As traditional insurance companies avoid new contracts due to climate change, emerging insurance companies using 'AI' are expanding their influence

It is known that natural disasters are increasing due to climate change, and insurance companies with jurisdiction over disaster-prone areas are being forced to take measures such as discontinuing the provision of compensation. Under these circumstances, it has been reported that emerging insurance companies that use AI to consider disaster risks and technology-based insurance companies that use sensors to detect disasters and pay insurance claims 'immediately' are expanding their influence.

Climate Change Is Breaking Insurance. Here's How Tech Could Save It. - WSJ

Long-standing regulations prevent insurers from setting prices that account for accelerating climate change. For example, in California, where fires are common, insurance claims are increasing, and the more these claims increase, the more risky it becomes for insurance companies. Therefore, insurance companies reduce risk by using a 'reinsurance' system in which insurance claims are paid by other insurance companies, and they set insurance premiums that take reinsurance into consideration. In California, insurance premiums that take into account the rapidly increasing costs of reinsurance are not allowed, and insurance claims are increasing. Due to this situation, the two existing major insurance companies in California have stopped accepting new insurance policies.

But this change also presents an opportunity for a new type of insurance company. People who want to buy insurance are finding that they are not satisfied with traditional insurance companies and are turning to 'unlicensed' insurance companies. These insurance companies are not subject to the same rules that apply to traditional insurance companies, and typically offer less coverage and charge higher premiums.

The secret behind these emerging unlicensed insurance companies is technology.

Kettle, a new insurance company based in California, uses AI to verify the risk of real estate damage caused by wildfires and sells insurance according to the risk. Three years have passed since the AI began operating, and its predictions are almost perfect, with 98% of the approximately 20,000 properties damaged in the past being homes that the AI estimated to be in the top 25% of high-risk properties. It seems like it is.

Kettle offers commercial property insurance as well as luxury residential excess and reinsurance, and we pride ourselves on being the best option for people who can't get coverage from other insurance companies. .

In addition to companies that use AI to evaluate risks, there are also insurance companies that use their own technology to pay insurance claims.

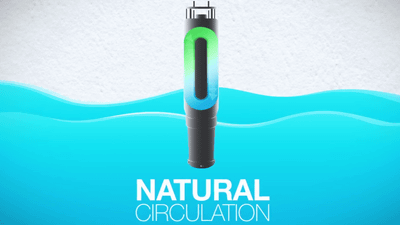

FloodFlash, an insurance company that provides flood insurance, has built a system that installs water sensors in each property and automatically pays out insurance claims when a flood occurs and the water level reaches a certain level. If the water level rises to 20 cm above the ground, a sensor connected to the Internet will be activated and the insurance company will automatically pay $3 million (about 437 million yen). If it rises to 40 cm, the payment amount will increase to 5 million dollars (about 728 million yen).

The advantage of this system is that there is no process to estimate how much damage has been caused by a disaster, and insurance claims are paid immediately. In this way, a system in which the coverage is determined in advance and insurance claims are paid when ``some trigger'' such as the amount of water is activated is called ``parametric insurance,'' and it has been introduced in various parts of the world mainly as a measure against natural disasters. It is progressing.

This approach is said to limit the insurance company's liability and ultimately lead to lower insurance premiums for the insured, with the hope that it will be able to take on cases that other insurance companies would like to take on but lack the resources to do so. I am.

Max Clark, who introduced parametric insurance at his company, said: ``Such tools will allow some insurers to continue offering insurance even as climate change worsens and the damage caused by extreme weather increases.'' ”

Related Posts:

in Software, Posted by log1p_kr