Analysis of 45 million tax payment record revealed that millionaires do not move even if tax is increased

By401 (K) 2012

In the United States, the tax rate varies depending on the state, and some states set income tax to zero.Panama documentIt is often thought that "wealthy people avoid high tax payment" because they were exposed, but as a result of analysis of 45 million tax records over 13 years, annual income of 1 million dollars (about 11 million Yen) More than the millionaires have found that the probability of changing residence for tax avoidance is very low, according to a survey by Stanford University.

Millionaire Migration and Taxation of the Elite: Evidence from Administrative Data

(PDF file)http://www.asanet.org/journals/ASR/Jun16ASRFeature.pdf

Higher Taxes Do not Scare Millionaires Into Fleeing Their Homes After All - Bloomberg

http://www.bloomberg.com/news/articles/2016-05-26/higher-taxes-don-t-scare-millionaires-into-fleeing-their-homes-after-all

As an example of a millionaires who hate expensive tax payments and change their residence, investorsDavid TepperThere was a report that Mr. moved from New Jersey to Florida State where income tax collection was zero. For New Jersey, it is a big loss that the billionaire's payment is lost. Famous golf playerPhil MickelsonHe also complained about California's expensive taxes and was implying a move to Florida.

If a state sets "billionaires tax", the state will have the risk of a high taxpayer flowing out to other states, but it was published in the research paper American Sociological Review Studies by Stanford University say that rich people rarely move to distant places far away because of "tax" alone. Studies show that politicians suffering from taxation standards have room to raise the tax rates of rich people.

Stanford University's research ranged from 1999 to 2011 over 13 years,United States Internal Revenue Service(IRS) 45 million tax payment records combined with historical mobile history data of wealthy people based on statistical model. As a result, even if the state sets 10%, which is the highest tax rate, it is calculated that the possibility that top class HNWIs will migrate to other states is less than 1%.

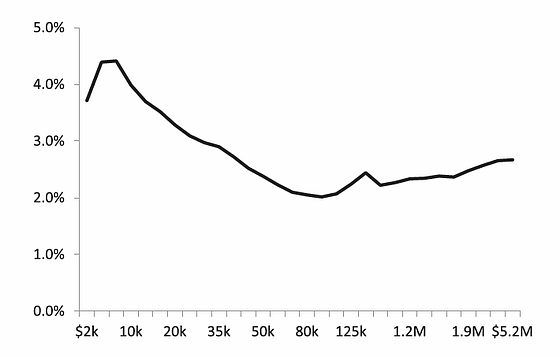

Based on the tax payment record of 45 million cases, the graph below plots the proportion of households migrating outside the province by income. About 50 million households with a high net worth receiving an annual income of at least 1 million dollars (about 11 million yen) are migrating at the 2.4% level, whereas the annual income located on the left of the graph is 10,000 The actual migration rate of the dollar (about 1.1 million yen) is about 4.5%, which highlights the result that "I do not migrate as much as rich".

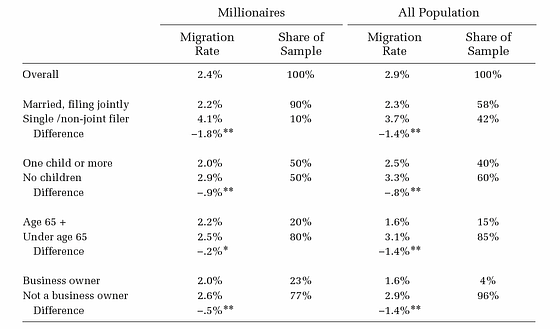

For this reason, most rich people are "working rich people", their own business and living are deeply rooted in the community. Below is a table showing the migration rates of billionaire by condition, showing that they are married, having one or more children, being older, being an employer, etc. According to conditions such as millionaires' We also know that the migration rate will decline.

For certain types of IT entrepreneurs, New Hampshire and Tennessee states with lower tax rates will not replace Silicon Valley. Wall Street lawyers need to stay in the vicinity of Wall Street Street. Famous actors and film directors have no meaning to live in Hollywood, Florida, even in the same place name as Hollywood, California. Because it makes it difficult for businesses to gain huge profits, it is less likely that wealthy people will simply migrate to distant places for tax avoidance.

In addition, according to this analysis, interesting discoveries such as "Rich love Florida state" are also reported. In the United States there are seven provinces in which income tax collection is set to zero, only the state of Florida has confirmed the migration of wealthy people. In Texas, Tennessee, New Hampshire, etc. where the same income tax collection is zero, migration of wealthy people for tax avoidance has not been confirmed, but this is the only state in Florida that is located along the Caribbean coast It is considered to be related to what is being done. There are two possibilities that "tax avoidance" + "a house where a beautiful ocean can be seen" may be factors that attract rich people, and researchers name this phenomenon "Florida effect".

ByKim Seng

Related Posts:

in Note, Posted by darkhorse_log