Google banned the advertisement of "payday loan" financial products for low-income people who reach hundreds of percent annual income

Google has changed its advertising policies and added "Payday loans"We did not display it. The financial vendor handling payday loans has raised the voice of repulsion as soon as possible.

Google Public Policy Blog: An Update to Our AdWords Policy on Lending Products

http://googlepublicpolicy.blogspot.jp/2016/05/an-update-to-our-adwords-policy-on.html

Google to ban payday loan advertisements - The Washington Post

https://www.washingtonpost.com/news/the-switch/wp/2016/05/11/google-to-ban-payday-loan-advertisements/

◆ What is payday loan?

A payday loan is a small amount of consumer financial products representing the current United States. "Payday" means "payday", which is called a payday loan because it is a loan that the borrower can obtain finance with substantial collateral as salary it receives on the next payday. Specifically, a person who borrows money to a payday loan company including the interest rate, and the loan company collects the receivable by cashing the check on the next pay day. Since America is a check society and life is suddenly inconvenient when stopping the use of checks, debtors who settle checks with payday loans desperately pay back, so there are indications that the debt recovery rate is high.

At first glance it is a payday loan that seems to be problematic as a financial product, but the problem lies at an outrageous interest rate. In the United States, there are many provinces that stipulate the statutory upper limit interest rate at around 10%, but payday loans have an aspect that impose an extraordinary interest rate of hundreds of pcts far beyond that. The mechanism that produces this extraordinary profit is made up of the existence of a successful "gift certificate".

The situation of a specific payday loan is explained as follows. A consumer (debtor) who wants to borrow 100 dollars (about 11,000 yen) receives a gift certificate with a face value of $ 30 (about 3,300 yen) along with a 100 dollar bill from a payday loan company. In other words, because I borrowed 100 dollars + 30 dollars of money, I will issue a check with a face value of 130 dollars for repayment. Of course, the payday loan company will receive a payment of 130 dollars (about 14,000 yen) from the designated bank on the payment transfer date of the obligor and collect the receivables.

The big problem here is that,A gift certificate handed over with cash is just a piece of paper that can not actually be usedThat. In essence, the payday loan is that the obligor will pay 130 dollars to get 100 dollars of finance. There are many companies in the US that pay salary is paid every two weeks, so payday loans are mainly mainstream until 2 weeks. In other words, the payday loan company is devastating a ridiculous profit far beyond the statutory interest rate of 780% when converting to annual interest because it is 30% interest rate in two weeks.

Payday loans are relatively financial instruments targeting low-income groups (sub-prime loans) with low credit ratings. By securitizing and selling housing loans for sub-prime loans that can not be collected due to sloppy screening, it has evolved into a global financial problemSubprime mortgage problemByLehman shockIt was payday loan that appeared as a breakthrough of the post · sub-prime mortgage after it was triggered.

Although it is a malicious and successful payday loan, payday loan companies that appeal to the public are spreading at a stretch due to the fact that the amount of money to be lent out is small and the problem of bad debt is few by taking advantage of the characteristics of checks, He said that he is getting more and more. However, it seems that there is no doubt that it is gray as a financial product from a high interest rate that is outlawed, and that its existence is exposed to criticism.

◆ Responding to Google payday loans

Google has banned excessive sexual and violent expressions as well as illegal acts of selling guns, explosives, narcotics, etc. as advertisement policies. And, Google has been striving for an attitude of advertisement that is undesirable with regard to payday loans early, and in May 2014, due to the fact that spam-infected pages are displayed by search keywords such as "payday loan" (So-called "payday loan update") that greatly changes the display ranking of search keywords in the search keywords, and has begun to eliminate payday loan advertisements.

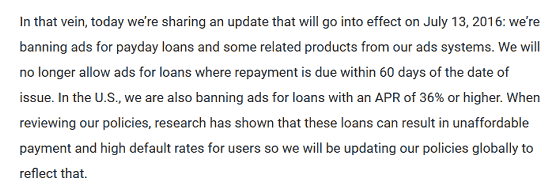

And in May 2016, within the advertisement policy newly launched, "prohibition of payday loan advertisement" was announced. Of a number of financial instruments, payday loans were to obtain the disgraceful title of the first financial products prohibited all over the world.

Please note that the advertisement policy starts on July 13, 2016, and after that date payday loan ads will no longer appear on the top and the right side of the Google search results page. However, payday loans are not excluded from search results.

Google that banned payday loan advertisement, but correspondence of IT companies such as Yahoo.com that allow viewing to Facebook excluded from advertisement display is divided. However, it seems likely that the flow of excluding payday loans will accelerate as a result of Google's policy change.

In response to Google's policy changes, many payday loan companies have expressed their will to oppose. Payday loan companies argue that "excluding payday loans that are deeply involved in the lives of low-income people is not beneficial for low-income people" or "the only move in eliminating payday loans in financial products In addition to the expected response that it is discriminatory, there is an opinion that "If you eliminate payday loan advertisements, advertising business of Google and other high-tech enterprises could have a bad impact on advertising revenue a little while."

Although the total loan amount itself due to payday loans has been decreasing in recent years, the market share of payday loan service by the Internet is still increasing,JefferiesAccording to the report, it has reached about 40% of the total loan amount of 40 billion dollars (about 4.4 trillion yen) by 2015. Together with the analysis by the Consumer Finance Protection Agency that online payday loan service tends to have a higher nominal fee of a gift certificate than the store type payday loan service, payday loan service advertisement by Google and Facebook The exclusion movement seems likely to change the financial situation for low-income people in the USA.

Related Posts:

in Note, Posted by darkhorse_log