Crude oil futures prices closed for the first time in history, oil-producing countries collaborating to cut production, but demand is declining

In the crude oil futures market on the New York Commercial Exchange, May trading near the end of the month with the first negative price of $37.63 a barrel (about 4050 yen). The price has dropped to minus 40.32 dollars (about 4300 yen).

NY crude oil futures, the first price ``minus'' May flood throw sale flooded: Nihon Keizai Shimbun

Only the May item was put into a 'sale' state, and the June item has finished trading at 20.43 dollars (about 2200 yen) per barrel, which is about 10% cheaper than one week ago.

Reasons for the decline in prices include the reduction of energy demand by restraining corporate activities due to the spread of the new coronavirus infection, and the drop in demand for gasoline and other products due to the general public being restricted from going out.

In addition, the stockpiling capacity of crude oil is close to the limit, and there is a separate cost to secure the capacity, so there are situations where the buyer cannot find it. According to analyst Tsutomu Kosuge, 'No one wants crude oil.' There is a need to let go of the inventory because it is good.”

Even if the crude oil price crashes, there is no buyer, the price is no longer a problem (Tsugu Kosuge)-individual-Yahoo! News

By the way, when the OPEC Plus meeting ended unsuccessfully in March 2020, crude oil futures prices had dropped to the lowest level for the first time in several years.

It has also been pointed out that the crude oil price reduction war broke out between oil-producing countries, which is a positive threat to the new coronavirus-GIGAZINE

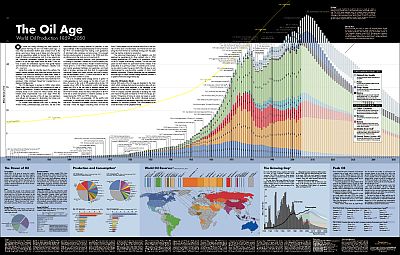

After that, on April 13, 2020, OPEC Plus reached the final agreement on 'Coordinated production reduction of 9.7 million barrels per day'. The reduction of 9.7 million barrels is the largest measure ever, but it is only about 10% of the world's crude oil supply, which is far below the estimated demand.

CNN.co.jp: OPEC Plus agrees to cut production by 9.7 million barrels a day

By the way, the price of crude oil futures surpassed $100 a barrel for the first time 12 years ago, in February 2008.

Crude oil futures market closing price topped $100 a barrel for the first time-GIGAZINE

Related Posts:

in Note, Posted by logc_nt