How did the Chinese company 'BOE', which is attracting attention as a supplier of Apple's organic EL displays, grow?

Apple has

BOE Technology: Apple's Next OLED Supplier?-YouTube

Apple's Newest OLED Supplier-by Jon Y

https://asianometry.substack.com/p/boe-technology-apples-next-oled-supplier

Based in Beijing, BOE is the most advanced display manufacturer in China, boasting the world's No. 1 share in the LCD manufacturing field and the world's No. 2 share in OLED displays. It also supplies OLED displays for iPhone 12 and iPhone 13, and it is reported that there is a possibility that LG displays in South Korea will be overtaken in the number of OLED displays supplied for Apple in 2023.

Such BOE was originally a state-owned vacuum tube factory in China called 'Beijing Electronic Tube Factory'. Following the privatization of the Beijing Electronic Factory as part of the economic reforms of Beijing, the founder, Mr. Wang Dong, raised RMB6.5 million (about 120 million yen at the rate at that time) in 1993. And privatized. At the time of writing the article, various local governments such as Beijing own the shares of BOE from the remnants of the time when it was a state-owned factory, and 9 of the top 10 shareholders are state-owned enterprises.

BOE, which was technically behind in the display industry, plans to transfer technology from foreign countries to catch up with advanced companies and establish a joint venture with foreign display companies by providing cheap labor. I took it. As a result,

In addition, BOE will invest in

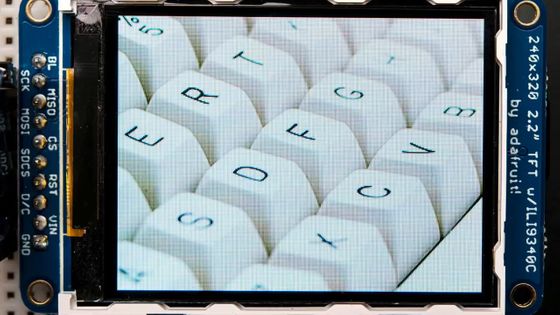

It was difficult for new companies to enter the market because TFT LCDs have low gross profits and require a large amount of capital to increase supply capacity.

However, in 2001, the Korean semiconductor manufacturer

First, in 2001, Hynix semiconductors were

The acquisition, which was also criticized at the time, quickly made the BOE the 13th largest company in China. In an interview in 2003, CEO Wang said, 'The only way to get the core technology that was in the hands of this Korean and Japanese company was the acquisition.'

BOE, which absorbed the display technology and capabilities of Hynix Semiconductor, built a state-of-the-art LCD factory with the financial support of the Beijing Municipal Government, as well as to build a distribution network and capabilities in the international market. It strengthened its power by acquiring a 26% stake in

In addition, as Chinese companies such as Huawei and Xiaomi gained global influence, the BOE, which is closely related as a core supplier, also grew.

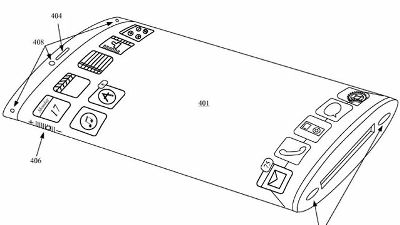

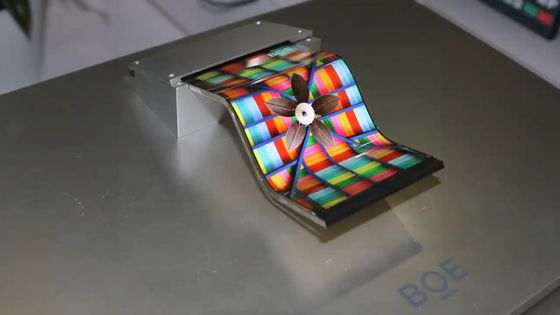

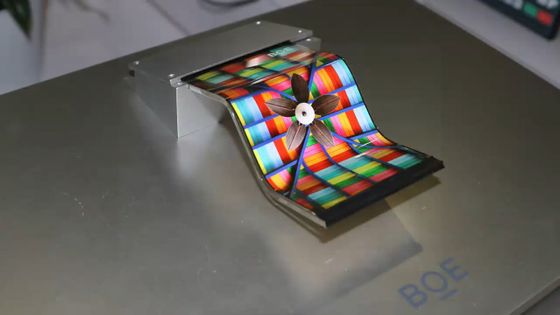

BOE's core business is display technology, which owns a factory that includes a state-of-the-art 10.5th generation TFT LCD production line and the only 6th generation flexible

In the flexible AMOLED display that is also used in Huawei's folding smartphones, we hold the second patent after Samsung display. In recent years, we have also been investing in the IoT and medical fields.

However, the low gross profit in the liquid crystal display field and the large loss due to aggressive investment have caused the BOE to record a chronic operating loss for the fifth consecutive year from 2008 to 2012.

In 2019, the core display sector lost 237 million dollars (about 27 billion yen), and the gross profit is only 13%, which is lower than the average fast food restaurant. , BOE relies heavily on government subsidies to become the world's largest LCD display maker. In 2019, we received subsidies of 400 million dollars (about 44 billion yen) from various local governments, and from 2010 to 2019, we received a total of more than 1.7 billion dollars (about 190 billion yen). Subsidies account for 50% of net income during this period.

At the time of writing, BOE has made a significant investment in OLED displays, which are expected to dominate the display market in the future. Asianometry points out that passing Apple's quality tests and becoming an OLED display supplier would be beneficial in gaining an advantage in OLED displays.

Related Posts: