"Panama document" will be released which reveals how huge enterprises · affluent people hide enormous gold in tax havens etc

ByThibault Houspic Follow

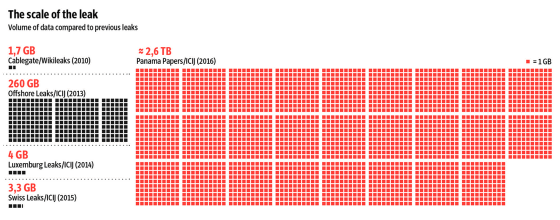

People close to Russian President Vladimir Putin, Prime Minister of Iceland, Lionel Messi, the star player of football, and other world famous peopleTax Haven(Tax avoidance area) to reveal the actual state of using the asset is revealed. "Panama documentThis document, also known as "Panama Papers", gathered data of 11.5 million cases totaling 2.6 terabytes, and the actual state of offshore transactions which are rarely elucidated is clarified.

Panama Papers The secrets of dirty money | Süddeutsche Zeitung

http://panamapapers.sueddeutsche.de/articles/56febff0a1bb8d3c3495adf4/

◆ Published "Panama document"

This document concerns the work content of Panasonic law firm "Mossack Fonseca (Mosac Fonseca)" over the past 40 years, ICIJ (International Consortium of Investigative Journalists: International Research Coverage Journalists Association) is a German newspaper "Süddeutsche Zeitung(South German newspaperThose obtained through ". Mr. Gerald Lyle, who runs the ICIJ secretariat, said, "From the scale of the leaked content, it will be the biggest blow to all those involved in offshore transactions (cross border financial transactions)," I talk about the magnitude of the impact.

Its scale is also evident in what the South German newspaper shows. The figure below shows the scale of the data, but the size of the leaked data shown in red is the leak leaked in 2013, the leak information of the largest offshore deal ever to date You can see that it is huge that it is not comparable with.

From the fact that the media reported all over the world in this case, I can feel the seriousness of this case. BBC also reports about the elite tax-haven by Leak document of Mosac Fonseca this time.

Panama Papers: Mossack Fonseca leak reveals elite's tax havens - BBC News

http://www.bbc.com/news/world-35918844

Reveal the actual situation in the fund management data of the elite class of the world - BBC News

http://www.bbc.com/japanese/35957243

According to the BBC, this document includes notes on family members and aides of Egyptian former President Mubarak, Asyad President in Syria and an unpublished offshore corporation related to Colonel Gaddafi, who had laid a dictatorship system until 2011 until Libya It is said that there is. Furthermore, alleged suspicions that Russian banks, Bank and Russia are conducting money laundering (money laundering) scale of 1 billion dollars (about 110 billion yen), are mentioned to President Putin Close people are also involved. This was the first time that Bank and Russia were found to be managed and the bank was subject to economic sanctions by the United States and the European Union (EU) implemented under Russia's consolidation of the Crimea ... apparently ...

News on this subject is also distributed in AFP communication, and I report in detail about celebrities and companies that emerged from leaked documents.

Country leaders and celebrities, two huge trading ICIJ pictures on tax avoidance areas International news: AFPBB News

http://www.afpbb.com/articles/-/3082799

According to the place where AFP has reported, soccer Spanish first division in this document, FC and Lionel Messi player of Barcelona, offshore companies related to the relatives of Xi Jinping Jintao has put a force on corruption eradication in China, Iceland The prime minister of Sigmundoru Gunroigson, as well as president of Ukraine, King of Saudi Arabia, Prime Minister of Pakistan was also said. It is also made clear that this document contained 214,000 groups of companies and others.

■ People and companies whose names surfaced in the survey

· Multiple people close to Putin Russian President

ICIJ said, "We have secretly transferred 2 billion dollars (about 220 billion yen) of funds through banks and companies." There was no name of Putin himself in the internal document.

· Prime Minister Gunroygson and his wife in Iceland

In the midst of his financial crisis, he kept secretly an offshore company with Icelandic financial bonds equivalent to several million dollars.

· Juan Pedro Damiani of the International Football Association (FIFA)

His law firm, serving as a member of FIFA's ethics committee, had a track record with the three charged with the FIFA scandal. Three of them were former FIFA vice chairman Eugenio Figueredo, Hugo Jinkis, former senior sports marketing company bribery who bribed for the purpose of obtaining football game rights in Latin America His son Mariano Jinkis defendant.

· Lionel · Messi and his father

Argentina football star player Messi and father Jorge Horacio Messi owned a dummy company, Panasonic Mega Star Enterprises in Panama. This company did not appear in the investigation by the Spanish authorities over Messes fathers' tax evasion allegations.

· President Michel Platini of the European Football Confederation (UEFA)

According to French TV Amfo (Francetv info) of French media, Mr. Platini who had been suspended for six years from FIFA received benefits from Panama-based tax companies, but no illegal activity has been confirmed.

However, he also said that most of the transactions which were made clear this time is legitimate. Nonetheless, ICIJ notes that there is the possibility of politically significant impact on the person whose name emerged. According to BBC, Mosac Fonseca has been continuing to operate "not to be criticized" for 40 years and has commented that he has never been prosecuted for crime.

Furthermore, according to ICIJ, at least 33 individuals and organizations included in the document are suspected of being illegal in connection with North Korea, Iran, Lebanon's Shiite fundamentalism organization "Hezbollah", the US government's blacklist It is said that the name is also raised. The data obtained is from 1975 to the end of 2015 and ICIJ says that it will clarify the actual situation inside the tax avoidance area of the world which was unknown so far. More than 370 reporters in more than 70 countries participate in the verification of the obtained documents, and it has not been clarified at the moment who has leaked the document.

◆ The existence and meaning of "tax · haven"

Monaco and Dubai,Cayman IslandslikeTax HavenIn order to acquire foreign capital and foreign currencies, countries and regions that intentionally invite companies and affluent assets by zeroing corporate taxes or setting extremely low tax rates.

Utilizing this mechanism, individual companies up to the level of individuals not included in large companies, high net worth individuals, and high-net worth individuals set up corporations in Tax Haven, so that they originally eschewed taxes that were supposed to be paid to their country There is a reality that it is. From a tax and haven perspective, it is also known as "offshore (beyond the shore)" because it is a financial service for companies and companies that are not actually in Japan.

Its origin was that the small country without industry in the home country was created to attract industries from other countries, but companies that have focused on low corporate tax rate (or tax free) · Establish a corporation in Haven and "save" a tremendous amount of corporate tax by moving profits. Some of these companies include companies that have been heard by anyone, including Apple, Google, Amazon, and UK StarbucksI paid tax only once in 15 yearsThere is also the actual state of being. Moreover, it is pointed out that it is used as a means of money laundering (money washing) of criminal organizations because of its high anonymity.

I found out in 2011Olympus IncidentAmong them, the existence of a paper company that was founded in the Cayman Islands became a hot topic.

Olympus huge loss hidden incident, I went to the island without tax Cayman - GIGAZINE

Nonetheless, all these transactions are "legitimate" acts based on local laws, so it can be taken as a natural course of action in light of the company's objective of pursuing maximum profit. However, by doing so, it is also a fact that there is a negative aspect that the tax revenue drops because the tax that was originally supposed to be put in a certain country will disappear. When tax revenue falls like this, it is obvious that tax can be taken from another place to make up for it,While Japanese large companies and wealthy people are escaping huge taxes in the world at tax havens, common consumption tax increases for consumption taxes and social security reductionsThere is also pointed out that it is done.

As it is to say, thanks to companies and people avoiding taxes, it is a tax-and-haven structure that people who can not avoid being spared, but their existence is becoming problematic internationally. The Organization for Economic Cooperation and Development (OECD)Certain conditionsIn addition to noting the non-member countries / areas that fall under the category of tax havens in the list of harmful tax regulations, countermeasures such as countermeasures against taxation are taken in various countries around the world, etc. are under way.

In 2013 ICIJ has taken action on the official website to disclose databases that can identify corporations and individuals using tax havens and the pressure on tax havens is increasing.

There was a lot of addresses in Japan that opened a database of secret files that someone could use a tax haven - GIGAZINE

It seems that interest will gather in the future for this leaky drama which is supposed to be new information in future.

Related Posts:

in Note, Posted by darkhorse_log