What is the `` pink tax '' where the tariff on women's underwear is higher than men's underwear?

On February 8, 2023, the Progressive Policy Institute (PPI), a think tank in the United States, announced that the tariff rate imposed on imported women's underwear in the country is higher than that for men. released a report that it was discriminatory.

Progressive Policy Institute PPI's Trade Fact of the Week: US underwear tariffs are unfair to women - Progressive Policy Institute

Women's underwear is taxed at higher rates than men's

https://www.axios.com/2023/02/13/womens-underwear-tariffs-pink-tax

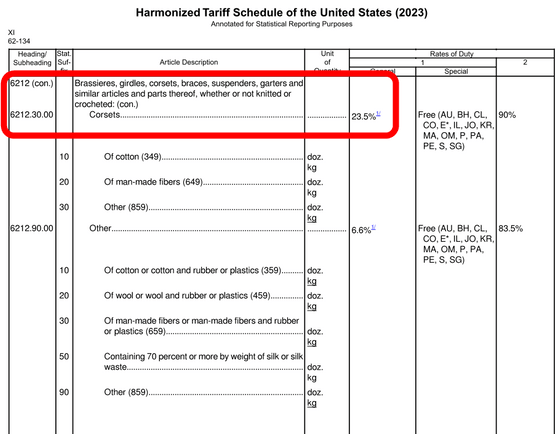

According to a report compiled by Ed Gresser, PPI's vice president and director of trade and global markets, the law setting tariff rates on clothing ranges from 'men's cotton pants and briefs' to 'unclassifiable There are 68 types of detailed classifications up to 'things', and the tax rate varies depending on the item.

The specific tax rate ranges from 0.9% to 23.5%. 16%, and for cotton products, 7.4% for men and 7.6% for women. In particular, the highest tax rate was set for women's underwear, 20% for girdles and 23.5% for corsets.

When these tax rates were averaged, the tax rate for men's underwear averaged 11.5%, while women's underwear averaged 15.5%, which was clearly higher for women's underwear. As a result, about three-quarters of the $1.54 billion (about 203.35 billion yen) in underwear-related tariffs collected by the United States in 2022 was paid for women's underwear.

If you actually check

Tariffs are meant to protect the domestic industry, but since 98% of American clothing is imported, it does very little. It's unclear why women's underwear has a higher tax rate, with The Washington Post, which covered the PPI report,

From an international perspective, the average 14.7% tax rate set by the United States on imported underwear is by no means high. There is a feature that the tax amount of is higher than that of men's underwear.

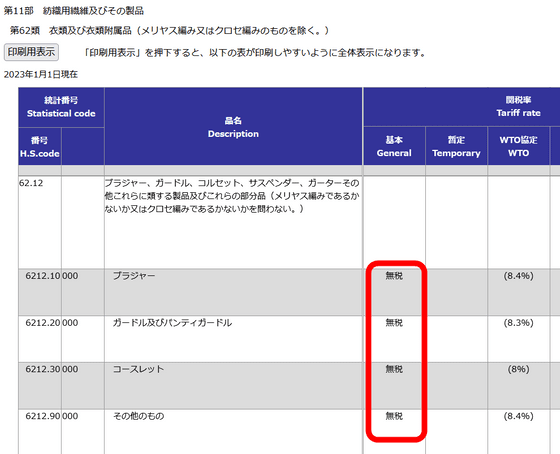

In most countries, the tax rate on imported underwear is the same for men and women: 5% in Australia, 10% in New Zealand, 18% in Canada, 20% in Colombia, 20% in Jamaica, 25% in India, and 30% in Thailand. %, and 45% in South Africa. The PPI states that 'under the customs systems of Japan and the EU, the rate of duty on items under Section 62.12, such as brassieres and corsets, is 0% in Japan and 6.5% in the EU, which is lower than 9% and 12% for other items. He pointed out that women's underwear is given preferential treatment in both regions, contrary to the United States.

You can see the tariff rate on Japanese imported underwear from this link .

PPI described this survey result as 'the worst Valentine's Day surprise.'

In what could be the worst Valentine's Day surprise ever, PPI's @EBGresser discovered that there's a 'pink tax' on women's underwear in the US, noting that most other countries don't gender underwear tariffs.

—PPI (@ppi) February 13, 2023

Get the facts from @EmilyRPeck of @Axios : https://t.co/RalSWtNpux

Related Posts:

in Note, Posted by log1l_ks