We used tax havens to open databases of secret files that someone can search, there are many Japanese addresses

The problem of avoiding paying taxes as much as possible using tax avoidance areas, so-called "tax havens" is a worldwide problem, but in the case of Apple, for example, revenue from a subsidiary of Ireland from the Irish subsidiary through the Netherlands to the Caribbean Free Area Move to countriesDouble Irish & Dutch sandwichTechnique to develop a 35% tax rate to 2%, Google also used the same meansTax avoidance of 3.1 billion dollars (about 290 billion yen) in the past three years, Amazon has paid no tax at all in the UKTax payment is zero yen, StarbucksI have paid tax only once in the past 15 yearsThere is the reality that.

At the end of the rapid spread of such wealthier people become increasingly wealthy, finally a nonprofit press "International Research Reporting Journalists Association (ICIJ)" has more than 100,000 secret companies, trusts and funds And others published a tremendous database site that can visually search where actually in the world it is connected via tax havens. Anyone can use it for free,CSV file can also be downloadedIt has become.

ICIJ Releases Offshore Leaks Database Revealing Names Behind Secret Companies, Trusts | International Consortium of Investigative Journalists

http://www.icij.org/offshore/icij-releases-offshore-leaks-database-revealing-names-behind-secret-companies-trusts

ICIJ Releases Offshore Leaks Database to Public - YouTube

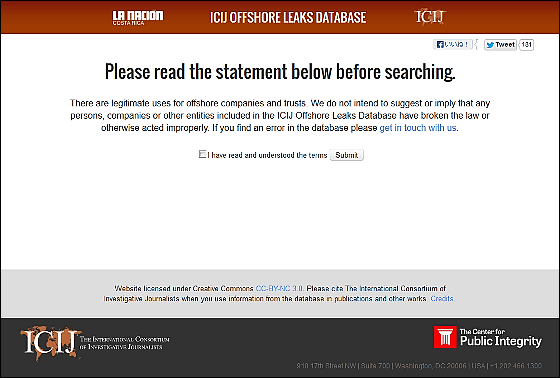

The database is accessible from the following.

ICIJ Offshore Leaks Database

http://offshoreleaks.icij.org/

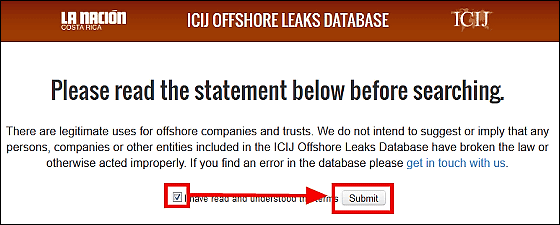

Please check and click

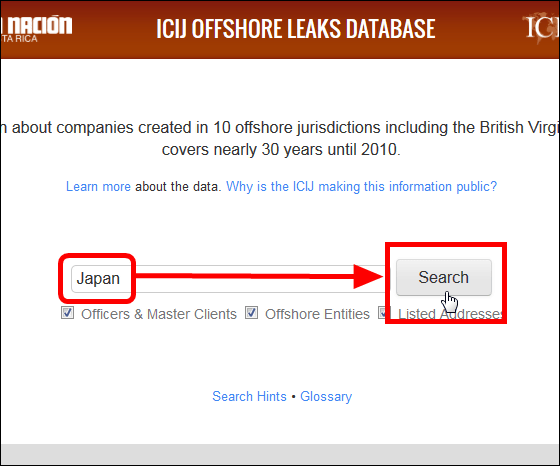

Searchable range is owner information such as paper company made of 10 tax havens including British Virgin Islands · Cook Islands · Singapore, covering 30 years until 2010. To investigate Japanese information enter "Japan" and click.

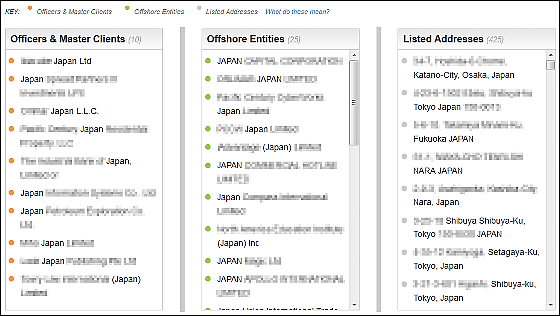

Then you will see it staggered in this way. The "Officers & amp; Master Clients" on the left side is an intermediary, the central "Offshore Entities" is hiding behind the paper company using tax havens, entities such as company names and fund names, and the rightmost " Listed Addresses "is the address that ICIJ examined.

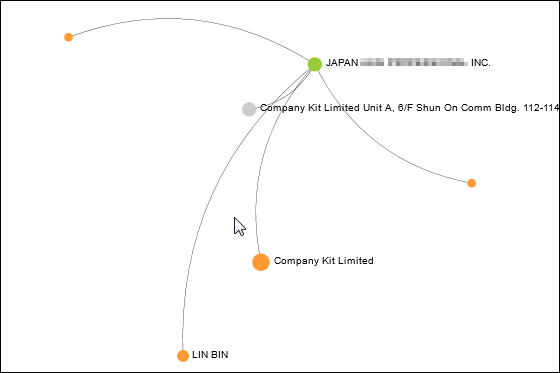

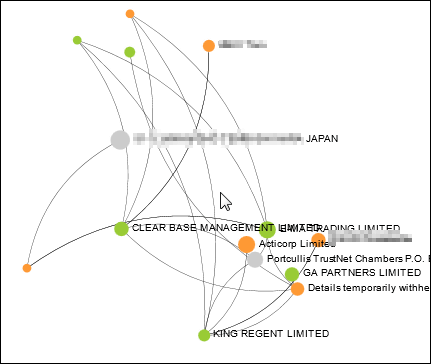

When you click on the list of each search results, the following figure is displayed and you can click on it to display the point further connected to it, for example, find the corporation from the name of the person who is in mediation , Furthermore it is possible to determine the address of the corporation or the manager etc. On the contrary it is also possible to figure out the corporate name and the name of the intermediary from the address and follow the company names behind it .

By following this order you will see that you are escaping this kind of network around the world and paying no tax.

In short, rich people do not pay taxes as much as possible by making use of these means, there are aspects where the general people who are not taking charge of tax revenues short of the state can not use or use the rest of these means. Of course, even if the tax is up, rich people who use such tax havens will still escape without paying taxes, so the disparity between those who have more and those who do not have more will spread It will be just that.

In addition, even if it is said that it is a lawful law even if it is said that it is lawful, if it continues to be carried out in a malicious and excessive departure act, it will be possible to respond because a new law will be created, but still Even though it sees from the reality that even though it is viewed as a problem, "people with" is exercising influence internationally as well as being wealthy in the first place, so each country is aligned with measures in the new law It is currently difficult to execute it. That is why the exposure of such secret files is carried out by non-profit news organizations and thus encourages movements to control international tax escape.

Incidentally,Asahi Shimbunaccording to"The file contains at least 40 corporations related to Japan, 450 or more small business owners, physicians, and some are expected to be releasedIt is already reported in JapanNational Tax AgencyAlso from another route "Of the large amount of information on entities (corporations, trusts etc) located in offshore (so-called tax haven countries / areas etc.), we received information that is expected to be related to Japanese taxpayers"We are keenly investigating as tax evasion cases and fraudulent funds are being thoroughly examined, and we are focusing on how far we can pursue them by the National Tax Agency in the future.

Related Posts:

in Note, Review, Web Service, Pick Up, Posted by darkhorse