"You should tax the robot to replace people" "It is not good to just fear not to be enthusiastic about technological innovation," Bill Gates says

Microsoft founderBill Gates, the world's richest manAccording to Quartz's interview, Quartz will realize in the near future such as "think that the robot should be taxed", the reason, the frank opinion that "the situation that fears of innovative technology is not good" is not good I will clarify my idea of robot technology that will be.

Bill Gates: the robot that takes your job should pay taxes - Quartz

https://qz.com/911968/bill-gates-the-robot-that-takes-your-job-should-pay-taxes/

Quartz:

What do you think about "robot tax" that the robot should be taxed for the purpose of covering the training expenses required to convert workers who are deprived of jobs by automation in the manufacturing industry etc. to other fields?

Gates:

For example, a worker who works at a factory for $ 50,000 pays taxes from income, but if a robot who does the same work appears, it may be said that you should pay a similar level of tax .

What the world wants now is to release workers from the manufacture of daily necessities that we are using, for example, elderly care or childcare, robots such as empathy and comprehension can not substitute for human beings It will encourage transition to a job with special needs. In such a field, human resources are still overwhelmingly shortage.

Therefore it is impossible to give up workers who have been replaced by automation and to give up taxation for finance to have them shift to work to be done by human beings.

Quartz:

I should introduce robot tax.

Gates:

There are many ways to increase productivity further and create new taxes. It is a good time to start discussing about robot tax. There is wealth born by reducing workers and improving efficiency. I do not think the robot company is furious with the robot tax. No problem.

Quartz:

Can you find a way that robot tax does not prevent innovation (technological innovation)?

Gates:

When people argue that substitution of workers by robots is a "loss", people should try to lower the introduction speed of the robot by increasing the tax level. Which fields will be hit hard by the appearance of robots? What kind of migration program is functioning and what kind of financial support is required?

The pace at which a robot substitutes a person in a certain field exceeds a threshold at a stroke. Warehouse work, driving, room cleaning etc are jobs that lose meaning in the next 20 years. It is pure profit to make people who take these occupations meaningful. It is important to have such a policy that can be done.

People should understand the ongoing technological innovation. It is not good to be crazy about technological innovation, but feeling uneasy is not good. That's because innovation means that something does not lead to positive things. As you know, "taxation" is a much better way than "prohibiting" any action.

Quartz:

Do you think that government should actively play an important role rather than leaving such changes in social structure to the enterprise side?

Gates:

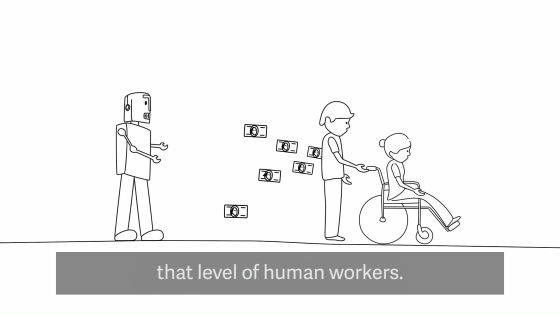

It will not be solved by the company side. If you want to do something to resolve inequality, workers who are tempted by jobs need to help those with lower incomes. In other words, it means improving social services for elderly and disabled people, and placing many people in the education field. There is an economic structure that "people will buy more if we become more rich". But in terms of resolving inequality, the government can play a greater role. Where taxation policy is excellent, we can divide the points. "Tax revenue should be obtained with new taxation, so which tax revenue should be put in which field?"

In addition, a simplified version of interview with Mr. Gates can be confirmed in the following movie.

Bill Gates: the robot that takes your job should pay taxes - YouTube

Related Posts: