Professional investors explain how the 'bubble' invited by the pandemic will end

How This Ends --AVC

https://avc.com/2021/02/how-this-ends/

According to Wilson, the recent rise in stock prices is caused by the 'monetary easing policy' implemented by central banks around the world. The monetary easing policy is an economic stimulus measure that increases the amount of funds circulating in society by lowering the policy interest rate, which is the interest rate when the central bank of the country lends to private banks.

The impact of the new coronavirus infection (COVID-19) has hit the food service industry and the aviation industry unprecedentedly, and it has been pointed out that 'small and medium-sized enterprises are going bankrupt one after another in New York'. Caused serious damage to.

It is pointed out that many small and medium-sized enterprises are out of business in New York due to the pandemic of the new coronavirus --GIGAZINE

In order to recover the economy from these effects, central banks around the world have jointly implemented monetary easing policies by lowering interest rates to near zero or lowering interest rates to negative interest rates. A central bank's monetary easing policy will allow financial institutions to raise funds at lower interest rates. This is aimed at the effect of economic measures such as making it easier for companies that have become difficult to manage to borrow money from banks, but since financial institutions also manage assets, finance that obtained a large amount of funds through monetary easing policy Institutions will also buy more stock. Wilson believes that global monetary easing has evolved into a global rise in stock prices.

Regarding the monetary easing policy that created the rise in stock prices, Mr. Wilson said, 'If the pandemic of COVID-19 ends and the world economy recovers, the monetary easing policy will end and interest rates will rise. Then, the air from the bloated asset bubble Will begin to fall out, and the stock market in the mood to go will also be braked. ' He said that if the pandemic converges and the real economy recovers, the bubble is likely to end.

On the other hand, regarding when the bubble will end, 'The damage to the world economy has been great and we do not know how quickly it can recover, so it is unknown when the monetary easing policy will end. What will happen in the latter half of 2021 In some cases, it can take several years, 'he said.

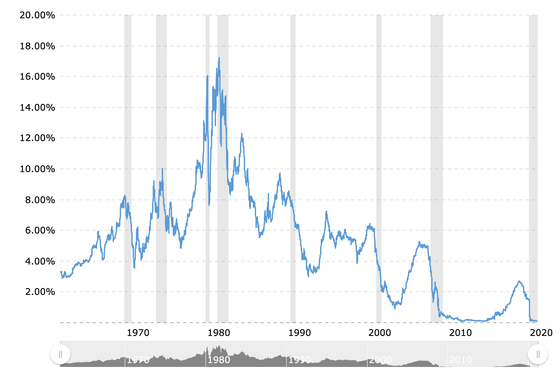

Wilson uses interest rates on US Treasuries as a guide to when the bubble will end. Below is a chart showing interest rates on one-year short-term government bonds issued by the US Treasury. Interest rates have been nearly 0% since the beginning of 2020, but Wilson predicts that the era of monetary easing will end when this approaches 2%.

Related Posts:

in Note, Posted by log1l_ks