More than 100,000 people face a crisis of salary non-payment due to the collapse of Silicon Valley Bank, and startup extinction is also feared

by

Silicon Valley Bank, a major financial institution that has played an important role in supporting the US technology industry, suddenly went bankrupt . sought to protect startups whose funds were deposited with

Urgent: Sign the petition now | Y Combinator

https://www.ycombinator.com/blog/urgent-sign-the-petition-now-thousands-of-startups-and-hundreds-of-thousands-of-startup-jobs-are-at-risk/

SVB Collapse: Bank Draws Support From More Than 100 VCs, Investors - Bloomberg

https://www.bloomberg.com/news/articles/2023-03-11/svb-draws-support-from-more-than-100-venture-firms-investors

Silicon Valley Bank's China venture in doubt as start-ups struggle to access US funds | Financial Times

https://www.ft.com/content/716b793e-d650-4e23-9e6f-600c1e4dc760

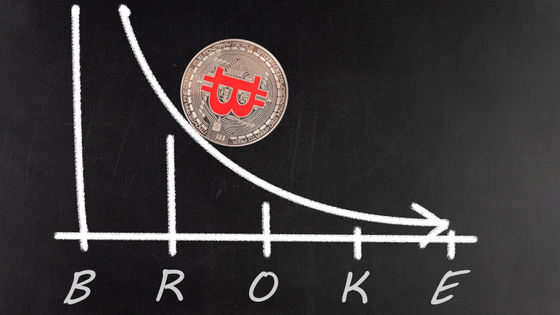

Silicon Valley Bank, which has made many loans to technology companies and has deposited a lot of funds for technology companies, went bankrupt on March 10, 2023 and came under the control of the Federal Deposit Insurance Corporation (FDIC).

Initially, the FDIC would provide up to $250,000 (about 34 million yen) for insured deposits under the Deposit Insurance Program.

Garry Tan of Y Combinator, which supports startups, warned of the turmoil, saying, ``This is an extinction-level event for startups, and will set startups and innovation back for more than a decade.'' I submitted a petition addressed to Commissioner Janet Yellen, FDIC Chairman Martin Gruenberg, and others.

This is an *extinction level event* for startups and will set startups and innovation back by 10 years or more.

— Garry Tan Chen Jiaxing (@garrytan) March 10, 2023

BIG TECH will not care about this.

All little startups, tomorrow's Google's and Facebooks, will be extinguished if we don't find a fix.

According to the National Venture Capital Association, there are more than 37,000 companies that have deposited more than $250,000 with Silicon Valley Bank, and if the buyer of Silicon Valley Bank remains undecided, these companies are likely to increase. It seems that you may not be able to access your deposit for months to years.

“In the Y Combinator community, one-third of the startups affiliated with Silicon Valley Bank used Silicon Valley Bank as their sole bank account,” Tan said. will not be able to prepare cash to pay for More than 10,000 businesses could be forced to suspend operations for non-payment of salaries, affecting more than 100,000 jobs in the economy's most vibrant areas of innovation, he added.

The petition has been signed by over 5,000 startup founders and CEOs, seeking relief for companies that collectively employ more than 400,000 people. The petition states, 'We're not asking for bank bailout, we're asking for small business depositor bailout,' Treasury Secretary Yellen said in a similar statement. ``We care about depositors, not bank owners and investors, and we work with regulators to address these concerns,'' he said in an interview on the 12th.

The FDIC then issued a statement jointly with the Treasury that it would 'fully protect deposits.'

US Treasury Department and FRB announce full deposit protection of failed 'Silicon Valley Bank' and 'Signature Bank' - GIGAZINE

It's not just Y Combinator that's signing off, it's also reported that about 125 venture firms, including Sequoia Capital , have signed a statement led by the venture firm General Catalyst .

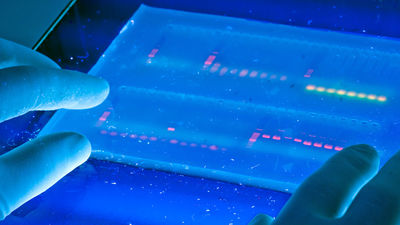

The aftermath of the Silicon Valley bank failure has reached overseas. In particular, Silicon Valley Bank has played the role of a bridge between China and the United States. There are also concerns that the funding of more than 10 high-tech and life sciences companies in the US may be at risk. “The failure of a Silicon Valley bank is fraught with the danger of systemic risk ,” Tan said. It has already planted between the camps and could trigger a run on all other small and medium-sized banks.'

Related Posts:

in Posted by log1p_kr