A mysterious person in the US paid 1 trillion yen in inheritance tax, breaking the previous record by seven times

It turns out that the United States has paid $7 billion (about 1 trillion yen) in inheritance tax, seven times the previous record. However, it is unclear who the wealthy person who created this inheritance tax is, and the news site Sherwood News has compiled speculation based on anonymous sources.

Who died and left the US $7 billion? - Sherwood News

The U.S. Treasury Department publishes daily cash and debt operation data . John Ricco of the Yale University Budget Institute was analyzing Treasury data for a study titled 'How COVID-19 deaths among the elderly have affected government revenues,' when he discovered that $7 billion in inheritance and gift tax payments were incurred on February 28, 2023.

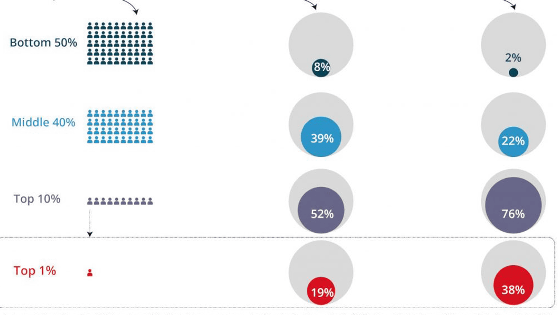

In recent years, the 'buy, borrow, die' technique has developed in the United States, allowing people to avoid most inheritance taxes by using debt, making the payment of inheritance tax almost optional.

What is the 'buy, rent, die' technique that allows the super-rich to increase their assets without paying taxes? - GIGAZINE

In fact, when David Koch, who was estimated to have assets of $42.2 billion (approximately 6.3 trillion yen), died in 2019, no unusual values appeared in the tax data. Also, in the approximately 20 years from 2005 until the current $7 billion (approximately 1 trillion yen) inheritance tax was incurred, the highest ever was about $1 billion (approximately 150 billion yen) paid in taxes in 2017.

If inheritance tax avoidance techniques were not used, based on the average inheritance tax rate, an estate of $17.5 billion (about 2.6 trillion yen) to $40 billion (about 5.9 trillion yen) would need to be inherited to incur an inheritance tax of $7 billion (about 1 trillion yen). In addition, inheritance tax must be paid within nine months of the death of the person, but in some cases the deadline may be extended, and Sherwood News estimated that this is the inheritance of a billionaire who died in 2022.

However, none of the billionaires whose wealth is widely known died in 2022, so it was unclear who had passed away and inherited huge amounts of money.

A reporter reported on this mystery in March 2023 , and a few months later, an anonymous tip was provided. According to the anonymous person, the owner of the estate was Fayez Sarofim, who died in May 2022, and the reason for the huge inheritance tax was that 'Mr. Sarofim was an immigrant and was grateful to America for making him successful, so he didn't care about taxes.'

Texas Monthly magazine published an obituary for Sarofim when he died in May 2022. Sarofim was the son of a wealthy Egyptian who owned a large cotton plantation in North Africa. He earned an MBA from Harvard University and moved to Houston in the 1950s. In 1958, at the age of 30, he founded an investment company and made his fortune managing the money of Houston's upper class.

For over 60 years from the time he founded his company until his death at the age of 93, Sarofim's investment company remained private, so he was not widely known as a billionaire. In the Forbes 400 list of America's billionaires, Sarofim's net worth was estimated at $1.5 billion (about 220 billion yen) as of 2022, and he was not ranked.

However, according to an anonymous source who provided information to Sherwood News, Sarofim's net worth is at least $20 billion. As for the reason why these estimates of his assets are far from the actual value, Sherwood News analyzed that 'Sarofim may have inherited assets overseas from his father,' but that a major factor is that 'unlisted companies, unlike publicly listed companies, do not have their assets tracked.'

Related Posts:

in Note, Posted by log1d_ts