Why has the Japanese electronic parts industry declined?

By

Exports of electronic components in Japan have dropped sharply since 2007 when the global financial crisis occurred, and there is no prospect of recovery until 2019. Willem Torbecke , senior researcher at the Institute of Economy, Trade and Industry, analyzes how Japan lost its superiority in the electronics industry.

Why Japan lost its comparative advantage in producing electronic parts and components | VOX, CEPR Policy Portal

https://voxeu.org/article/why-japan-lost-its-comparative-advantage-producing-electronic-parts-and-components

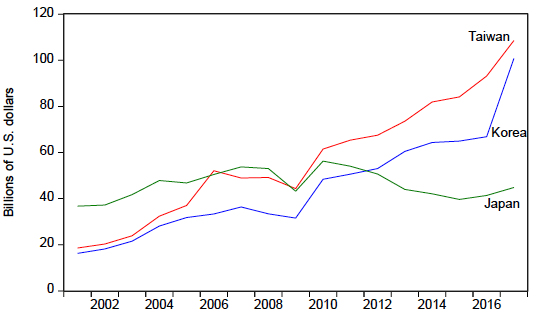

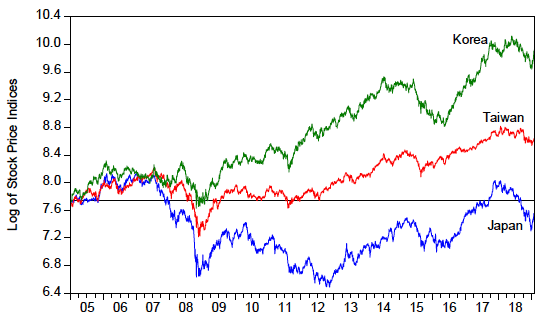

Mr. Torbecke took the experience process , distinguished trade between products and parts, and measured export production prices in Japan, South Korea and Taiwan using the method taking into account the change in cost due to the change of manufacturing location in the graph below. Represented. Referring to the graph, the value declined around 2008 after the global financial crisis. On the other hand, the graphs for South Korea and Taiwan have risen sharply since around 2009, and in 2017, Taiwan and South Korea each have more than double the value of Japan. Production costs are measured based on the Japanese corporate price index .

Japanese companies have low pricing power in competition with South Korea and Taiwan, and capital inflows into countries that produce cheap products due to the global financial crisis. Mr. Torbecke said it has fallen by 35% compared to the relative value of.

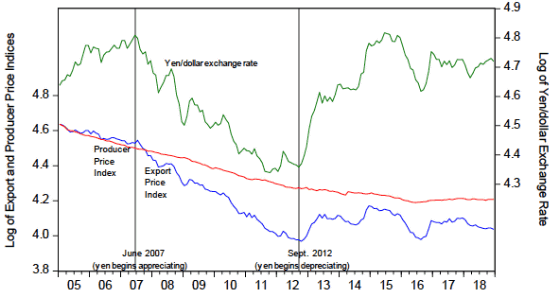

The following chart is a graph of the yen / dollar exchange rate, the corporate price index and the export price index. From this graph, Mr. Torbecke estimates that most of the drop in export prices from June 2007 to September 2012 is due to the strong yen.

On the other hand, taking into account the

The decline in export profit due to the strong yen had a major impact on the profits of electronic component manufacturers. The appreciation of the yen after the financial crisis and the depreciation of the New Taiwan dollar led to a drop in the price of semiconductor manufacturers, and the decline in profits caused significant damage to Japanese component manufacturers. However, despite the yen depreciation and the Taiwanese dollar appreciation since 2012, Japanese electronic component manufacturers could not regain the competitiveness of Korea and Taiwan.

There is a theory that investing in capital and research and development is necessary to maintain competitiveness in the export of electronic components, but Mr. Torbecke's study revealed that after a global financial crisis, Japanese electronic component companies moved to tangible fixed assets. Investment in Japan has declined and did not recover in 2019. Mr. Torbecke speculates that the strong yen caused a hysteresis effect that caused a long-term decline in the industry.

In contrast, companies that manufacture electronic components in Taiwan and Korea have improved profitability. Looking at the figure below, while the stock prices of the semiconductor manufacturing industries in Taiwan and Korea have soared, the stock prices of the Japanese semiconductor manufacturing industry in 2019 are below the 2005 values.

While Japanese semiconductor manufacturers are sluggish, Japanese electronic component companies that do not handle commoditized products such as semiconductors are performing well, and Mr. Torbecke cited Murata Manufacturing , which produces multilayer ceramic capacitors as an example. The Murata Manufacturing is focusing on the production of multilayer ceramic capacitors, and has been making good results by entrusting the production of low-priced electronic components to a Taiwanese company .

Murata Manufacturing produces high-end products that dominate the market share, including multilayer ceramic capacitors. Mr. Torbecke said that because Taiwanese companies produce low-end products, there will be no price competition between Murata and Taiwanese companies, and they are less susceptible to fluctuations in the yen and NT dollar prices.

Mr. Torbecke analyzes that the impact of the weak won in South Korea increases the return of Murata's stock. This reflects the theory that an increase in the country's REER results in a loss of trade competitiveness . South Korean parts manufacturers have a complementary relationship between Japanese parts manufacturers and low-end product producers, and the weakening of Won's demand for South Korean product exports is the demand for Japanese parts importing Korean products. There is a possibility to increase.

The lesson learned from the decline of Japanese electronic component companies is that companies prepare for a recession by preserving during a boom and preparing measures to improve the hysteresis effect during a recession. In addition, Torbecke says that instead of competing with commoditized products, it is necessary to specialize in high-end products that have high profit margins utilizing craftsmanship unique to Japanese companies. As an example, Mr. Torbecke cites market-dominated products such as ceramic filters manufactured by Murata and image sensors manufactured by Sony.

Related Posts:

in Hardware, Posted by darkhorse_log