Life insurance subscription may be refused as a result of genetic testing

ByUniversity of Michigan School of Natural Resources & Environment

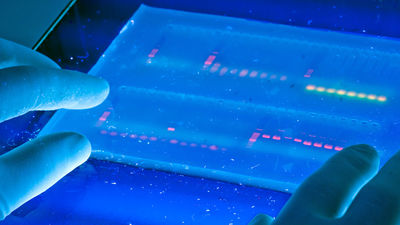

In the United States since 2008 Genetic Information Discrimination Act (GINA) has been enacted, requiring genetic testing at the time of joining health insurance, refusal to join insurance by genetic information, etc. are prohibited. However, the law does not cover life insurance, long-term medical insurance, or physical injury insurance, and the company subscribes to those who judged that it is "too dangerous" from the genetic information such as health status and family history obtained from insurance applicants You can refuse.

If You Want Life Insurance, Think Twice Before Getting A Genetic Test | Fast Company | Business + Innovation

http://www.fastcompany.com/3055710/if-you-want-life-insurance-think-twice-before-getting-genetic-testing

According to a survey by United Healthcare, the genetic testing market in the U.S. has reached the scale of 5 billion dollars a year (about 570 billion yen), and within the next 10 years it will reach $ 15 billion (about 1.7 trillion yen) to 25 billion dollars (about 2.8 trillion It is tried to grow to the scale of yen). Inspection expenses are also becoming cheaper, Illumina of a genetic testing companyWe sequence all of the human genome at about $ 1000 (about 114,000 yen)In addition to being able to do BRCA1 which is the causative gene of breast cancer, it can be done in the United States at about $ 250 (about 28,000 yen).

Although it is a rapidly growing genetic testing market, in the United States(PDF file)Genetic information discrimination prohibition law (GINA)Insurance such as life insurance, long-term medical insurance, physical injury insurance etc. is not restricted. Genetic testing is not required when joining life insurance, but it seems that it is customary for insurance attorneys to ask the customers about the results of medical examination including genetic test results. In the future, there is concern that the appearance of an insurance company seeking genetic tests when joining insurance, or the situation that customers who do not specify genetic testing become difficult to enter insurance.

If genetic testing information is required for various types of insurance other than health insurance, it may lead to a reduction in the genetic testing market. Several organizations are seeking GINA's amendment to the law and some groups continue protesting for over 10 years, but the existing insurance model is not designed to include the risk of genetic diseases, implementation of law amendment May lead to reversing the insurance industry's business model from the ground up. Therefore, there is a strong opposition campaign from the insurance industry in the revision of GINA.

ByPictures of Money

In Japan, there is no legal system to discriminate genetic information like GINA, but the handling of genetic information in insurance and employment is becoming a problem, and genetic testing companiesColor GenomicsYa23 and MeExplains the risk of disclosing genetic information to users. In the American life insurance industry, the provision of minimum plan life insurance with an affordable rate and a minimum guarantee range that an insurance company does not require health status questions is proposed as a compromise between genetic testing and insurance I will.

Related Posts:

in Note, Posted by darkhorse_log