Not only Silicon Valley Bank but 562 banks have failed since 2000

by Coolcaesar

Not just SVB. There have been 562 bank failures since 2000.

https://yarn.pranshum.com/banks

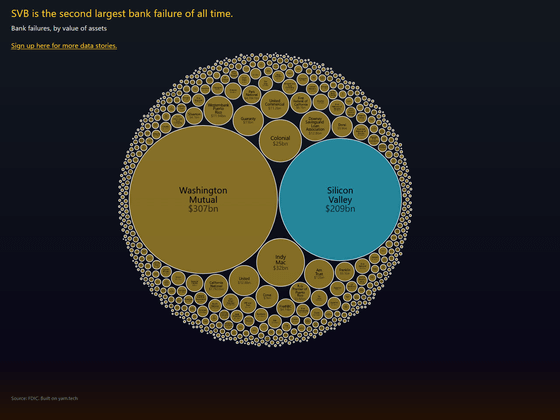

According to Maheshwari, the failure of Silicon Valley Bank, which boasted total assets of $ 209 billion (about 28 trillion yen), is the second largest since 2000. The only case since 2000 that has exceeded this scale is the Washington Mutual Bank (total assets of 307 billion dollars: about 41 trillion yen), which went bankrupt in 2008.

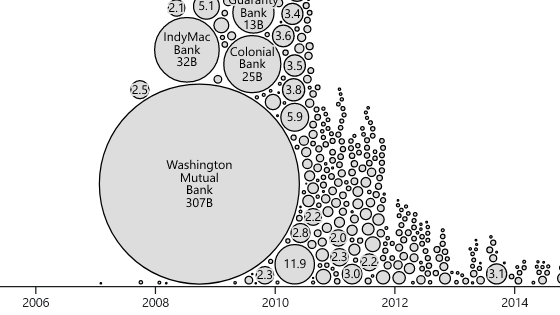

A chart by Maheshwari showing the scale of past bank failures in circles. Largely lined up in the center are Washington Mutual Bank and Silicon Valley Bank. You can see that there were countless small bank failures. According to Maheshwari, Silicon Valley Bank is the 562nd bank failure since October 2000.

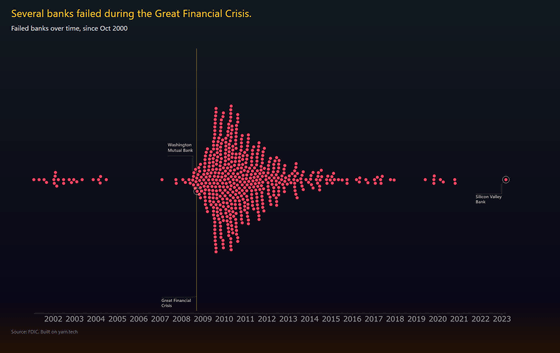

The following shows the timing of bank failures since October 2000. In 2007, when the global financial crisis began, there were few banks that failed, but around the time the Washington Mutual Bank failed The number of cases is increasing at once.

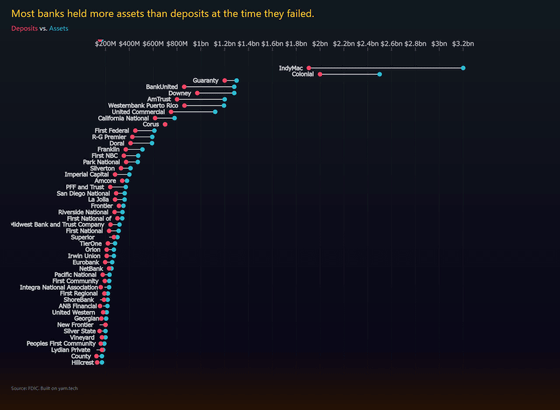

A diagram showing the amount of deposits (blue) and assets held (red) at the time of bankruptcy. You can see that most banks have more assets than their deposits even at the time of bankruptcy.

Mr. Maheshwari expects that Silicon Valley Bank will follow the same trend as the Washington Mutual Bank, with large banks coming in next week and acquiring them.

Related Posts:

in Note, Posted by logc_nt