A ``signature bank'' specializing in virtual currency will be closed by regulatory authorities, and three banks will be closed in a row in a week

by

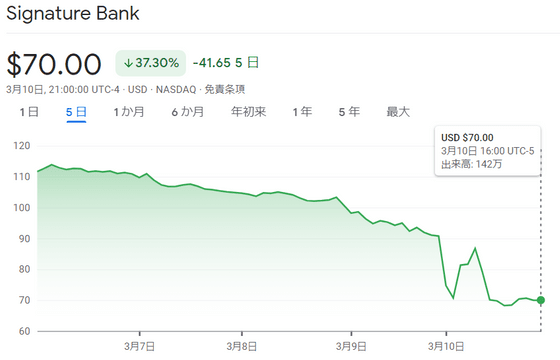

On March 12, 2023, New York state banking authorities closed Signature Bank, a commercial bank that primarily operated with cryptocurrency companies. On March 8th, Silvergate Bank , which was also a virtual currency company, went bankrupt, and on March 10th, Silicon Valley Bank went bankrupt. , the financial industry is growing sense of crisis.

Press Release- March 10, 2023: Superintendent Adrienne A. Harris Announces New York Department of Financial Services Takes Possession of Signature Bank | Department of Financial Services

https://www.dfs.ny.gov/reports_and_publications/press_releases/pr20230312

Signature Bank shuts down by regulators, noting systemic risk

https://www.axios.com/2023/03/12/signature-bank-shut-regulators

Signature Bank Closed by New York State Regulators - Bloomberg

https://www.bloomberg.com/news/articles/2023-03-12/signature-bank-closed-by-new-state-regulators-fdic-says

``For the protection of our depositors, we are pleased to announce that we have acquired Signature Bank under Section 606 of the New York Banking Act,'' the New York State Department of Financial Services (DFS) said in a statement on the 12th. I revealed that I put it under control and stopped banking business.

Signature Bank has 40 branches in 5 states, with total assets of approximately $110.36 billion (14.846 trillion yen) and total deposits of approximately 88.5 billion as of December 31, 2022. At 90 million dollars (about 11.917 trillion yen), it was

DFS has appointed the Federal Deposit Insurance Corporation as the Trustee of Signature Banks, and the deposits of Signature Bank customers are expected to be fully protected.

Signature Bank, which began accepting customers of cryptocurrency companies in 2018, quickly became a popular bank for cryptocurrency users, and as the cryptocurrency market overheated, deposits and stock prices soared.

However, the massive influx of speculative money into Signature Bank has made it very risk conscious. Also, in December 2022, the virtual currency exchange FTX collapsed , and attention was drawn to the signature bank where FTX had an account. In response to this rapid deterioration in the business environment, Signature Bank is taking measures such as reducing the percentage of deposits related to cryptocurrencies.

However, with the collapse of another major bank in the cryptocurrency industry, Silvergate Bank, in March 2023,

The decision by the financial authorities to suspend the operation of signature banks was also aimed at preventing the spread of systemic risk. While the measures will fully protect deposits, holders of the bank's shares and bonds may face losses.

According to news media Bloomberg, the fact that Signature Bank was under the control of regulatory authorities was a surprise to insiders. The bank was heavily debited on March 10, 2023, but calmed down on the 12th. It was just then that DFS took control of Signature Bank under the Banking Act.

'DFS is committed to protecting consumers, ensuring the integrity of regulated entities and preserving the stability of the global financial system, in light of market events, in all regulated financial markets,' DFS said in a statement. We are working closely with these entities, keeping a close eye on market developments, and working closely with regulators in other states and countries.'

Related Posts:

in Note, Posted by log1l_ks