``Laws that tax wealthy people's money earned by investment'' will bring more revenue than expected and lead to disparity between rich and poor

In Washington state in the United States, in order to secure the budget for childcare and public education, in 2021, ``7% tax will be imposed on

Lessons from Washington State's New Capital Gains Tax - The Urbanist

https://www.theurbanist.org/2023/06/01/lessons-from-washington-states-new-capital-gains-tax/

There is no income tax or corporate tax in Washington state, instead there are sales tax and use tax equivalent to Japanese consumption tax, business and occupation tax that is levied on the total income earned by business owners within the state, etc. exists. Mr. Chege points out that these taxes favor 'the richest Washingtonians' and put a heavy burden on low-income earners.

When Mr. Chege was studying accounting at university, he seems to have volunteered to help low-income earners with their tax returns. At that time, he noticed that people such as bus drivers, hotel employees, and nursery teachers paid higher tax rates than wealthy people who knew tax loopholes and hired good accountants. .

'The tax system is designed to favor the rich,' Chege said. 'Most people I know live on a salary. We pay a sizable percentage of our income in sales and property taxes through mortgages and rent payments, and as a result, the lowest-income earners in Washington state pay a higher proportion of state and local taxes than the highest-income earners. 'It's about six times higher than that.'

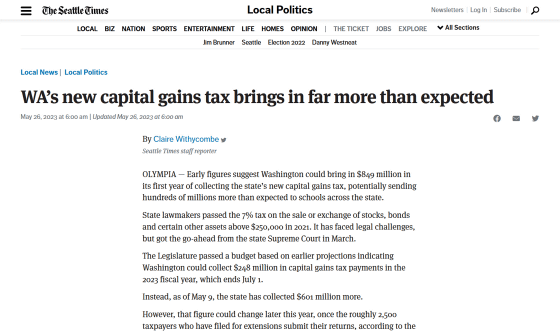

In order to correct this situation and secure the budget for childcare and public education, we will impose a 7% tax on annual capital gains of $250,000 or more from the sale of stocks and bonds by Washington State residents. A “Capital Gains Tax” has been passed by the State Legislature in 2021.

This tax system does not cover retirement accounts and capital gains from real estate transactions, and small and medium-sized enterprises that meet the requirements are also exempted, so it is targeted at wealthy people who earn huge amounts of income from financial transactions. It is

Several wealthy people filed a lawsuit seeking the withdrawal of capital gains tax, claiming that ``capital gains tax is equivalent to inhabitant tax prohibited by the state constitution.'' However, in March 2023, the Washington State Supreme Court dismissed the plaintiff's complaint and ruled that ``the capital gains tax is a commodity tax that is not subject to constitutional restrictions.''

Washington state's capital gains tax upheld by state Supreme Court - Axios Seattle

https://www.axios.com/local/seattle/2023/03/24/washington-state-capital-gains-tax-upheld

When Washington passed the capital gains tax, it expected revenue of $248 million in fiscal 2023, which ends July 1, 2023. However, as of May 9, 2023, when some eligible people have not yet paid taxes, they have already collected $ 601 million (about 86 billion yen) in taxes. It is reported that if the 2,500 taxpayers who have applied for payment extensions have completed their tax returns, the final capital gains tax revenue for fiscal 2022 could reach $ 849 million (about 121.4 billion yen). .

WA's new capital gains tax brings in far more than expected | The Seattle Times

https://www.seattletimes.com/seattle-news/politics/was-new-capital-gains-tax-brings-in-849-million-so-far-much-more-than-expected/

“The richest people in Washington state are much richer than we thought, and they continue to get richer and faster than we once thought,” Chege said of the lessons learned from this case. It means that we are

In addition, he pointed out that the capital gains that the wealthy earn are generated by the public infrastructure built based on the tax system that places a large burden on the low- and middle-income class, and by the workers who are actually working. . “We should end the tedious arguments used to defend the rich not paying taxes,” Chege argued.

Related Posts:

in Note, Posted by log1h_ik