Silicon Valley Bank at a discounted price of $16.5 billion. In addition, about $ 90 billion (about 11.76 trillion yen) of securities and other assets will continue to be under the control of the FDIC for disposal.

First Citizens BankShares is a major regional bank founded in Raleigh, North Carolina in 1898 and has assets of more than $ 167 billion (about 21.83 trillion yen) throughout the United States.

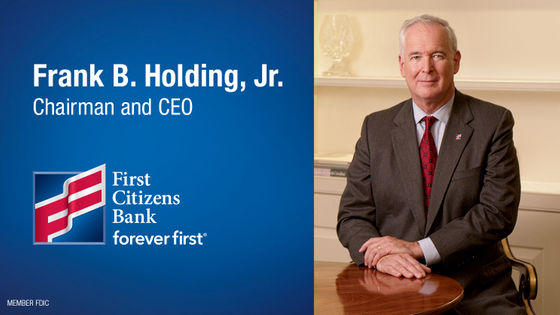

Frank Holding, CEO of First Citizens BankShares, said, 'First Citizens BankShares has been selected by the FDIC to take over important relationships with Silicon Valley banks' depositors and customers, and to strengthen the banking system and America's economy. I am proud to say that. “This acquisition will allow us to build on our long-established strong foundation, adding scale and geographic diversity, compelling digital capabilities, and meaningful solutions to our customers. I will.”

“We are proud that the FDIC has selected First Citizens to take on the important relationships with Silicon Valley Bank's depositors and customers, and in turn, strengthen the banking system and the US economy.” – Frank B. Holding, Jr. Read more: https://t.co/WK00OrcQY9 pic.twitter.com/qUxZQRo8pt

—First Citizens Bank (@firstcitizens) March 27, 2023

First Citizens BankShares added, 'The combined company with Silicon Valley Bank will be more resilient and resilient than ever with a diversified loan portfolio and deposit base, while supporting Silicon Valley Bank's depositors and borrowers. We are staying safe,” he said.

According to First Citizens BankShares, 17 branches of Silicon Valley Bank will resume operations from March 27, 2023 in the form of `` First Citizens BankShares Silicon Valley Bank Division ''. Customers of Silicon Valley Bank will be able to access their accounts through their legacy website, mobile app, and branch offices until a decision is made to upgrade the system. In the future, you can continue to use Silicon Valley Bank checks and cash cards, and you will need to continue making loan payments as before.

Related Posts:

in Note, Posted by log1r_ut