Graph explaining how ``rate hike'' affects salaries and employment

The Federal Reserve Board (FRB) in the United States is rapidly curbing inflation by

How Rate Hikes are Affecting the Economy

https://www.apricitas.io/p/how-rate-hikes-are-affecting-the

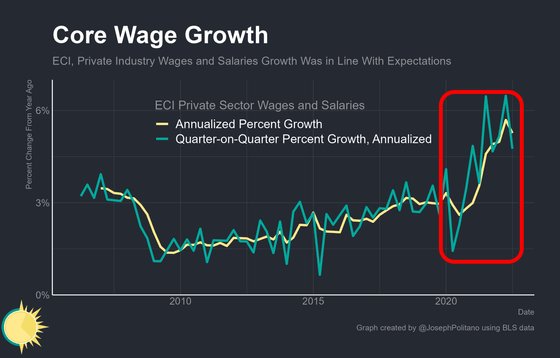

The FRB has been tightening monetary policy and raising interest rates since the beginning of 2022 in order to respond to the high inflation in recent years, and the effects are gradually appearing in economic indicators. One of them is the Employment Cost Index (ECI).

The ECI, released on 28 October 2022, saw private sector wage growth slowing year-on-year for the first time in two years, with a notable quarter-on-quarter slowdown.

According to Politano, the average hourly wage shows 'changes in the average salary of everyone in the job,' while the ECI shows 'how the cost of hiring someone has changed.' About. In addition, the ECI is calculated over a long period of time while taking into account factors such as differences in occupation and industry, so it can be said to be the most reliable indicator of wages in the United States.

As the term '

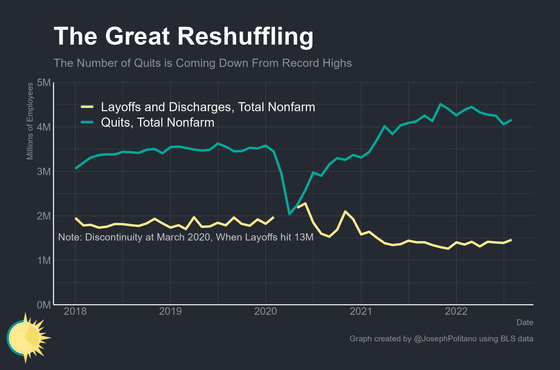

In addition, the turnover rate is an important indicator as it serves as a guideline for future wage increases, but it is also declining after peaking at 3% at the end of 2021 (green line in the graph below). In addition to this, which must be discounted for its slightly lower reliability, job openings were also down by nearly 2 million.

Various factors are involved in changes in the turnover rate, so it cannot be discussed in a unified manner, but when the labor market overheats, people change jobs in search of better treatment or stop working because they are satisfied with a high salary. Therefore, it is believed to be strongly associated with inflation. As a result, the Fed expects job openings to decline, meaning turnover and new hires to enter.

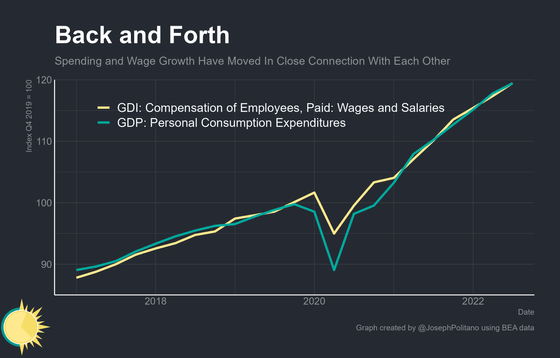

Thus, one of the reasons the Fed is so focused on wage dynamics is that overall growth in 2021 and 2022 is expected to rise even as the US government spends a lot of money to stimulate the economy in the face of the pandemic. Expenditure growth has largely coincided with movements in labor income. This can be seen from the fact that the movements of personal consumption expenditure (green line) and wages (yellow line) shown in the graph below are similar.

If money is provided by unemployment benefits, economic stimulus, economic recovery programs, etc., spending should grow, but the fact that it is growing at the same rate as labor income means that the money that the government has provided is increasing the economy. It is suggested that it remains inside. But with spending growth slowing alongside wage growth, Politano said, 'Private consumption growth in the third quarter of 2022 arguably saw something close to 'normal' for the first time since late 2020. It will be.”

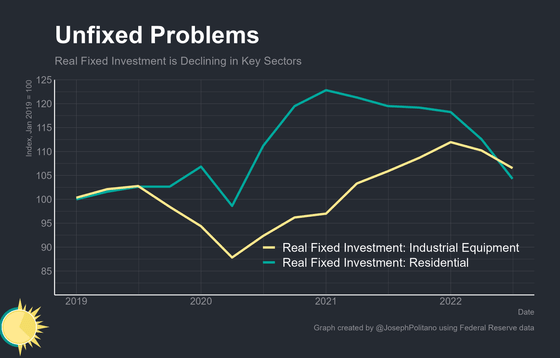

But it is also true that the side effects of monetary tightening are starting to appear. For example, as you can see from the graph below showing capital investment, both industrial machinery (yellow line) and housing (green line) are declining, and rapid inflation control measures have already surfaced as a decline in investment.

Politano said this was partly due to a surge in mortgage rates that pushed single-family home starts down to early-2020 levels. Mortgage interest rates in the United States are over 7% as of November 2022 and are expected to rise further in the future.

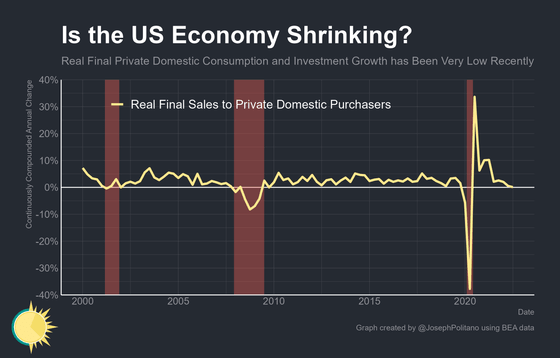

In addition, as the graph showing trends in real private sector final consumption shows zero growth for two consecutive quarters, the economic slowdown that the FRB believes is necessary to curb inflation has already begun. .

'Recessions invariably lead to negative growth in real private final consumption, which highlights how weak the economy is in the face of rising interest rates,' Politano said. did.

Related Posts:

in Note, Posted by log1l_ks