Why does the government say that 'a little inflation is desirable' and aim for price increases?

Most people dislike

Why can't prices just stay the same? - YouTube

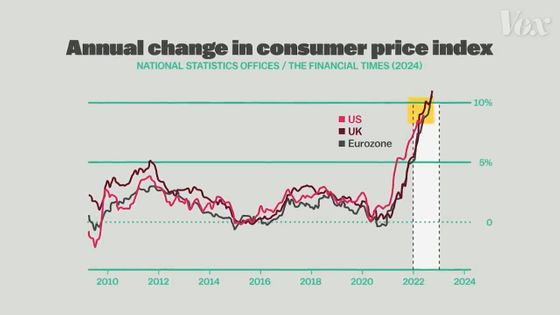

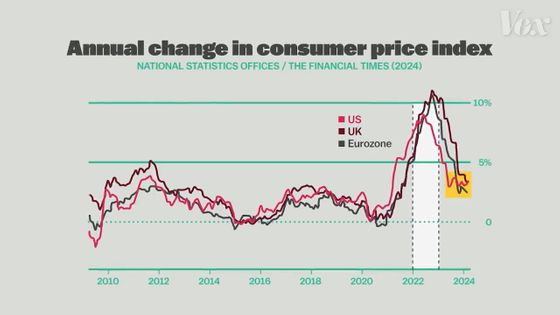

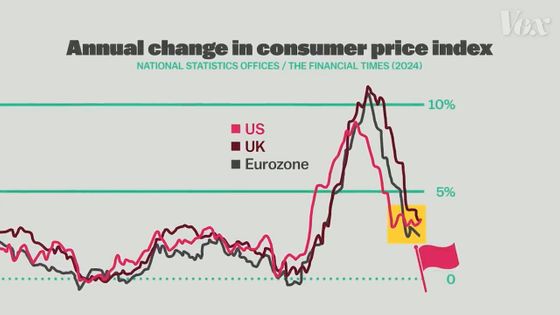

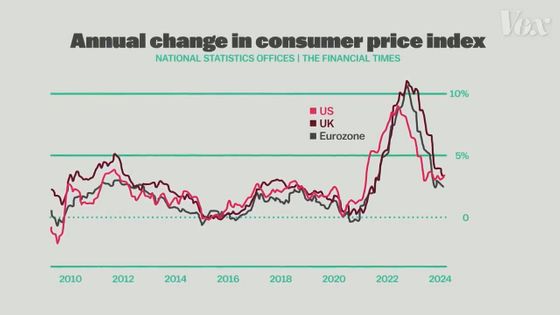

The year 2022 saw extraordinary inflation recorded in countries around the world.

The US, UK and European countries all saw inflation rates exceed 10%, meaning that the prices of many goods have risen by 10% from the previous year.

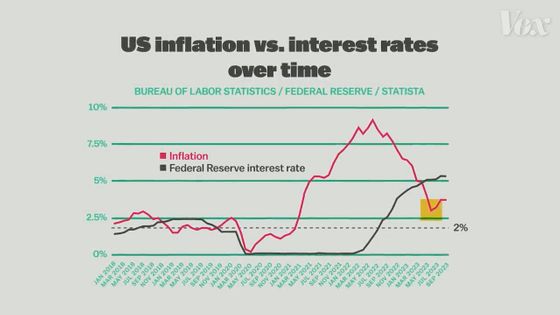

Fortunately, the inflation rate has slowed and, at the time of writing, has fallen below 5% and stabilized at around 2-3%.

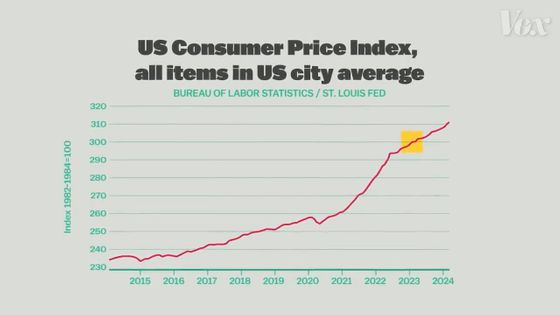

However, this is only a decline in the rate of inflation, and prices themselves are still rising. Looking at the graph below showing the average price of goods in the United States, we can see that prices have continued to rise almost consistently.

Inflation is a nuisance to most consumers, but if you've ever researched inflation or seen it discussed in the news, you've probably heard the following phrases:

'A little bit of inflation is a good thing.'

'Everybody wants a little bit of inflation.'

Rising prices seem to be bad for everyone, yet for some reason prices continue to rise and inflation rarely hits 0%.

The main reason is that governments and central banks want inflation.

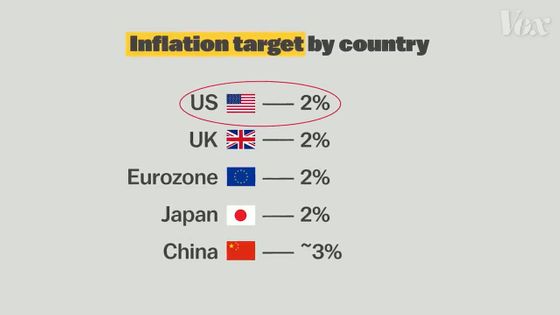

Many countries are seeking some degree of price inflation, and many, including Japan, have inflation targets of 2-3%.

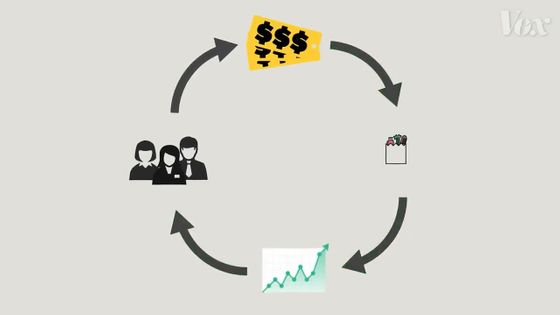

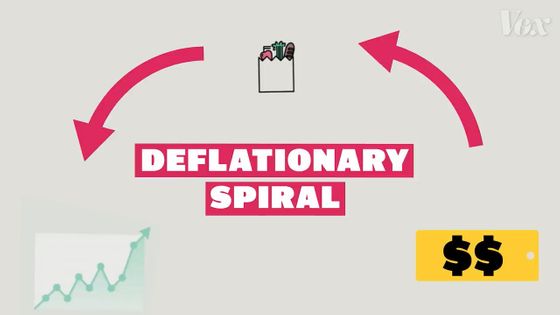

The reason governments target inflation is because they want what economists call a 'virtuous cycle of inflation.'

This virtuous cycle begins when people recognize that prices are rising. If prices are expected to continue to rise in the future, many people will think, 'I should buy various things now while they are still relatively cheap,' and will be more likely to spend money on things like cars and home appliances. In addition, prices of daily necessities such as clothing and food will also rise, so the amount of money people spend will naturally increase.

Then, businesses make more profits and employ more people, which means more people have more money to spend, increasing the demand for various goods.

This cycle continues because increasing demand encourages higher prices. This is known as the virtuous cycle of inflation: As long as wages are rising, rising prices are not much of a problem.

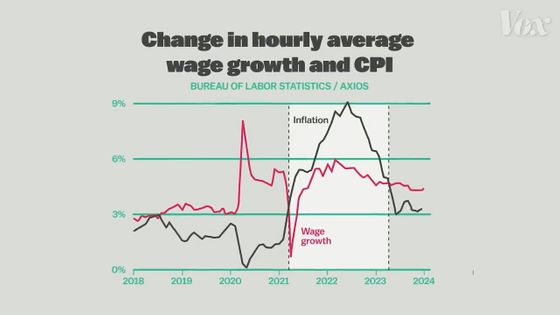

However, in the United States, wage growth has not kept up with inflation for two years, including the year 2022, when rapid inflation occurred. When this happens, prices rise due to inflation, but income is insufficient, which puts pressure on household finances.

This trend has been reversed since mid-2023, with wages at the bottom in particular increasing at a rate that exceeds the inflation rate. However,

Problems can also arise when there is a disruption somewhere in this virtuous cycle of inflation. For example, disruptions to the supply chain can lead to product shortages, which can lead to companies raising product prices to increase their profits. If this goes too far or combines with other factors, it can lead to price increases that put a strain on people's lives.

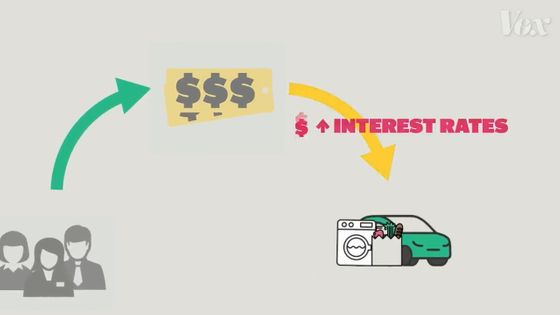

However, governments have a tool to combat inflation: the so-called '

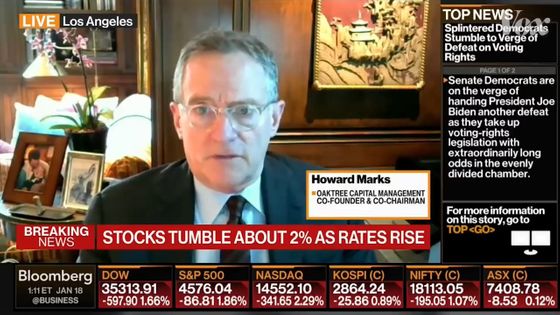

'When borrowing costs rise, the investment costs to hire talent also rise. This ultimately slows down the economy,' Mabudu explains.

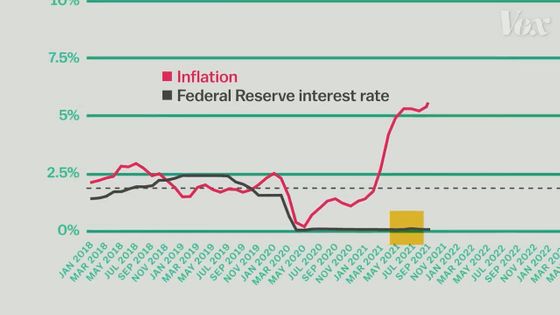

In fact, in 2022,

'When the Fed uses interest rates to suppress inflation, what they're doing is suppressing demand. They're telling people, 'You can't have a job,' 'You're going to lose your job,'' Mabudo said. 'This slows demand and suppresses price growth.'

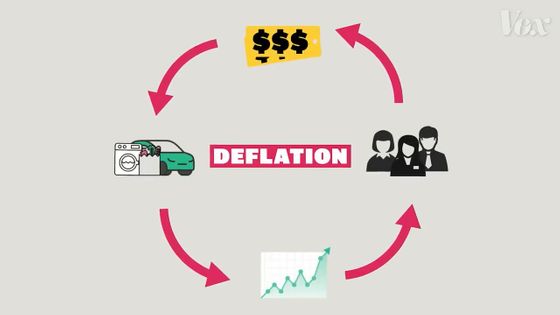

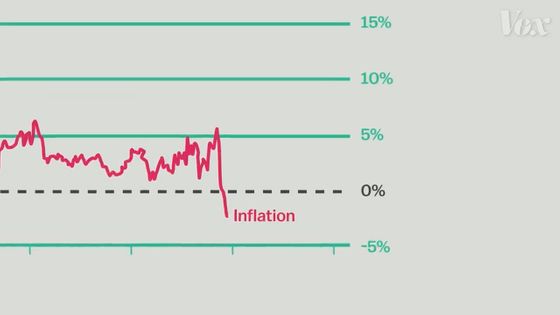

On the other hand, what happens if prices fall instead of rise? This is called '

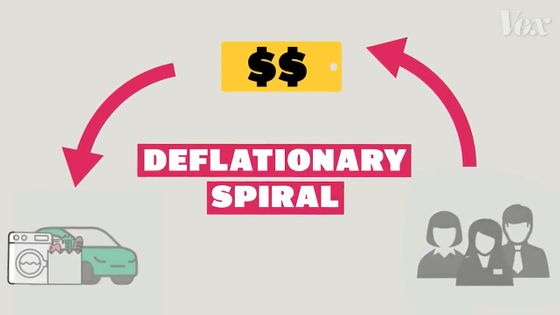

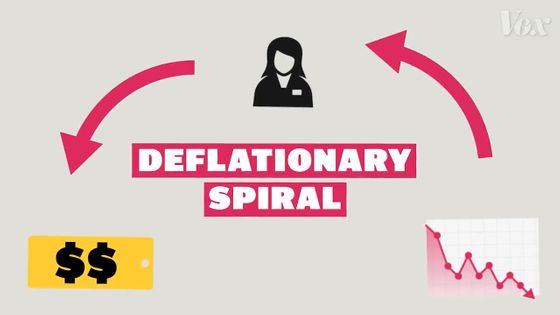

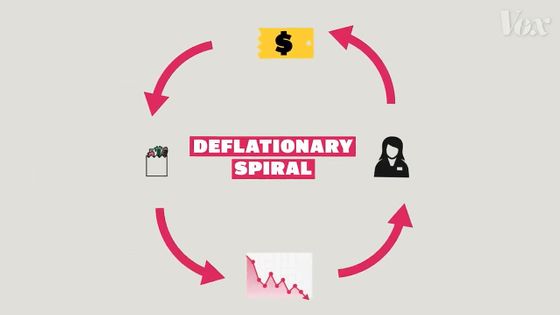

However, there is a big problem with the 'deflationary spiral' caused by deflation.

If prices continue to fall, consumers may refrain from making large purchases, thinking that prices may fall further in the future. Prices of daily necessities will also fall, leading to reduced spending.

Less spending means less income for businesses, which are forced to cut costs, which leads to laying off employees and lowering wages for those who are employed. Ultimately, people spend less and those who can afford it save more.

Lower demand leads to lower product prices, and the spiral continues. All of this adds up to slower overall economic growth.

It is harder for governments to fix deflation than it is to deal with inflation, because governments do not have the same capacity to deal with deflation as they do with inflation.

For example, the most recent time the inflation rate fell below 2% was in the spring of 2020, when the Federal Reserve lowered interest rates to almost zero, at 0.05%. This worked to raise prices, but if inflation does not return to normal, the government, which had already lowered interest rates to almost zero, would have very limited options.

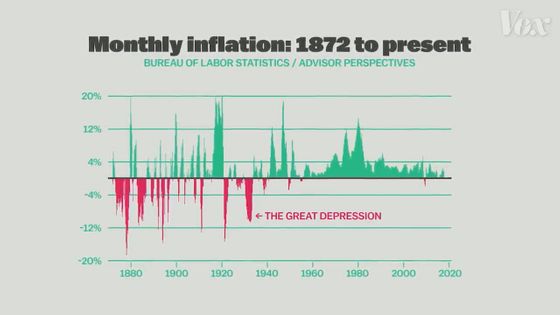

Historically, there have not been many periods of deflation. To correct a prolonged period of deflation, a major shock to the economy is required.

For example,

Japan, which had been in chronic deflation for decades, turned to inflation in the aftermath of the global inflation that occurred in 2022. In this way, to escape from a long-lasting deflationary spiral, there is a part of it that has to rely on shocks that make people's lives difficult.

Once inflation falls below 0%, it is difficult to correct.

If we look at a graph of the inflation rate, we can see that it is constantly fluctuating due to various factors and is extremely unstable. If the goal was to keep the inflation rate at 0%, there is a danger that even small things could lead to deflation, which could lead to a deflationary spiral.

That is why the government has set a target of around 2% inflation, which is considered 'slight inflation.'

Related Posts:

in Video, Posted by log1h_ik