Paramount launches hostile takeover of Warner Bros. Discovery, bids for $17 trillion

Warner Bros. Discovery (WBD) has

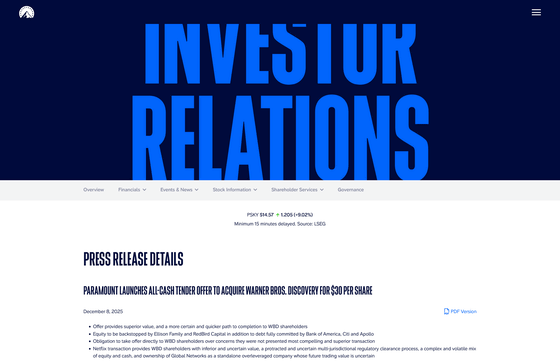

PARAMOUNT LAUNCHES All-CASH TENDER OFFER TO ACQUIRE WARNER BROS. DISCOVERY FOR $30 PER SHARE | Paramount

https://ir.paramount.com/news-releases/news-release-details/paramount-launches-all-cash-tender-offer-acquire-warner-bros

Paramount Skydance launches hostile bid for WBD after Netflix deal

Paramount Launches Hostile Bid for Warner Bros.

https://www.hollywoodreporter.com/business/business-news/paramount-launches-hostile-bid-for-warner-bros-1236444601/

Paramount Launches Hostile Takeover Bid for Warner Bros. Discovery at $30 per Share

https://variety.com/2025/tv/news/paramount-hostile-takeover-bid-warner-bros-discovery-1236603175/

Netflix and WBD announced on December 5, 2025, local time, that they have entered into a definitive agreement under which Netflix will acquire WBD's film and television production and streaming businesses. Netflix will pay $27.75 (approximately 4,300 yen) per WBD share in cash and stock, valuing the company's equity at $72 billion (approximately 11.2 trillion yen) and its enterprise value at $82.7 billion (approximately 12.9 trillion yen).

Netflix signs final deal to acquire Warner Bros. - GIGAZINE

In return, Paramount Skydance will pay $30 (approximately 4,670 yen) in cash for each WBD share and aim to acquire all of WBD's businesses, including the Global Networks business, which is scheduled to be separated.

Paramount announced on December 1st that it had submitted a bid for the acquisition and that WBD had informed it that it needed to make changes to its proposal. Paramount then raised its offer to $30 per share, but WBD CEO David Zaslav never contacted the company again.

Paramount CEO David Ellison reportedly sent a message to Zaslav saying, '$30 per share is not Paramount's best and final offer,' and hinted at a higher bid. Paramount COO Andy Gordon expressed frustration, saying, 'Throughout this process, WBD never received a written offer to raise the price.'

While Netflix's proposed acquisition has been approved by WBD's board of directors, CEO Ellison has expressed doubts about whether it will be approved by regulators, stating that 'it would be anti-competitive to allow the merger of the number one streaming service (Netflix) and the number three (HBO Max).' Paramount, meanwhile, has touted its close ties with the Trump administration as a way to quickly secure regulatory approval.

WBD said it will carefully consider Paramount's proposal and will notify shareholders of any decision within 10 days.

Related Posts:

in Note, Posted by logc_nt