Research results that taxpayers have the biggest burden on the poorest people than the wealthiest people

ByJohn Watson

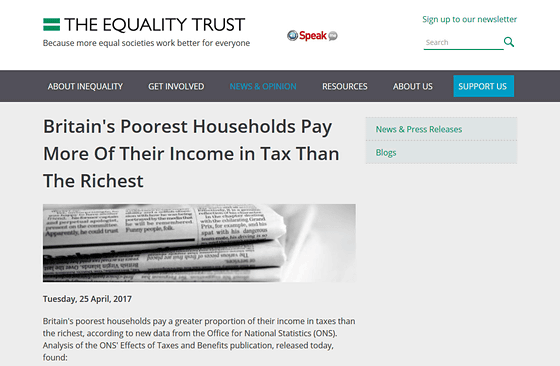

Research results have been reported showing Britain's unfair tax system that low-income people in the bottom 10% pay tax at higher tax rates than the top 10% of HNWIs.

Britain's Poorest Households Pay More Of Their Income in Tax Than The Richest | The Equality Trust

https://www.equalitytrust.org.uk/britains-poorest-households-pay-more-their-income-tax-richest

Poorest pay higher taxes than richest, new figures show | The Independent

http://www.independent.co.uk/news/uk/home-news/lowest-earners-more-tax-richest-office-national-statistics-inequality-council-tax-vat-equality-trust-a7704331.html

The Equality Trust analyzed the British government statistical data, etc., the lowest income group of the lowest 10% has 42% of the average income as income tax, national insurance, VAT (VAT) · We are paying in the form of local tax. On the other hand, we know that the top 10% of the HNWIs pay 34.4%, which is about a third of income, as tax. In particular, the burden on the low income group is great with local taxes and VATs, for example, the proportion of regional taxes and VATs in average income is 7% and 12.5% for low income groups, respectively, There are only 1.5% and 5%.

In the UK tax system, "the lower the income is, the higher the rate of taxation becomes," but,Teliza MayWith the prime ministerPhilip HammondAfter the dissolution general election scheduled to be held on June 8,Scheduled to raise VAT's tax rate by 2.5%It is reported that it is. We already have VAT rate of 2011David CameronIt was raised from 17.5% to 20% in the former prime minister, and the Conservative Party said that "There is no plan to raise the tax rate in the future", but it will break this declaration. If the tax rate rises further, the burden on low-income brackets is expected to be even greater.

The Equality Trust also points out the income disparity between the rich and low-income groups. The average income of the top 10% of the wealthy people is 116,323 pounds (about 16 million yen), while the average income of the lowest income group with the lowest 10% is only 10,992 pounds (about 1.6 million yen) . In the handed amount minus the tax, the average amount of the top 10% of the wealthy people is 70,2746 pounds (about 10 million yen), the average value of the lowest income group with the lowest 10% is 6370 pounds (about 900,000 yen) It is getting.

ByDavid Blackwell.

Dr. Wanda Wyopolska, executive officer of The Equality Trust, said, "The current state of wealthier tax burden than the hired servants are indicative of a regressive and broken UK tax system Sometimes tax cuts against high net worth are supported and tax reforms to protect low income brigades may be attacked severely.As we make a living, these ordinary people, as they make a living, I will not do that. "

Related Posts:

in Note, Posted by darkhorse_log