Citibank loses the case by mistakenly remittance of more than 95 billion yen, and about 53 billion yen becomes uncollectible

by

Citibank lost the case in a trial in which Citibank, one of the world's leading banks, mistakenly sent a huge amount of cash and was fighting over the necessity of returning it. Citibank has indicated its intention to appeal against the ruling that it is not possible to recover about 500 million dollars (about 52.8 billion yen) out of the total of 900 million dollars (about 95.1 billion yen) that was mistakenly remitted.

Citibank can't get back $ 500 million it wired by mistake, judge rules --CNN

https://edition.cnn.com/2021/02/16/business/citibank-revlon-lawsuit-ruling/index.html

Citibank just got a $ 500 million lesson in the importance of UI design | Ars Technica

https://arstechnica.com/tech-policy/2021/02/citibank-just-got-a-500-million-lesson-in-the-importance-of-ui-design/

When American cosmetics maker Revlon acquired another company in 2016, Citibank, which was in charge of managing Revlon's loans, mistakenly gave a total of $ 900 million to creditors who financed Revlon. I sent the money. Citibank, which was planning to repay only a small amount of interest, demanded a refund from the creditors, but some did not accept the refund, so the issue was brought to court.

For more information, including how Citibank filed the proceedings, read the following articles.

A mistake occurred in which a bank mistakenly remitted a total of 90 billion yen or more, and tens of billions of yen were not returned, leading to a lawsuit --GIGAZINE

According to IT news site Ars Technica, Citibank's mistake was caused by a confusing user interface (UI) for financial software called 'Flexcube.'

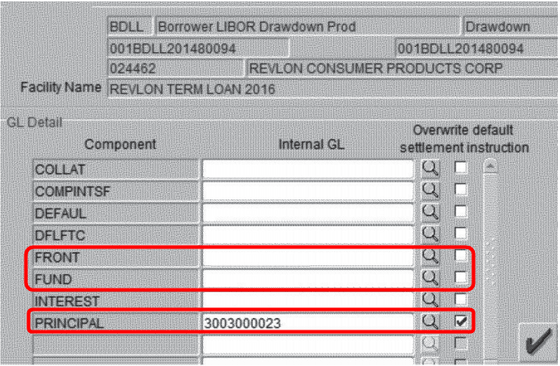

Below is a screenshot of the Flexcube released as a court document. Employees of Citibank's subcontractors in India will be treated as principal if they enter the Citibank settlement account number in the 'PRINCIPAL' field and check it, so the entire payment will be made. There is no such thing. ' However, in reality, similar inputs were required for FRONT (advance payment) and FUND (fund).

Prior to this operation, a triple check was done, including Citibank executives, but no one noticed the mistake. Citibank executives even commented at the time of approval, 'It looks good. Please continue. I'm going to liquidate the principal.' However, Citibank did not intend to liquidate the principal.

This mistransfer is like paying off your debt ahead of schedule and is usually not a big deal. This is because if the relationship between the creditor and the debtor is good, it is common to prepay the loan and then negotiate a loan under similar conditions. However, Lebron and some creditors did not have a good relationship and did not respond to Citibank's refund request. In addition, Lebron's cash flow has deteriorated due to the pandemic of the new coronavirus infection, and the repayment of loans was in jeopardy, which added to the problem.

There, Citibank filed a lawsuit seeking a refund of about $ 500 million that could not be recovered from the creditors, but federal courts said, 'It made sense to believe that the creditors were prepayment of the remittance. We ruled that Citibank would not allow the collection of funds.

'It was unreasonable to think that Citibank, one of the most sophisticated financial institutions in the world, inadvertently remitted this amount,' the judge said in a statement.

In response to this ruling, Citibank said, 'We strongly oppose this ruling and will appeal. We have the right to a refund and will continue to pursue a full recovery of funds.' And announced a policy of aiming to recover all the funds sent by mistake.

Related Posts:

in Software, Posted by log1l_ks