Viral influencer meme coin 'Hawk Tuah' plummets 90% upon launch, sparking insider trading allegations and slams on social media

Hawk Tuah, a

meme coin

created based on an internet meme, saw its price fluctuate dramatically upon launch, plummeting 90% from its peak in just a few hours.Hawk Tuah memecoin dumps 90% amid backlash over controversial launch

https://cointelegraph.com/news/hawk-tuah-memecoin-dumps-90-percent-outrage-token-launch-insider

Hawk Tuah is an onomatopoeia for spitting, first used by Harry Welch in an interview on the YouTube channel Tim & Dee TV, and quickly became an internet meme.

Today's English slang 'Hawk tuah' means: To gather saliva and spit it out. Tuah is a southern dialect, and in the eastern dialect it is called tooie.

— Inosuke (@inosuke_beast) June 21, 2024

Example: I spat on the dick I was sucking

You gonna give'em that hawk tuah.

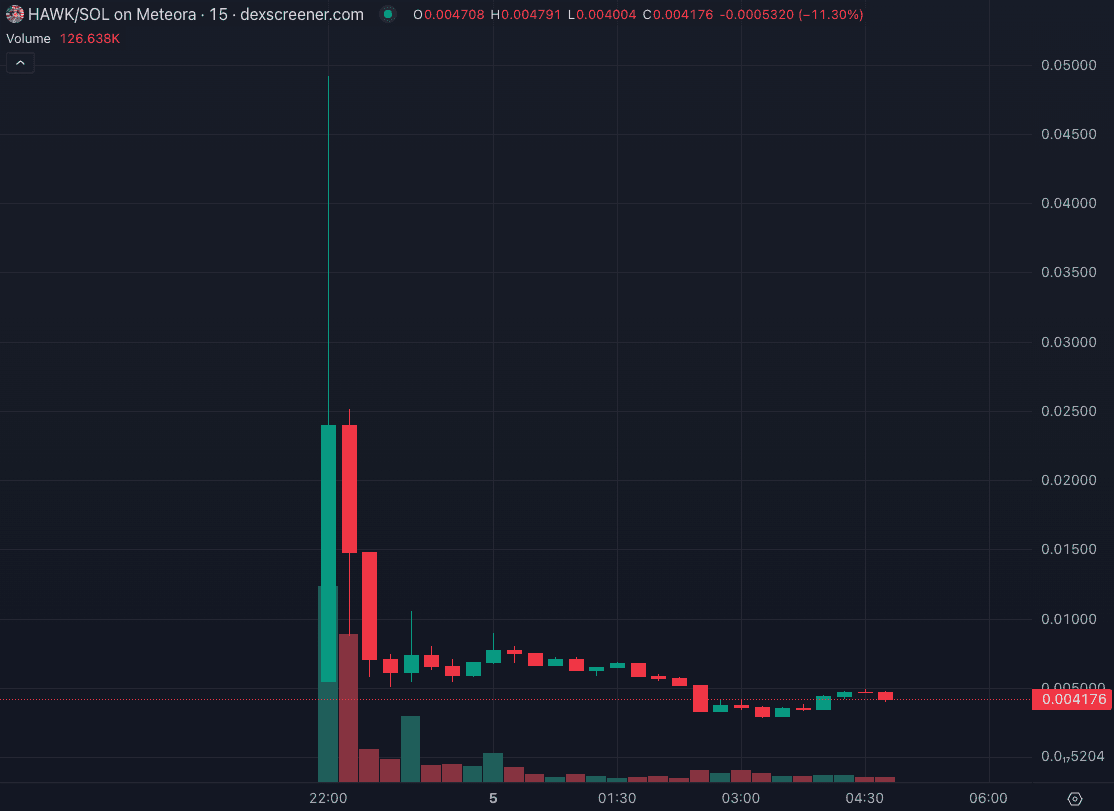

The actual price chart looks like this. After launching at 10 pm on December 4, 2024, the market capitalization rose to $490 million (about 73.5 billion yen), but quickly reversed and fell to about $40 million (about 6 billion yen).

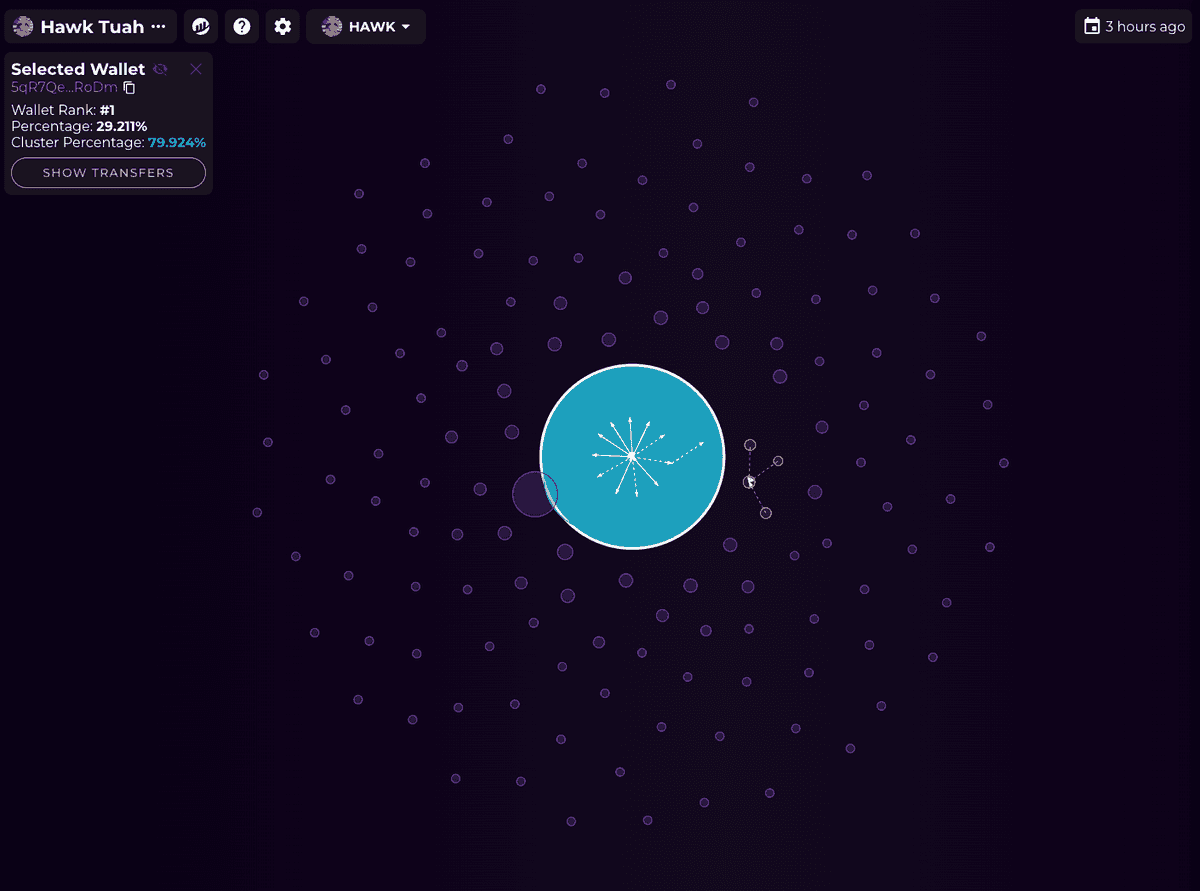

According to Bubblemaps and Dexscreener, which track and visualize blockchain data, 'snipers,' an organization that rapidly bought up large amounts of token supply at launch, held large amounts of Hawk Tuah at one point. Together with 'insiders' who held tokens before launch, it is estimated that they held 80% to 90% of the supply.

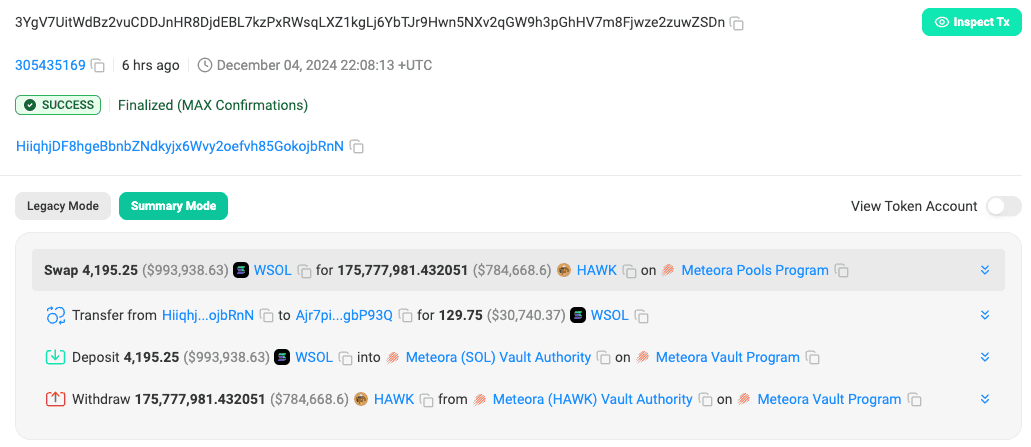

Further analysis of the data revealed that one wallet purchased 17.5% of Hawk Tuah’s supply for $993,000 within seconds of its launch, then sold it off when the price rose, making a profit of $1.3 million.

Although the act of spreading false information with the intent of fluctuating the prices of securities such as stocks is prohibited under the Financial Instruments and Exchange Act as '

spreading rumors

,' it is not regulated in the context of virtual currency trading, which often becomes a problem.A popular YouTuber is accused of getting the equivalent of 57 million yen by manipulating the price of virtual currency with his fans - GIGAZINE

The method of inflating the price and then selling it when outsiders jump on it has long been known as 'pump and dump,' and Hawk Tuah is a typical example of this. Meanwhile, Harry Welch, who created Hawk Tuah, denied the involvement of insiders and said that 'the team has not sold any tokens,' but there is a community note that says 'we are actually selling them,' and numerous complaints have been made in the reply section.

Copy and pasting:

— Haliey Welch (@HalieyWelchX) December 4, 2024

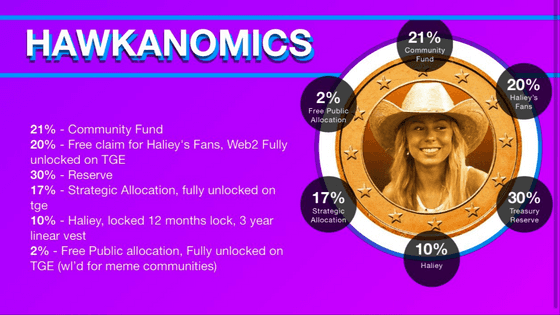

Hawkanomics:

Team hasn't sold one token and not 1 KOL was given 1 free token

We tried to stop snipers as best we could through high fee's in the start of launch on @MeteoraAG

Fee's have now been dropped pic.twitter.com/E7xN9VmCrx

Law firms have also appeared advertising, saying, 'If you lost money on Hawk Tuah, contact us to learn about your legal rights.' The situation is extremely confusing.

If you lost money on $HAWK , contact our firm to learn about your legal rights.

— Burwick Law (@BurwickLaw) December 5, 2024

Our firm represents thousands of nft and token investors in securities matters.

This is an attorney advertising.

Related Posts:

in Note, Posted by log1d_ts