Will Apple struggle to secure chip production lines as it competes with NVIDIA over TSMC's production capacity?

by

TSMC, one of the world's largest semiconductor foundries, has long been a 'top customer' for Apple, which outsources the manufacturing of chips used in iPhones and Macs to TSMC. However, in response to the recent boom in AI, Apple is competing with NVIDIA for TSMC's manufacturing lines and is struggling to secure chip production sites, according to Taiwanese technology journalist Tim Karpan.

Apple is Fighting for TSMC Capacity as Nvidia Takes Center Stage

https://www.culpium.com/p/exclusiveapple-is-fighting-for-tsmc

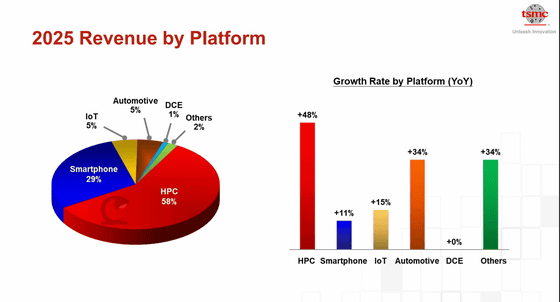

In its financial report , TSMC said its sales for the fourth quarter of 2025 (October to December) increased 25.5% year-on-year to $33.731 billion (approximately ¥5.35 trillion), and its net profit was $16.01 billion (approximately ¥2.54 trillion), exceeding the forecast of $15.17 billion (approximately ¥2.4 trillion).

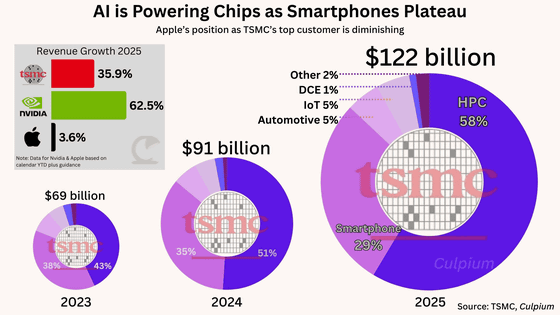

In addition, TSMC's full-year sales for 2025 are expected to reach $122.424 billion (approximately ¥19.4 trillion), a 36% increase from the previous year. TSMC expects its growth rate to increase by approximately 30% in 2026 compared to the previous year, and plans to increase its capital expenditures to a record high of $52 billion (approximately ¥8.24 trillion) to $56 billion (approximately ¥8.87 trillion), an increase of approximately 32% from the previous year. TSMC CEO Wei Zhejia commented, 'The risk of underinvestment is far greater than overinvestment.'

TSMC's business model is more capital-intensive than its competitors, with capital expenditures exceeding 33% of sales, a much higher ratio than Google's parent company, Alphabet, at 15%. TSMC's depreciation expenses as a percentage of sales also reach 45%, compared to Alphabet's 10%.

by

According to Karpan, Apple's product sales, excluding its services division, are expected to grow by just 3.6% compared to TSMC's high growth rate.

There are two major factors behind this: the massive demand for high-power chips due to AI, and the stagnation of the smartphone market.

In August 2025, Wei reportedly notified Apple that it would have to accept the largest price hike in recent years. While Apple accepted the decision, Wei had previously hinted at price increases during earnings briefings, and TSMC's rising gross profit margins confirmed the company's growing pricing power.

More seriously, Apple is facing fierce competition for manufacturing capacity at TSMC, which once held a monopoly, as the continuing boom in AI means that GPUs from customers like Nvidia and AMD are taking up more and more space on a single wafer.

In fact, sales in TSMC's high-performance computing (HPC) division, which includes AI chips, increased 48% year-on-year, while sales in its smartphone division grew by just 11%, slowing from the 23% increase in the previous year.

TSMC owns more than 20 fabs, but as production of larger, more in-demand chips has become a priority, it's becoming harder to automatically secure production lines for iPhone chips, Karpan said.

As of the time of writing, mass production is taking place using the cutting-edge 2-nanometer (N2) process, with Apple being a major buyer. However, increased production of the A16 process, which uses Super Power Rail (SPR) technology optimized for HPC, and N2P are planned for the second half of 2026. Mass production of the next-generation full-node A14, designed for both mobile and HPC, is also planned for around 2028.

According to supply chain analysis, NVIDIA is likely to overtake Apple as TSMC's largest customer in terms of revenue in the first half of 2025. Even if the reversal does not occur for the full year of 2025, it is expected to occur in 2026.

However, as of the time of writing, Apple manufactures a wide variety of chips in more than 12 TSMC fabs, far exceeding NVIDIA's manufacturing base. 'For nearly a decade, Apple has been the driving force behind TSMC's continued investment in new facilities,' Karpan said. While customers like NVIDIA and AMD will have an advantage in the short term, Apple's importance to TSMC will not diminish.

Related Posts:

in Hardware, Posted by log1i_yk