It turns out that 15 EU member states 'subsidize fossil fuels more than renewable energy'

The

Review No 01/2022: Energy taxation, carbon pricing and energy subsidies --RW_Energy_taxation_EN.pdf

(PDF file) https://www.eca.europa.eu/Lists/ECADocuments/RW22_01/RW_Energy_taxation_EN.pdf

15 EU states subsidise fossil-fuels more than renewables

https://euobserver.com/climate/154245

The EU is promoting a policy to phase out subsidies for fossil fuels as a policy to reduce greenhouse gas emissions by 55% compared to 1990 levels by 2030. At the time of writing the article, the subsidies for renewable energy in the EU as a whole are larger than those for fossil fuels, but when looking at each EU member state, there is a difference in the ratio of subsidies.

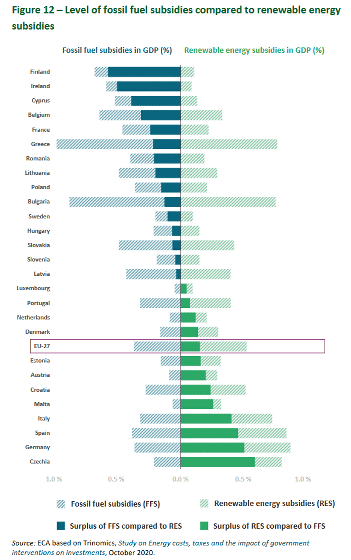

In the graph below, which was published in the report released by the European Accounting Auditor, the blue diagonal line is 'subsidy for fossil fuels in GDP' and the green diagonal line is 'subsidy for renewable energy in GDP'. is showing. Then, add up the subsidies for fossil fuels and renewable energy, and if there are many subsidies for fossil fuels, the ratio is shown in solid blue, and if there are many subsidies for renewable energy, the ratio is shown in green. It is shown by a solid line.

On average, the EU has more subsidies for renewable energy, but some countries have more subsidies for fossil fuels.

Subsidies for fossil fuels exceed subsidies for renewable energy in Finland, Ireland, Cyprus, Belgium, France, Greece, Romania, Lithuania, Poland, Bulgaria, Sweden, Hungary, Slovakia, Slovenia and Latvia. 15 countries.

There are 12 countries with the largest amount of subsidies for renewable energy: Luxembourg, Portugal, the Netherlands, Denmark, Estonia, Austria, Croatia, Malta, Italy, Spain, Germany and the Czech Republic. Is a minority.

Subsidies for fossil fuels have remained at around 55 billion to 58 billion euros (about 7.25 trillion to 7.65 trillion yen) annually from 2008 to 2019, and two-thirds of the total is exempted or reduced. It was said that preferential treatment such as was occupied. These subsidies could reduce the effectiveness of carbon pricing , which is taxed on carbon dioxide emissions, distort the market, and make clean, energy-efficient technologies relatively expensive.

The European Accounting Auditor's report also points out that tax exemptions in emissions trading are primarily devoted to carbon emissions from the use of fossil fuels, which serve as subsidies for fossil fuels. increase. Tax exemptions are in place to stay competitive with non-EU companies in the heavy industry, aviation industry and power generation, but their effectiveness is questioned in the 2020 (PDF file) report . ..

A report from the European Court of Auditors points out that one of the challenges for environmental protection in the EU is 'to be consistent between energy taxation and climate goals.' All member states will align and tax those that have a negative impact on the climate so as not to cause distortions within the EU, saying that fossil fuels should not result in cheaper prices than renewables. We encouraged you to follow the principles.

Related Posts:

in Note, Posted by log1h_ik