The case where the insurance company discontinues the payment of medical expenses to the elderly early due to ``prediction by AI'' becomes a social problem

In the United States, the public medical insurance program 'Medicare' for the elderly aged 65 and over and the disabled under the age of 65 is being developed. There is a plan called 'Medicare Advantage' that you can use. It is reported that a private medical insurance company that provides this Medicare Advantage has stopped paying medical expenses because of predictive analysis by AI.

How Medicare Advantage plans use AI to cut off care for seniors

https://www.statnews.com/2023/03/13/medicare-advantage-plans-denial-artificial-intelligence/

Medicare Advantage gave insurers the freedom to deny or limit service, making it a highly profitable product for insurers.

Over the past decade, AI has developed techniques to predict how much treatment a patient will need, which doctor they will see, and when they will be able to leave the hospital or nursing home. has become an integral part of CVS Health, a leading healthcare company with a health insurance business, has embraced AI-powered predictive technology for several years. In addition, United Health , one of the world's largest healthcare companies, has acquired naviHealth , a company that uses AI to connect individual patients and medical care, for about $ 1 billion (about 135 billion yen).

However, it seems that insurance companies are giving priority to AI predictions and ignoring the physical condition and treatment status of patients themselves.

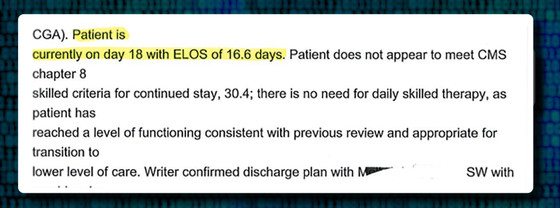

Frances Walter, an 85-year-old woman living in Wisconsin, who was allergic to painkillers, broke her left shoulder one day in 2019 and was hospitalized in a nursing home. naviHealth's algorithm predicted that Walter would be discharged from the hospital in 16.6 days.

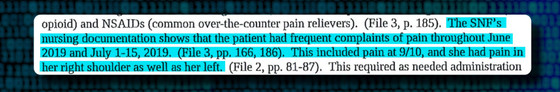

Security Health Plan, an insurance company that provides Medicare Advantage, which Mr. Walter subscribes to, has stopped paying nursing care costs on the 17th day of hospitalization according to the naviHealth algorithm. However, Walter, who cannot get a painkiller injection due to allergies, complained of severe pain for several weeks after paying the nursing care medical expenses, and he could not even use a walking aid, let alone change clothes and toilet alone. was

According to records obtained by medical news outlet STAT, two days before Walter's refusal to pay nursing care was issued, NaviHealth's medical director cites an algorithm that predicted an estimated length of stay of 16.6 days. has recovered sufficiently to no longer meet the eligibility criteria for Medicare.'

After that, the court ruled that ``the judgment of the insurance company is at best speculative,'' and the insurance company paid Walter thousands of dollars (about hundreds of thousands of yen) for nursing care costs for more than 20 days. But that was a year after Walter left the hospital.

According to a government database , the number of lawsuits challenging Medicare Advantage denial of medical payments increased 58% between 2020 and 2022, with nearly 150,000 in 2022 alone. This is just the number of cases that ended up in court after appealing, and if we include patients who were forced to give up, the number of cases of Medicare Advantage refusal to pay is likely to be higher.

Physicians, medical directors and hospital administrators are 'increasingly being denied Medicare Advantage payments for care routinely covered by traditional Medicare,' according to STAT. It is said that there is. The insurance company claims that ``if there is a possibility of refusal to pay, we will discuss the patient's care with the hospital,'' but some medical professionals who actually talked with the insurance company representative said, ``Explanation When I tried, I was stared at with a blank expression and refused to share information.' 'The insurance company said, 'I think this patient can be well managed with a lower level of care,'' he testified. Some people do.

naviHealth has not published scientific studies evaluating the performance of its algorithms, nor has it publicly shared the results of its internal testing of its performance. A naviHealth spokesperson said, “The coverage of naviHealth’s algorithms is determined based on Medicare standards and the patient’s insurance plan. It is used to inform families, service providers and other caregivers about whether they may need care and is not used to determine insurance payments.' doing.

Related Posts: